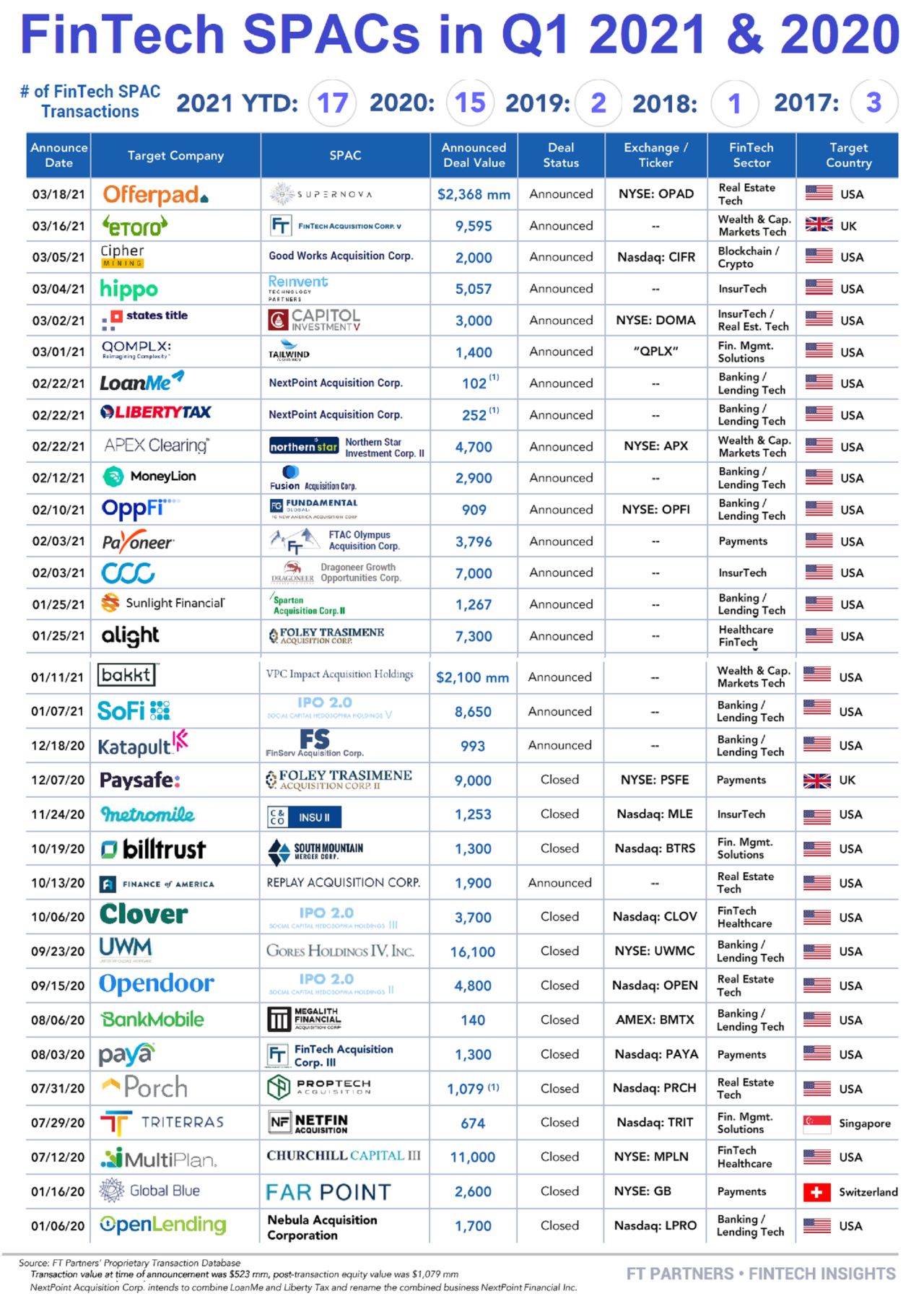

In Q1 2021, 17 blank check companies announced plans to merge with fintech firms, totaling a combined valuation of US$62.396 billion, data from fintech-focused investment bank Financial Technology Partners (FT Partners) show.

These figures are a new record for the industry and surpass those for the whole year 2020 during which 15 special purpose acquisition companies (SPACs) merged with fintechs for a combined valuation of US$57.539 billion.

In Q1 2021, banking and lending technology specialists made up for a big chunk of fintech SPAC deals with six announced transactions: LoanMe, LibertyTax, MoneyLion, OppFi, Sunlight Financial and Social Finance (SoFi).

Insurtech and wealth and capital markets technology were two other hot segments with three announced transactions each: Hippo, States Title and CCC Information Services in insurtech; and eToro, APEX Clearing, and Bakkt in wealth and capital markets technology.

Other segments represented include healthcare fintech (Alight), payment (Payoneer), financial management solutions (Qomplx), blockchain/cryptocurrency (Cipher Mining), and real estate technology (Offerpad).

Nearly all of the fintech SPAC transactions have a target investment that’s from the US, showcasing that the country continues to drive the frenzy. The only exception is eToro, an Israeli stock brokerage company.

eToro announced in March a US$10 billion merger deal with Fintech Acquisition Corp V, a SPAC backed by banking entrepreneur Betsy Cohen. The deal is the biggest announced so far in 2021, and the third largest of the past year.

Founded in 2007, eToro is a social trading and multi-asset brokerage company that focuses on providing financial and copy trading services. The company counts 20 million registered users and generated gross revenue of US$605 million in 2020, a 147% jump from a year earlier.

SPAC craze arrives in Europe

SPACs have become the go-to listing vehicle for fintech companies and while much of the craze has taken place in the US, it’s now coming to Europe.

In March, former Commerzbank CEO Martin Blessing launched the Amsterdam initial public offering (IPO) of a SPAC targeting the acquisition of a fintech company in the region within the next 24 months.

Earlier this year, Bernard Arnault, the chairman of luxury goods group LVMH and Europe’s richest man, joined hands with global alternative asset management group Tikehau Capital to launch a SPAC focusing on the financial services sector.

Former London Stock Exchange CEO Xavier Rolet is reportedly planning to launch his own US$300 million blank check company. The US-listed SPAC would target fintech investments.

In parallel, European fintechs too are warming to the controversial practice. Germany’s banking-as-a-service (BaaS) provider Solarisbank is said to be contemplating the route of a SPAC merger. It’s aiming for a billion-euro valuation, and the deal could lead to an IPO in early 2022, according to Finance Forward.

In Switzerland, a handful of local private companies are reportedly being wooed by US-listed SPACs interested to acquire them.

New research by S&P Global Market Intelligence found that at least 40 large SPACs with gross IPO proceeds of US$500 million and above are still in search of companies in the financial or tech sector, or have not defined a target sector. The firm estimates that these SPACs could generate total acquisition value of US$262.8 billion.

The post 2021 Breaks Record in Fintech SPAC Deal Count and Volume appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments