2021 was the tipping point for the acceptance of cryptocurrencies and digital assets in Switzerland. Investors entered the space at a rapid pace and client demand became simply too large to brush aside. Meanwhile, financial institutions started actively joining the sector and some larger banks are now reportedly working on a digital asset offering behind the scene, according a new report by Swiss blockchain-focused early stage venture capital (VC) investor CV VC.

In early 2021, digital assets moved “from something easily dismissed as hype (or worse) to a nascent and exciting new asset class,” and at this stage of the game, it’s safe to say that they “are clearly here to stay,” the report says.

Drawing on more than 80 interviews with senior executives from banks, wealth managers and service providers as well as professional individual investors and family offices, the report shares that several respondents confirmed that a number of large Swiss institutions are preparing for a digital asset offering out of public view.

This will likely give the sector a boost considering that larger Swiss banks have been mostly absent so far, preferring to adopt a wait-and-see approach towards cryptocurrencies and digital assets over regulatory concerns, the report says.

At the moment, over 14 private, retail and online banks are active in the digital asset space, the research found, and more are projected to enter this year amid rising investor demand. Swiss exchange operator SIX, for example, is awaiting regulatory backing for its Swiss Digital Exchange (SDX) and hopes it will be able to start operating in the second half of 2021.

2021 saw many key developments taking place in the Swiss crypto industry, the paper notes, citing the entrance of the first Swiss pension fund into digital assets, and the announcement that insurance firm AXA would start accepting bitcoin for payments.

In April, Geneva-based Taurus got regulatory approval for the first independent, regulated marketplace for digital assets, a major step given that Switzerland is still missing a venue for larger trading volumes.

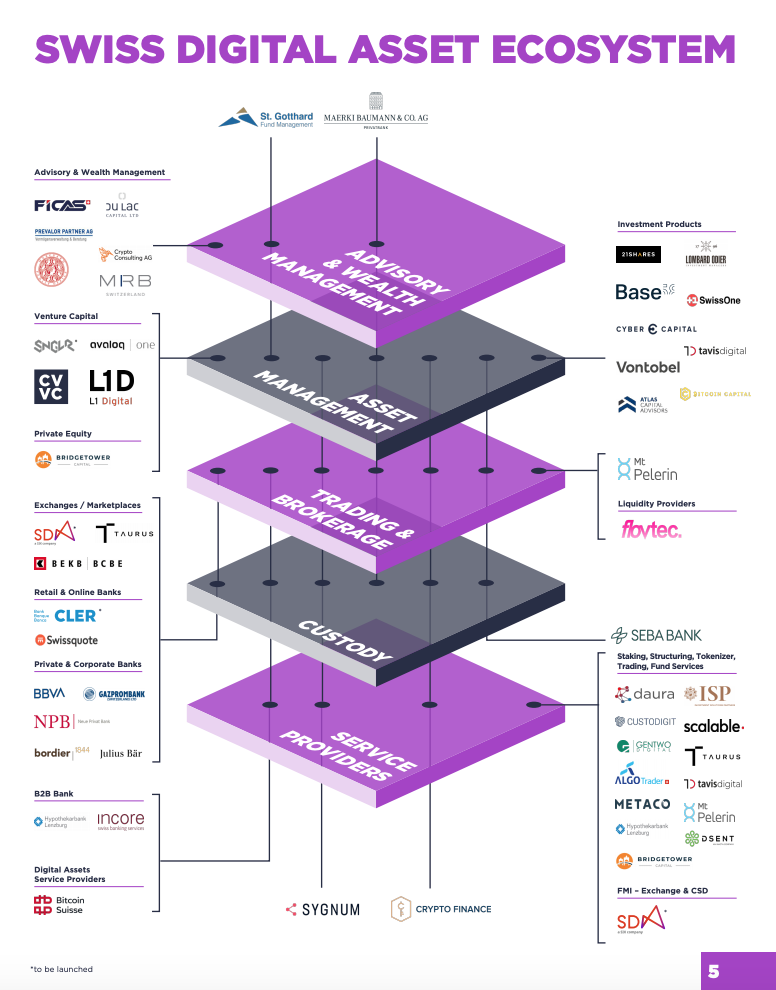

“Clearly, digital assets are making huge strides towards wider adoption in Switzerland,” the report says, and the country is now home to a diverse and rapidly maturing digital asset ecosystem comprising pure players, fintech companies, and incumbent financial institutions.

Swiss Digital Asset Ecosystem, Source: First Swiss Digital Asset and Wealth Management Report 2021, CVVC

Switzerland: a leader in blockchain and digital assets

Switzerland’s competence in wealth management, experienced regulator and modern regulatory framework have allowed to country to become “one of the most advanced nations when it comes to blockchain and crypto assets, not only in Europe, but also globally,” according to the recent EU Blockchain Ecosystem Development Report.

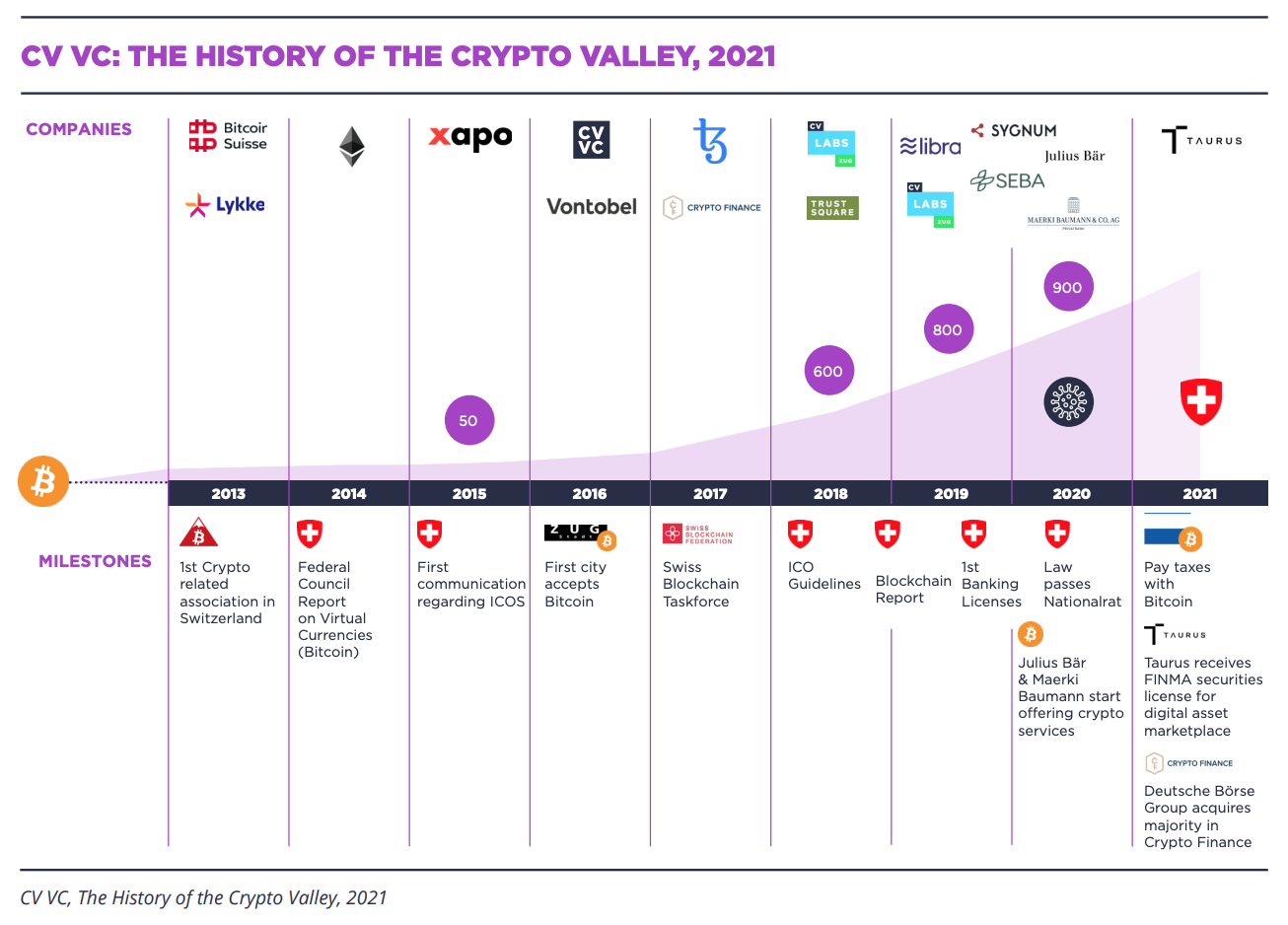

Back in 2019, Switzerland was the first country to award banking licenses to crypto banks SEBA and Sygnum, a world-first that put the “Crypto Nation Switzerland” on the global map of the growing digital asset ecosystem.

Last year, the Parliament adopted the Federal Act on the Adaptation of Federal Law to Developments in Distributed Ledger Technology (DLT Act). The law is designed as a blanket act that provides for selective adjustments in a total of nine federal laws, spanning from civil law to financial market law and insolvency law.

Among other things, the legislation enables the adoption of DLT as a new way of issuing financial instruments, and introduces a new financial market infrastructure authorization type, the so-called DLT trading facility. These facilities provide custody, settlement and clearing services for both cryptocurrencies and digital securities.

The History of the Crypto Valley, 2021, Source: First Swiss Digital Asset and Wealth Management Report 2021, CV VC

Last month, Germany’s stock exchange operator Deutsche Börse snapped up Swiss crypto firm Crypto Finance, further reflecting a growing trend of traditional financial institutions gearing themselves up for the anticipated growth in the trade of digital assets.

Founded in 2017, Crypto Finance provides trading, storage, and investment in digital assets to institutional and professional clients. The acquisition will allow Deutsche Börse to extend its offering for digital assets by providing a direct entry point for investments, including post-trade services such as custody, the group said in statement.

The post 2021, a Tipping Point for Digital Asset Adoption in Switzerland appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments