The blockchain industry is maturing and beginning a new chapter as executives move from experimentation and research to active adoption and implementation, according to a new study by Deloitte.

Deloitte’s 2019 Global Blockchain Survey, released earlier this month, points to signs of blockchain’s increased maturity with surveyed senior executives showing deeper understanding of the technology and its potentials.

The research also shows increasing diversification of potential use cases for blockchain across multiple industries beyond financial services including technology, media, telecommunications, life sciences and health care, and government.

“What we’re seeing in 2019 is the continuing evolution of blockchain from a capable yet underdeveloped technology into a more refined and mature solution poised to deliver on its initial promise to disrupt,” the firm says. “The question for executives is no longer, ‘Will blockchain work?’ but, ‘How can we make blockchain work for us?’”

Deloitte, which polled a sample of 1,386 senior executives in a dozen countries, found that momentum has shifted from “blockchain tourism” and exploration toward the creation of practical business applications.

Results reveal continued strong investment with 40% of respondents willing to invest US$5 million or more in new blockchain initiatives over the next 12 months.

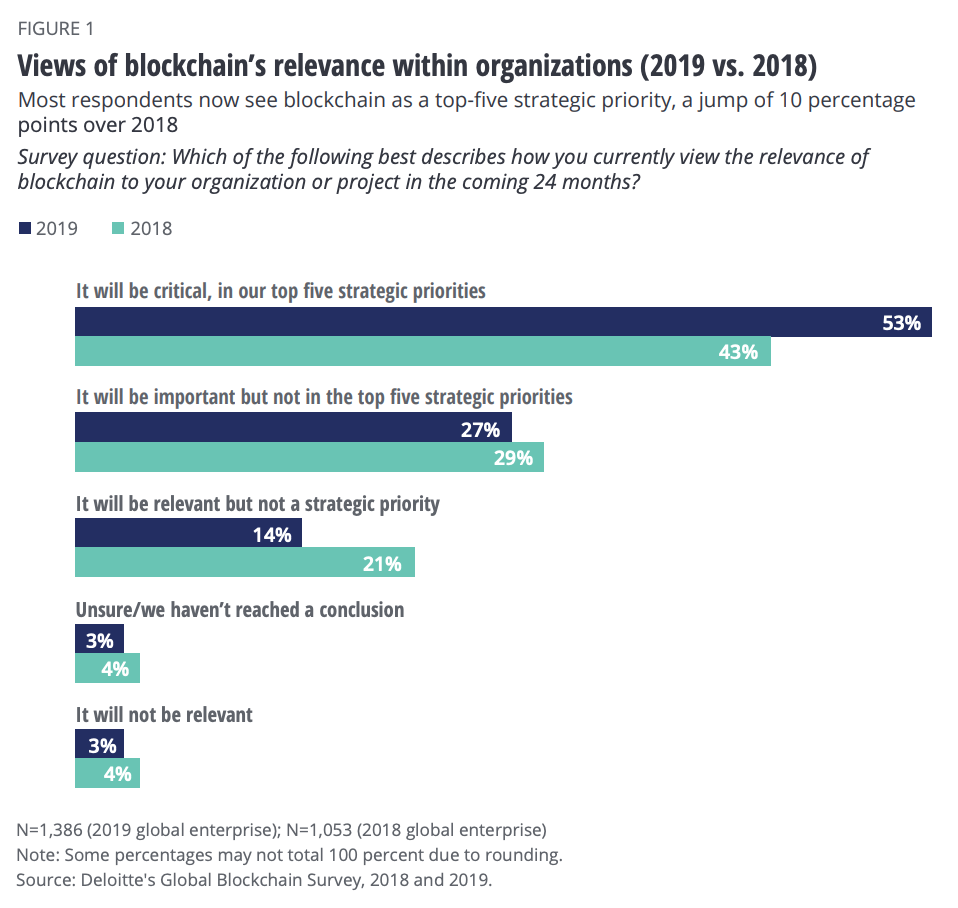

53% of respondents said blockchain has become a critical priority for their organizations in 2019, a 10-point increase compared to last year, and 83% see compelling use cases for the technology, up from 74% in 2018.

The research also explores the sentiment of executives towards blockchain consortia, which have grown in number and importance in recent years. R3, one of the most prominent blockchain consortia, now counts more than 300 companies and financial institutions.

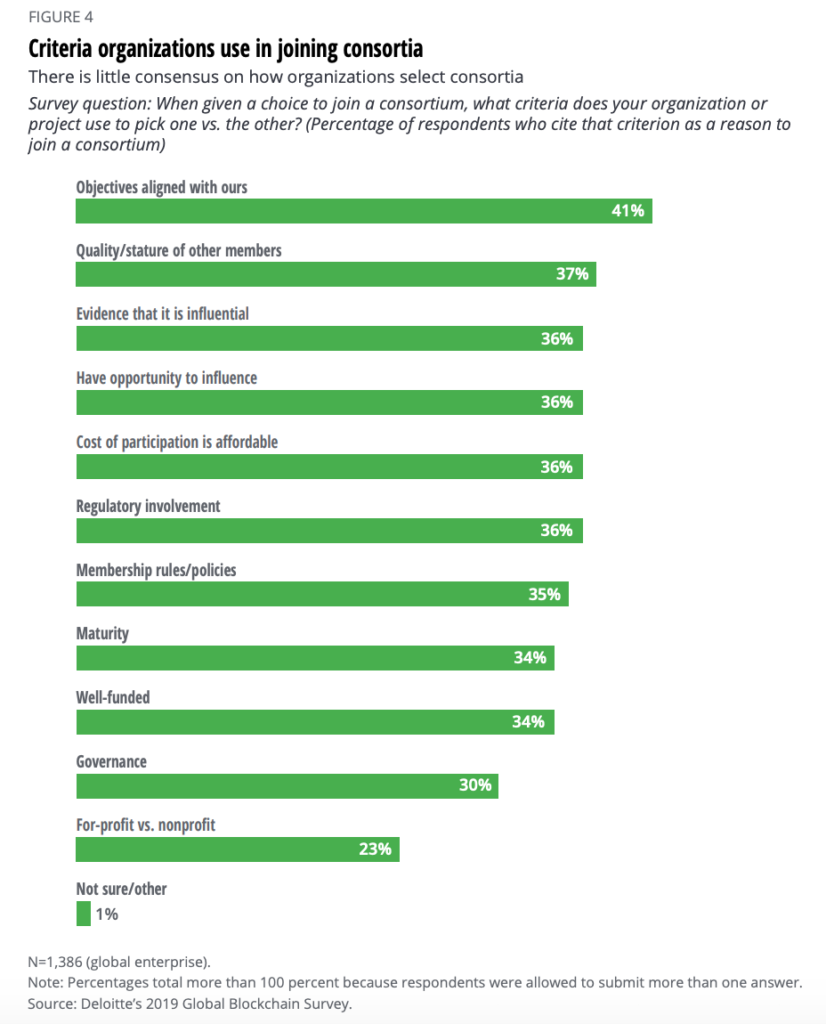

The overwhelming majority (92%) of survey respondents either belong to a consortium or plan to join one in the next 12 months. Respondents cited cost savings (57%), accelerate learning (55%) and sharing risk (47%) as the top three benefits expected from consortia participation. They named the main criteria used in selecting and joining a consortium as aligned objectives (41%), the quality/stature of other members (37%) and evidence that it is influential (36%).

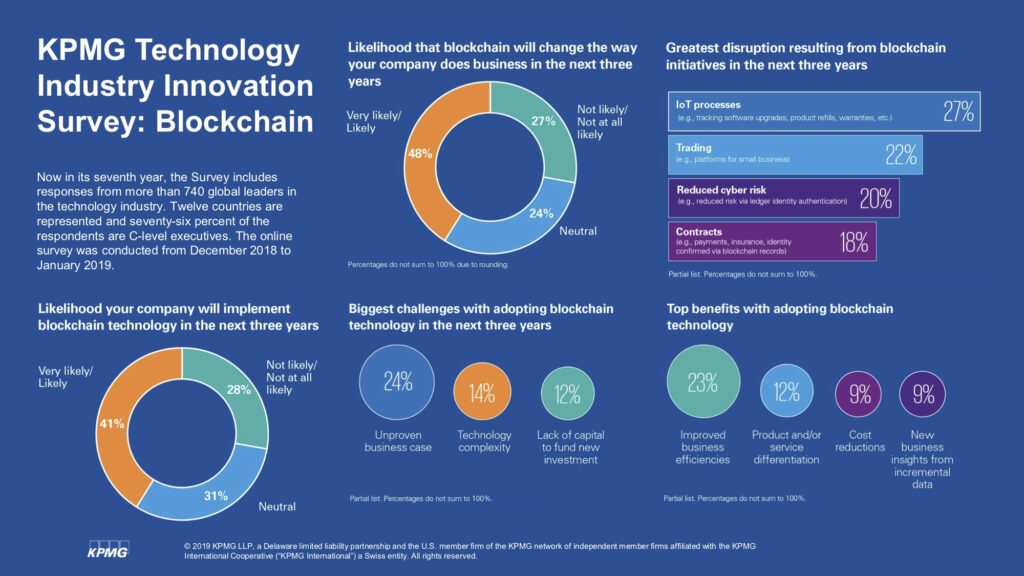

The Deloitte survey results echo findings from research conducted by other consultancy firms. KPMG released a study earlier this year which found that out of 740 global leaders surveyed, 41% said their organization will very likely or likely implement blockchain technology in the next three years. 48% said they are confident blockchain will very likely or likely change the way their company does business in the next three years.

According to the survey, the areas set to be the most disrupted by blockchain over the next three years will be Internet-of-Things (IoT) processes (27%), trading (22%), reduced cyber risk (20%) and contracts (18%). Respondents cited improved business efficiencies (23%), product and/or service differentiation (12%), cost reductions (9%) and new business insights from incremental data (9%) as the top benefits expected with adopting blockchain technology.

Some of the most promising blockchain trends to watch in 2019 according to market research firm CB Insights include fiat-crypto exchanges, which will be looking for additional revenue streams as they face increased competition from larger, more traditional financial services players; decentralized exchanges, which use blockchain technology to enable exchange without a centralized middleman; stablecoins, which are likely to witness broader adoption and new use cases emerging; security tokens, or “tokenized” assets on a blockchain platform; as well as non-fungible tokens, which use the technology to issue unique, non-transferrable tokens for use in gaming and more.

Featured image: Blockchain cryptocurrency, PxHere.com.

The post 40% of Business Leaders Willing to Invest More Than US$5M on Blockchain, Said Deloitte Study appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments