ClearBank, UK’s cloud-based clearing bank, has released a report that revealed 33% of European fintechs have faced regulatory intervention due to agency banking resiliency failures.

Agency banking is when a fintech offers its customers a service that is provided and managed by a licensed bank as the agent of that service. Common examples of these services include access to payment rails like Faster Payments in the UK or the provision of customer accounts.

The report ‘How well are fintechs served by banks? The state of agency banking across the UK and Europe’ revealed that fintechs, particularly larger one with more sophisticated needs, are underserved by their current banking partners.

ClearBank’s research is based on an independent survey of 100 fintechs across the Netherlands, Lithuania, Sweden, Switzerland and the United Kingdom.

Key findings from the report

Banks are critical to the success of fintechs but aren’t meeting their needs

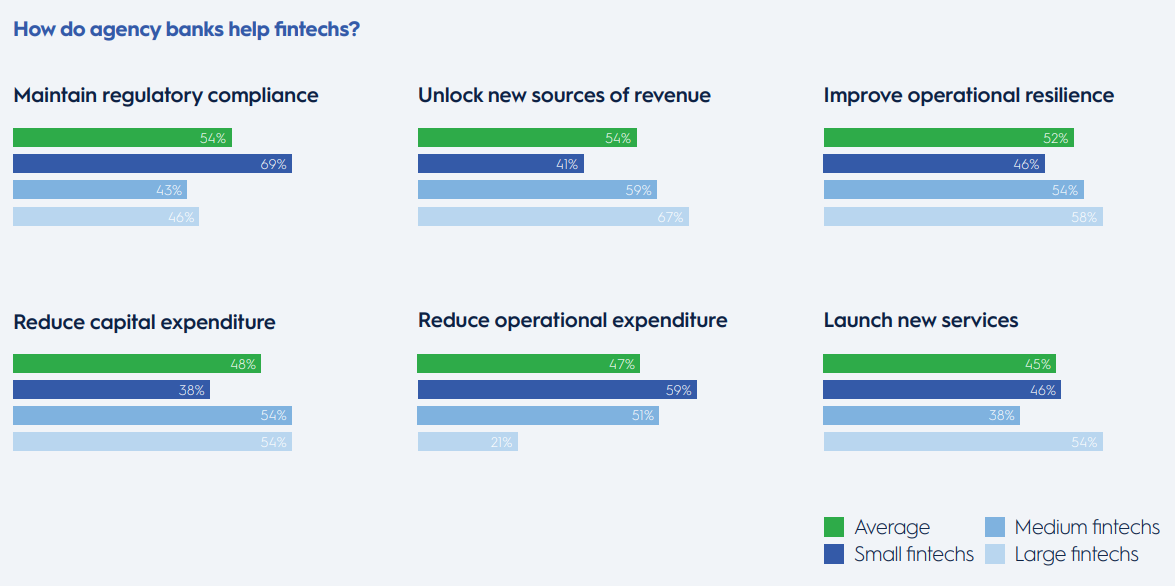

- More than 50% of fintechs see banks as mission-critical partners which help them maintain regulatory compliance, unlock new revenues and reduce operational expenditure.

- But nearly half of respondents (49%) don’t believe their agency bank has helped their business.

- A quarter of fintechs are not satisfied with their agency banking services especially access to payment rails like CHAPS (38%) and operating accounts (35%).

- Fintechs felt their bank is more focused on offering loans and debt products than on facilitating payments and helping them manage their accounts.

The bigger the fintech becomes the less well served it is

- 71% of larger fintechs use a traditional high street bank for agency banking services.

- Larger fintechs report missing out on important elements of agency banking: 50% of respondents don’t have reconciliations logged in real-time with just 30% of large fintechs are offered access to real-time payments. Meanwhile, 66% of larger fintechs require at least 2-3 days to open a customer account

- Overall, 42% of large fintechs are ‘indifferent’ about their agency banking partners.

Agency banking resiliency failures are creating major problems for fintechs

- One third (33%) of fintechs have faced intervention from the regulator because of an issue with an agency banking partner.

- One in 20 fintechs have suffered unforeseen rises in agency banking costs, lost revenue or seen services go down due to their agency bank.

- 15% of fintechs have delayed the launch of a new product/service because of their agency bank.

Fintechs want more from their bank, but are scared to switch

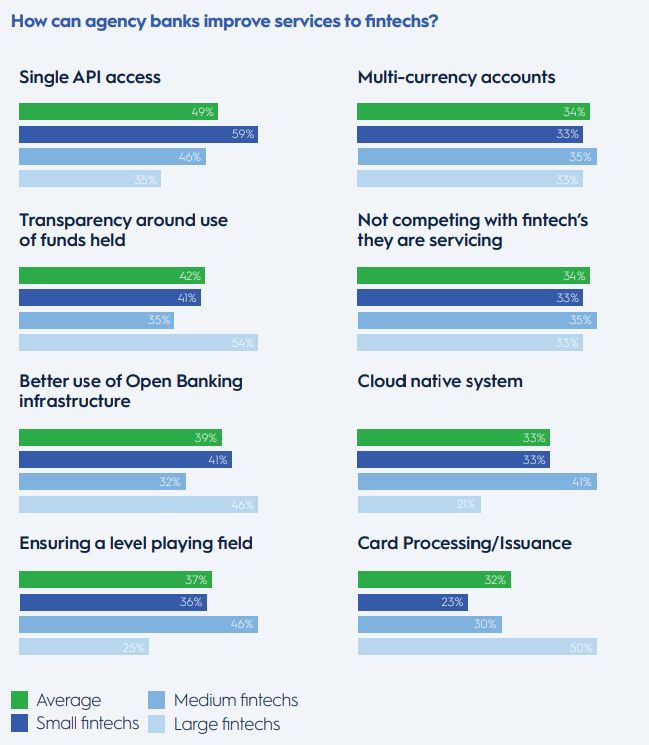

- The most requested agency banking improvements from fintechs are; single API access (49%), transparency around use of funds held (42%) and better use of Open Banking infrastructure (39%).

- However, 22% of fintechs don’t believe their agency bank can provide these improvements.

- And nearly half (48%) don’t believe they receive Banking-as-a-Service.

- 44% of fintechs stay with their agency bank is because “switching looks painful”.

- Despite this, 14% of fintechs plan to switch in the next 12 months.

Charles McManus

“Every fintech needs to work with an agency banking partner and the nature of this relationship is coming to define our industry. These partnerships are critical, yet as they stand agency banks have not been meeting the needs of fintechs. Firms are losing out.

There is also a reputational impact and the potential for hefty fines as operational resilience becomes an increasingly bigger priority. Providers need to do better and unless things change, the fintech sector will not reach its full potential.”

said Charles McManus, CEO at ClearBank.

The post 33% of European Fintechs Face Regulatory Intervention Due to Partner Banks appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments