Insurance companies have been slow to adapt to a digital-first approach. In an increasingly digital world, many insurers are put in a tough spot as they struggle to keep up with the demands of a new generation of consumers.

Taking advantage of the incumbents’ inability to meet these needs, we are seeing a surge of insurtech startups stepping in to seize the market. Fighting off these agile startups have proved to be difficult with the shackles of bureaucracy and legacy systems.

Ping An, however, is one of the few outliers in this scenario.

A relatively young player with just over three decades of experience, this insurer has managed to squeeze past all the incumbents to take the crown in the 2018 Forbes’ world largest insurers list and as of January 2018, the company is worth US$ 217 billion.

This is quite a feat, as most companies who made it in the top 20 list typically have over a century of history and nearly half of them established in Europe.

With such a track record, it is no surprise that Ping An is frequently featured as a poster boy of insurers successfully embracing the new digital world. Which incidentally, is something that we covered at great length in our Insurtech Tech 10: Trends for 2019 report.

European insurers seeking remain competitive would benefit from examining Ping An’s playbook and adopting several lessons for themselves.

From our observation and extensive studies, here are 3 key lessons we believe European insurers can learn from Ping An.

1. Looking beyond insurance, and developing an ecosystem

For Ping An, it’s not just about insurance, it’s about bringing in fringe services that gave them an advantage. In China, the new social+ business models have been impacting various industries from e-commerce all the way to insurance. Social+ brings a social element to connect users to businesses and strengthens their ecosystem play.

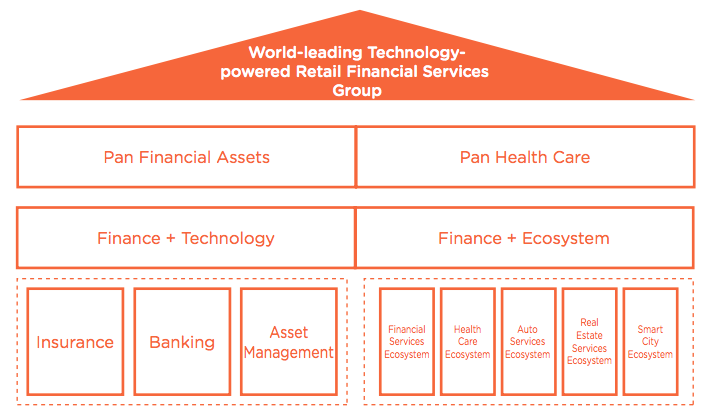

Source: PingAn Annual Report 2018

Ping An’s expansive ecosystem is nothing to be scoffed at. Today, the group offers services including finance (Ping An Bank), peer-to-peer (P2P) lending (Lufax), healthcare consultations (Ping An Good Doctor), real estate and auto listings (Pinganfang and Autohome respectively), and entertainment (Huayi Brothers) to its 500 million+ digital user base via its One Account customer portal.

2. Embedding yourself in your customer’s journey

Merely providing services in no longer sufficient today’s world, to build customer loyalty insurers need to embed themselves into their customer’s lifecycle.

One way that Ping An is doing is by playing an active role in their customer’s well-being. Through Ping An’s Good Doctor the company able to create brand stickiness to over 54 million users that are actively using the app monthly.

While being digital-first is crucial, being in the real world with your customers are equally important as well. Leveraging on AI-Powered unstaffed mobile clinics, Ping An is able to provide instant diagnosis or provide referrals to human doctors.

It is also equipped with an automated medicine medicine dispenser that will be stocked with over 100 types of common medicine.

3. Harnessing the power of data and AI

Data is king.

A statement that is as true as it is cliché. To no one’s surprise data is a huge part of Ping An’s play. That play is once again supported by Ping An’s far-reaching ecosystem.

With over 265 Million users registered on Ping An Good Doctor, it serves as a huge pool of data that the Ping An can tap into for various commercial reasons — from risks assessments to building better products.

Ping An’s deep focus into artificial intelligence also gave birth to their AI-powered medical imaging technology which boasts 95% accuracy for imaging 2 categories of lung cancer. They further developed that technology to cover 35 different type of illnesses.

As a result of that Shanghai’s Ministry of Health signed an agreement with them to ensure that all hospitals in Shanghai must connect with them in real time.

Taking Inspiration from the East

The time for insurers to reinvent themselves is long overdue, the world as we know it has been lifted from the ground beneath us.

Many would point to 6 years ago when Ping An shifted all the systems on the cloud as the beginning of their transformation journey that eventually lead to them being the most valuable insurance company in the world today.

It’s not too late for insurers in Europe to take a page out of Ping An’s playbook and start their own version of a transformation journey.

The post 3 Lessons European Insurance Giants can Learn from China’s Ping An appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments