Proptech has been something of a buzzword in startup circles of recent years, where companies use tech to improve the traditionally opaque and confusing real estate industry. With a clear need for industry disruption, proptech has grown significantly in the past few years.

In 2018, a total of US$9.6 billion was invested into real estate tech companies according to CREtech. A study by tech accelerrator MetaProp in NYC also found that investor confidence in proptech was at an all-time high by the end of last year, as the real estate sector slowly embraces innovation, proptech is expected to continue its momentum this year.

A need for proptech also becomes clear in Switzerland when last year, the government took concentrated efforts to cool down what was characterised as an overheated property market, and finally stopped a 15-year period of uninterrupted housing price rise. Authorities warn that banks could be exposed when interest rates rise from the “abnormally low levels” used by the central bank to rein in the Swiss franc.

Nevertheless, according to a survey conducted by EY, the overwhelming majority of its participants (94%) still consider Switzerland an attractive location for real estate investments in 2019.

Therefore, any transparency and operational cost-cutting that can be introduced by the right proptechs might be valuable in keeping Switzerland’s market away from any dreaded real estate bubble.

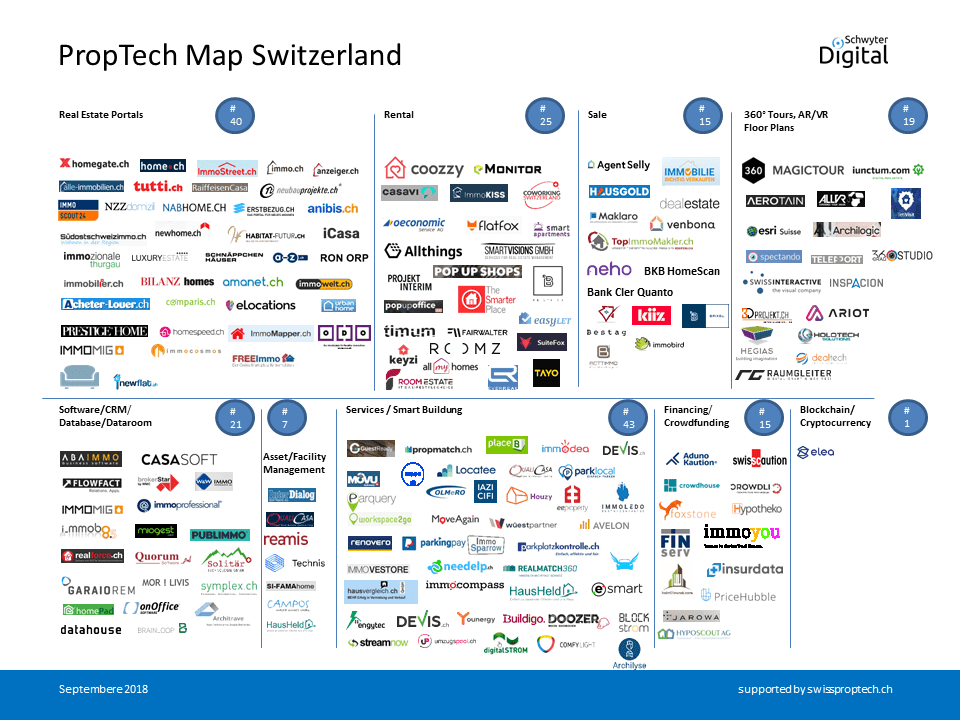

With over 200 companies as of January 2019, the Swiss proptech industry has witnessed strong traction. Today, the sector includes startups and tech companies covering a wide range of areas from asset management and financing, to property rental, sale, and smart building.

Proptech Map Switzerland September 2018, by Swiss Proptech

Out of companies on the above list, we have selected ten interesting proptech companies in Switzerland to follow closely.

Crowdhouse

Zurich-based Crowdhouse was founded in 2015 as a real estate crowdfunding platform before evolving into Switzerland’s largest digital real estate ecosystem.

In collaboration with several partners and the Luzerner Kantonalbank as a strategic shareholder, Crowdhouse uses the latest technologies and innovative business models to provide services in the areas of property participation, financing, management and transactions.

As of April 2019, Crowdhouse had brokered over 100 real estate properties worth a total of CHF 800 million. The company is currently considering an initial public offering (IPO).

PriceHubble

PriceHubble develops application program interface (API) and software for the real estate industry. The company provides tools that use machine learning to offer various data-based real estate services, such as online real estate valuations and value predictions.

The company serves lenders, mortgage intermediaries, and real estate brokers, helping them to generate leads, offer advise, and create lasting engagements. It also serves real estate investors and private investors, helping them take investment decisions, forecast the future performance of their asset, and identify potential investment opportunities. It also caters to other parties in the real estate value chain, such as real estate portals, banks, asset managers, insurance companies.

Hegias

![]()

Zurich- based Hegias has developed the world’s first browser-based, automated virtual reality content management system, VR CMS, for the construction and real estate industries.

Hegias’ latest innovation promises to transform parts of the real estate business and a solution that’s up to 100 times cheaper than other high-end visualizations utilizing VR. The solution can prevent misunderstandings during planning and construction, and its software also supports the sales and rental process of real estate.

Hegias is currently raising a Series A funding round and already has EUR 900,000 in committed capital.

Archilyse

A spin-off of ETH Zurich founded in 2017, Archilyse develops software for numeric architectural analysis. It develops an API which allows users to run simulations and analyze and provide architecture information. Archilyse caters to portfolio managers, real estate developers and real estate valuers.

The solution can be used for multiple applications. For example, the Archilyse software enables an automated compliance check with local construction standards. Real estate companies and asset managers can digitalize their portfolio and use data enhancement to conduct more precise property evaluations, and development planners, interior designers and consultants can access visualizations and room utilization analysis.

Archilyse is backed by Ringier Digital Ventures, PropTech1 Ventures, Zürcher Kantonalbank and Dr Stefan Heitmann, the founder of MoneyPark and PriceHubble.

Immoledo

Immoledo is a proptech based in the canton of Thurgau. The company digitizes and simplifies the analysis of the status of buildings, enabling an individual analysis of a building’s structural fabric without the need to involve an expensive expert as well as the creation of the related investment plan.

Immoledo determines the best time for renovating the building and calculates the corresponding investment costs, broken down by structural elements. The building status can be projected dynamically during the utilization phases of the building, making it possible to determine when the different building components should ideally be replaced.

In December 2018, Immoledo received funding from Helvetia Venture Fund.

Neho

Founded in 2017, Proptech Partners is the operator of Neho, the first commission-free real estate agency in Switzerland. The company offers a unique real estate sales service by combining its experienced local agents with a digital platform that ensures transparency, honesty and optimization. Since 2018, Neho has served more than 170 customers.

A spin-off of Ecole polytechnique fédérale de Lausanne (EPFL), Neho is currently present in the cantons of Vaud, Geneva, Neuchâtel, Fribourg, Zürich, Winterthur, Schaffhausen, Basel and St. Gallen. The company is now part of the Investis real estate group, the second largest real estate group in Switzerland listed on the Zurich Stock Exchange which owns Privera and Régie du Rhône.

Allthings

Founded in 2013 in Basel as a spin-off of ETH Zurich, Allthings provides a platform that connects tenants, property owners and service providers. Tenants use the app for direct communication and to access a variety of digital services that simplify everyday life.

Property owners add a new service layer to their buildings and benefit from data-driven insights. Service providers like property managers, local commerce or concierge companies offer their services digitally to the tenants. Beyond that, third-party solution providers can be flexibly integrated into the modular and open Allthings platform, much like an app store for buildings.

Allthings has offices in Basel, London, Amsterdam, Berlin, Frankfurt am Main, and Freiburg, and has won numerous prizes. The company boasts a clientele that includes over 200 of Europe’s leading real estate companies and real estate service providers. It raised a CHF 13.7 million Series A funding round last year.

eSMART

Founded in 2011 as a spin-off of the Swiss Federal Institute of Technology (EPFL) in Lausanne, eSMART develops intelligent control systems for homes and workplaces. The company’s systems can be used locally or remotely and show users where, when and how they are consuming energy. It all happens with a distributed automation system made of modules that are plugged directly into the home’s existing electric grid and connected to a touch-screen, smart phones and computers.

eSMART has provided more than 300 apartments with its building automation system in the city Gland. Other new projects are currently underway.

blockimmo

blockimmo is a property transaction platform based on blockchain technology. It aims to be the global marketplace for tokenization of real estate.

The company uses blockchain technology to enable fractional property investments and ownership. On blockimmo, properties are officially and legally represented as security tokens on the Ethereum blockchain. The platform allows for joint property investments through crowdsales, enabling easier access to the investment class. Investors can start investing in properties starting at roughly CHF 1,000.

The company partners with financial institutions and other strategic partners in different countries to enable and grow the cross-border market.

eeproperty

Founded in 2015, eeproperty designs and develops solutions to enhance real estate services. The company offers an automated solution allowing the complete management of buildings’ shared spaces from payments to the access and uses of the infrastructures. It started with Vesta, the first automated and fully digitalized payment and management system for laundry rooms.

The post 10 Interesting Proptech Startups and Companies in Switzerland to Follow appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments