Personal finance management (PFM) solutions enable users to manage their finances easily by allowing them to keep track, making analysis of personal income, making plans about spending and income, automatically categorizing all transactions, and receiving financial help and recommendations.

Switzerland is home to several fintech startups operating in the PFM segment both in the B2B and B2C spaces. These include Contovista, eWise, Numbrs, and Qontis. The following four ventures are new entrants in the Swiss PFM scene to keep a close eye on:

GOKONG

Zurich-based GOKONG is a read-only app that allows users to track all of their finances in one place. The platform is not just a personal finance management software, but also “a live meter” that tracks goals and a spending management tool. It lets users see their account balances, transactions, investments accounts, retirements accounts, credit cards, non-financial assets and insurance policies.

Zurich-based GOKONG is a read-only app that allows users to track all of their finances in one place. The platform is not just a personal finance management software, but also “a live meter” that tracks goals and a spending management tool. It lets users see their account balances, transactions, investments accounts, retirements accounts, credit cards, non-financial assets and insurance policies.

“We’ve developed the Gokong platform around a few use cases,” Rahul Kaushik, CEO Gokong explains.

“For example, within Asset Liability management when users connect their accounts – investment accounts, checking accounts, Pillar 3a, pension accounts, Gokong could potentially provide a forecasted view of the next month based on recurring payments into Pillar 3a, investment accounts, savings, telecom, rent etc., we could gauge and quantify a recurring strain one cash.”

We’ve gotten some really valuable feedback and are now hard at work on some cool new features to help users make more informed choices,” Rahul claims

Yapeal

Headquartered in Zurich, Yapeal is a project that aims to build a new “neo-bank.” The YapApp mobile app opens access to sophisticated blockchain-inspired technology.

Some of the features include a fully digital onboarding process; Lifestyling Intelligence, which knows the lifestyle and habits of users; Financial Amigo to oversee the running budget, open and fill savings purses, monitor expenses while traveling, warn against overpayments, know when the tax bill arrives, and more; Yapster-to-all, which allows users to send money or request money, split and share bills, worldwide, in multiple currencies; Family Shizzle, a tool for managing kids’ pocket money; card control; contactless payments; and more.

The planned offer is set to include a Swiss bank account (multi-currency eligible), savings accounts, overdraft facilities, payment transactions, debit cards and mobile wallets for Google Pay, Apple Pay, Samsung Pay and wearables.

Yapeal is not a bank yet and is not licensed as such by Swiss authorities.

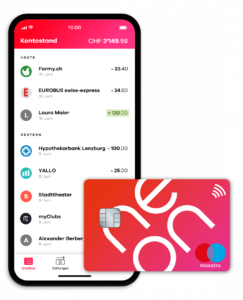

Neon

Founded last year, Zurich-based fintech startup Neon offers what is claims to be the first independent basic account offering of Switzerland that’s 100% geared for smartphones.

Founded last year, Zurich-based fintech startup Neon offers what is claims to be the first independent basic account offering of Switzerland that’s 100% geared for smartphones.

Neon is a new account app for everyday banking, independent of existing banks, that’s accessible through a mobile app. It aims to provide an alternative for digitally minded and cost-conscious customers who are looking for a simple and mobile everyday account solution.

The app, which has been available as a beta version since August 2018, lets users open an account in less than ten minutes and receive a Maestro card, without any base fees. Neon’s banking partner is Hypothekarbank Lenzburg.

Neon recently partnered with Contovista, a Swiss provider of personal finance management solutions for banks. Contovista has become the technology partner for Neon’s payment data analysis.

Clear Minds

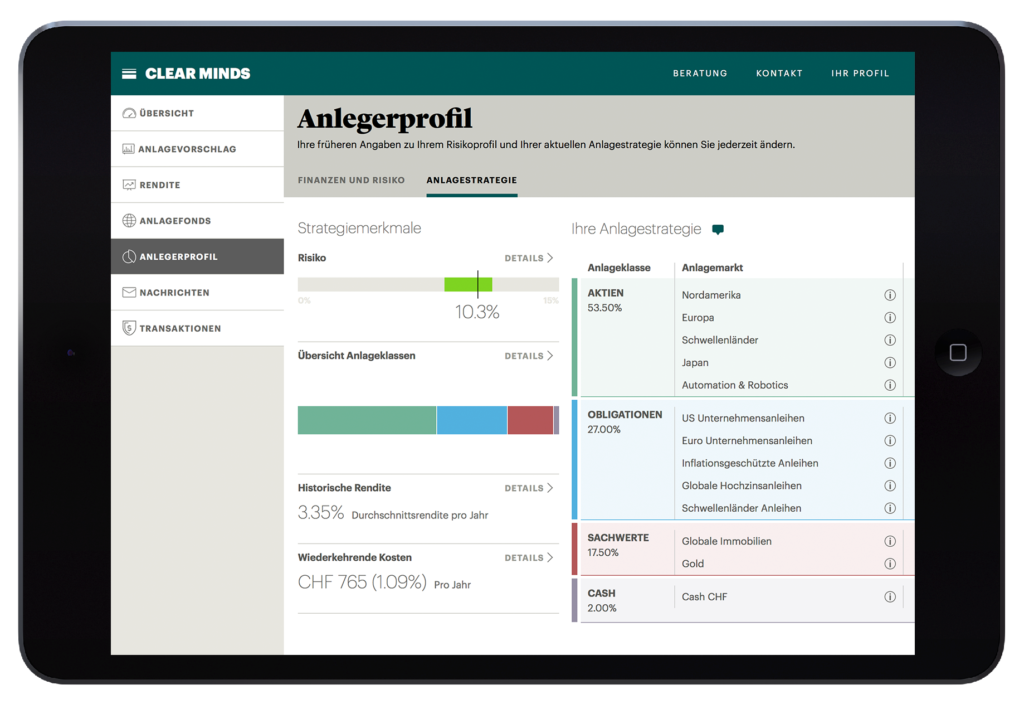

Founded by former UBS fund manager Adrian Schatzmann, Zurich-based Clear Minds is the latest digital asset manager to enter the Swiss financial services market.

The firm sees itself as a digital adviser and not a robo advisor, an important distinction according to Schatzmann.

“Most Swiss clients want advice,” he explained in an interview with finews. “They don’t however want to delegate decisions to an asset manager or robo advisor. At Clear Minds the client negotiates as he would with an advisory bank service, on the basis of a proposal with self responsibility.”

Clear Minds enables clients to decide the composition of their portfolio and preferred investment products at any time. Clients pay a flat rate of 39 CHF per month, regardless of the size of the investment. “The fees paid make a direct contribution to the long-term asset accumulation,” Schatzmann explained.

The post 4 Future Rockstar Personal Finance Management Tools and Startups in Switzerland appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments