Someone once said to me, “A cryptocurrency exchange could be the best exchange, until it isn’t.”

The question of “which is the best cryptocurrency exchange?” is a difficult one to answer. The best exchange today could be subject to a security breach tomorrow. The best exchange could be dethroned when a competitor comes up with a superior UI tweak.

Different investors will still prefer different exchanges, based on their trading habits and priorities. So what can be valuable to look at are an exchange’s sheer volume of transactions. With very notable exceptions, an exchange with a high volume of transactions usually equals to one that is tacitly endorsed by the crypto-community.

That being said, it bears repeating that one should exercise caution when transacting in the nascent and speculative cryptos.

In no particular order, some of the major platforms around the world to buy cryptocurrency include:

1. Coinbase Pro

Coinbase Pro has gone through a couple of rebrands in its time, formerly GDAX and before that, Coinbase Exchange. It is a US-based, regulated exchange affiliated with the well-known Coinbase.

Coinbase Pro offers the ability to exchange cryptos with fiat currencies USD and euro, or users can opt to pair their cryptos with bitcoin, Ethereum, and Litecoin. Coinbase Pro accepts bank transfers, withdrawals and deposits in euros, and wire transfers in USD.

Though Coinbase Pro does offer the ability to transfer from fiat to cryptocurrency, it’s not quite recommended for beginners, who should opt for Coinbase instead. Takers are subject to fees between 0.1% to 0.3%.

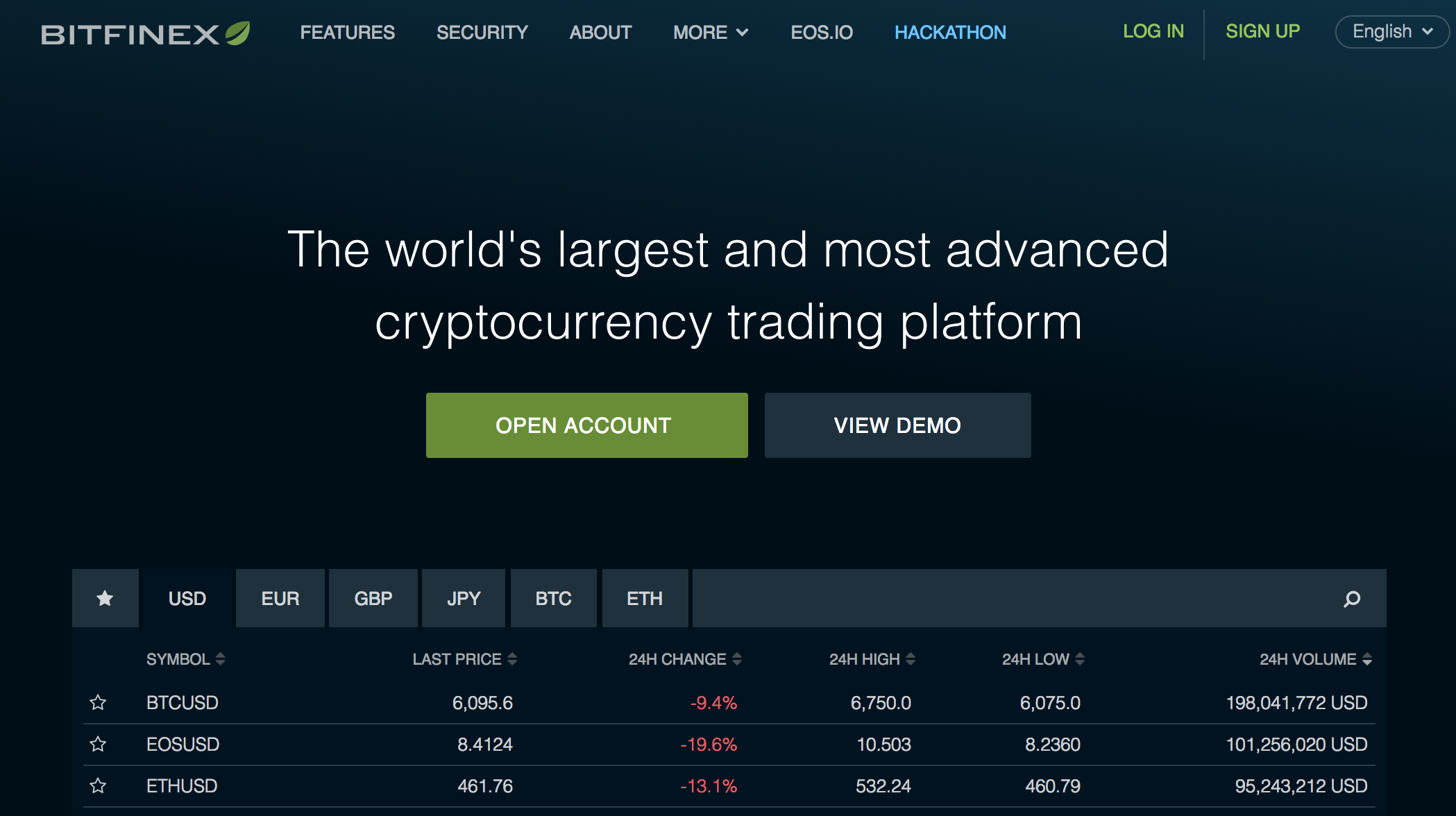

2. Bitfinex

Bitfinex is another exchange that allows you to pair cryptos with fiat currencies—USD and euro once again. They are based in Hong Kong, and founded in 2012 by Raphael Nicolle.

However, the team has discontinued service to USA-based customers.

You’ll find popular coins like Ripple, EOS, NEO, Zcash, and quite a variety of coins to trade on Bitfinex, against the base currencies USD, euro, bitcoin, and ethereum.

Bitfinex is not recommended for beginners. The platform is intricate yet robust, with a customisable interface that is partly the secret behind its appeal to experienced traders. The platform will even allow users to trade with a leverage, up to 3.3x using Bitfinex’s peer-to-peer margin funding. Its high liquidity is also an appeal for users.

While Bitfinex has made strides to increase security after a huge hack in 2016, they were very recently hit with another hacker attack at the time of writing, so some caution is definitely warranted.

A full breakdown of Bitfinex’s fees can be found here.

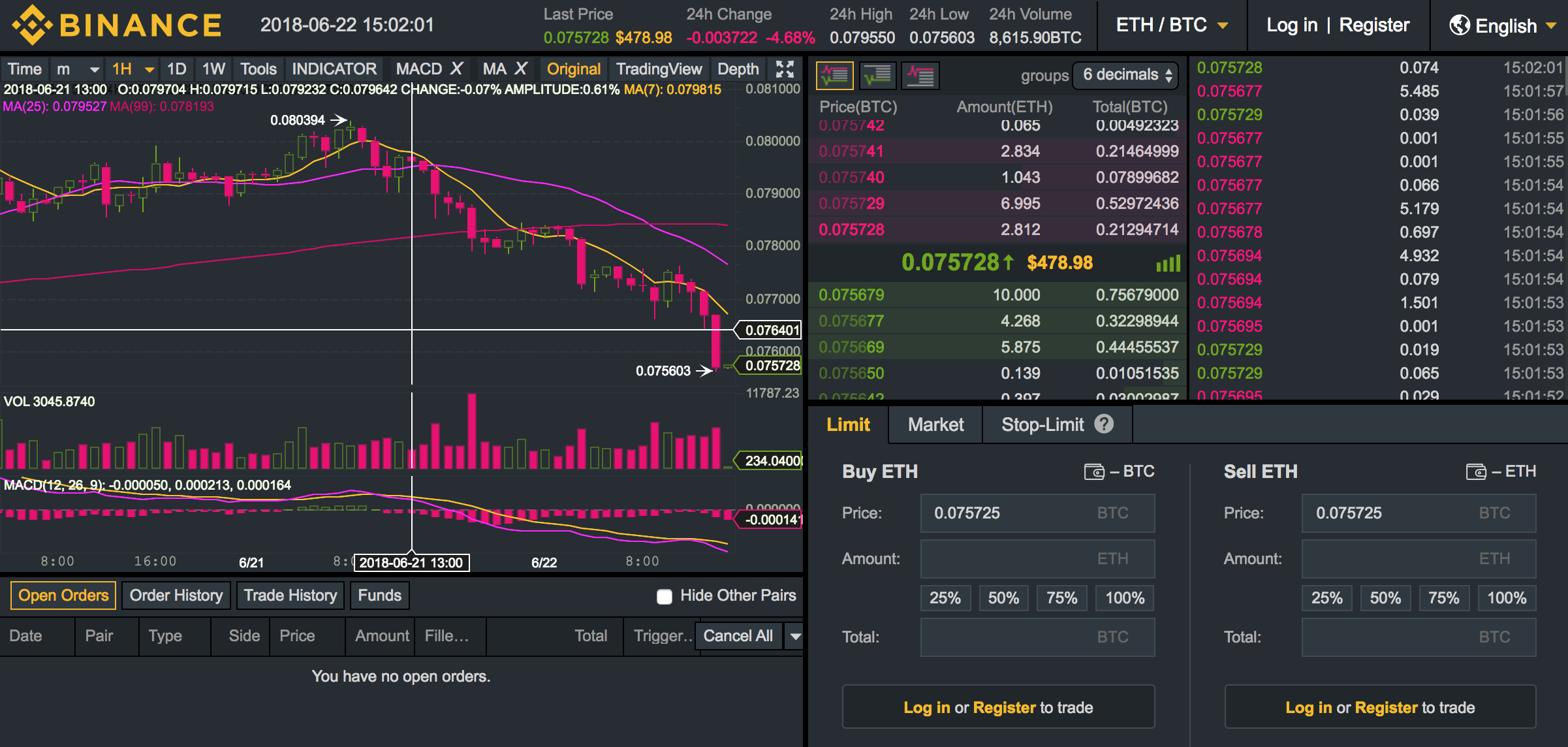

3. Binance

Binance is a China-based exchange that shot up to popularity in less than a year. Currently, the exchange offers trading pairs in bitcoin, BNB, ethereum, and Tether.

The platform offers two layouts: basic and advanced, which makes it friendly for relative beginners and for experts too.

Binance is probably one of the best-known cryptocurrency exchanges operating today. It has a huge variety of coins to choose from, so if you’re looking for an obscure altcoin, there’s a decent chance that Binance has it.

The caveat is that you can only trade crypto with crypto on Binance, as it doesn’t support fiat trading or fiat deposits.

The fees levied are 0.1% for each trade. The fees can be paid for using Binance’s in-house token BNB, and the tokens could translate to discounts.

4. BitMEX

Sorry USA users, without VPNs or a bypass, you’ll probably be unable to use BitMEX.

Besides being a cryptocurrency exchange, BitMEX is well-known for their research pieces about cryptocurrency, posted on the BitMEX blog.

This website is a peer-to-peer exchange that is denominated in Bitcoin, meaning that deposits, profits, and losses are all in Bitcoin, even if you’re buying and selling altcoin contracts. Similar to Binance, BitMEX doesn’t deal with fiat currencies.

One appeal of BitMEX is that there are no trading limits, as long as traders are above 18 years of age. This exchange is better utilised by more advanced traders with the skills to leverage on margin trading—where you “borrow” money from the exchange to have to hedge your bets on rapidly shifting cryptocurrency prices.

Do note that BitMEX only accepts deposits through bitcoin. Since this is a peer-to-peer site, the fees are levied based on maker fees and taker fees.

A breakdown of the platform’s fees can be found here. For example, for XBT, the Taker Fee is 0.075%. It has been noted however, that BitMEX’s withdrawal fees can be quite high.

5. OKEx

While many exchanges are friendly towards margin trading, OKex is notable for also facilitating futures trading. This refers to the risky act of buying or selling a particular contract at a set price, on a set date in the future, with a set quantity. It allows investors to predict the prices of cryptocurrencies, and attempt to use that to their advantage.

That being said, OKEx restricts access to futures trading with strict user guidelines.

OKEx also offers support for fiat-to-crypto transactions, but only against the Chinese Yuan, through a customer-to-customer marketplace which can be done between two OKEx users, who can set their own prices. The marketplace allows withdrawals as well.

The platform supports a wide variety of cryptocurrencies to trade.

One key appeal of OKEx is the relatively lower fees in the cryptocurrency market, as the platform tiers them based on 30-day trading volumes.

Beginners who just wants to buy and sell crypto sans the complications could instead opt for OKEx’s sister platform, OKCoin.

OKEx has faced accusations of falsifying their trade volumes.

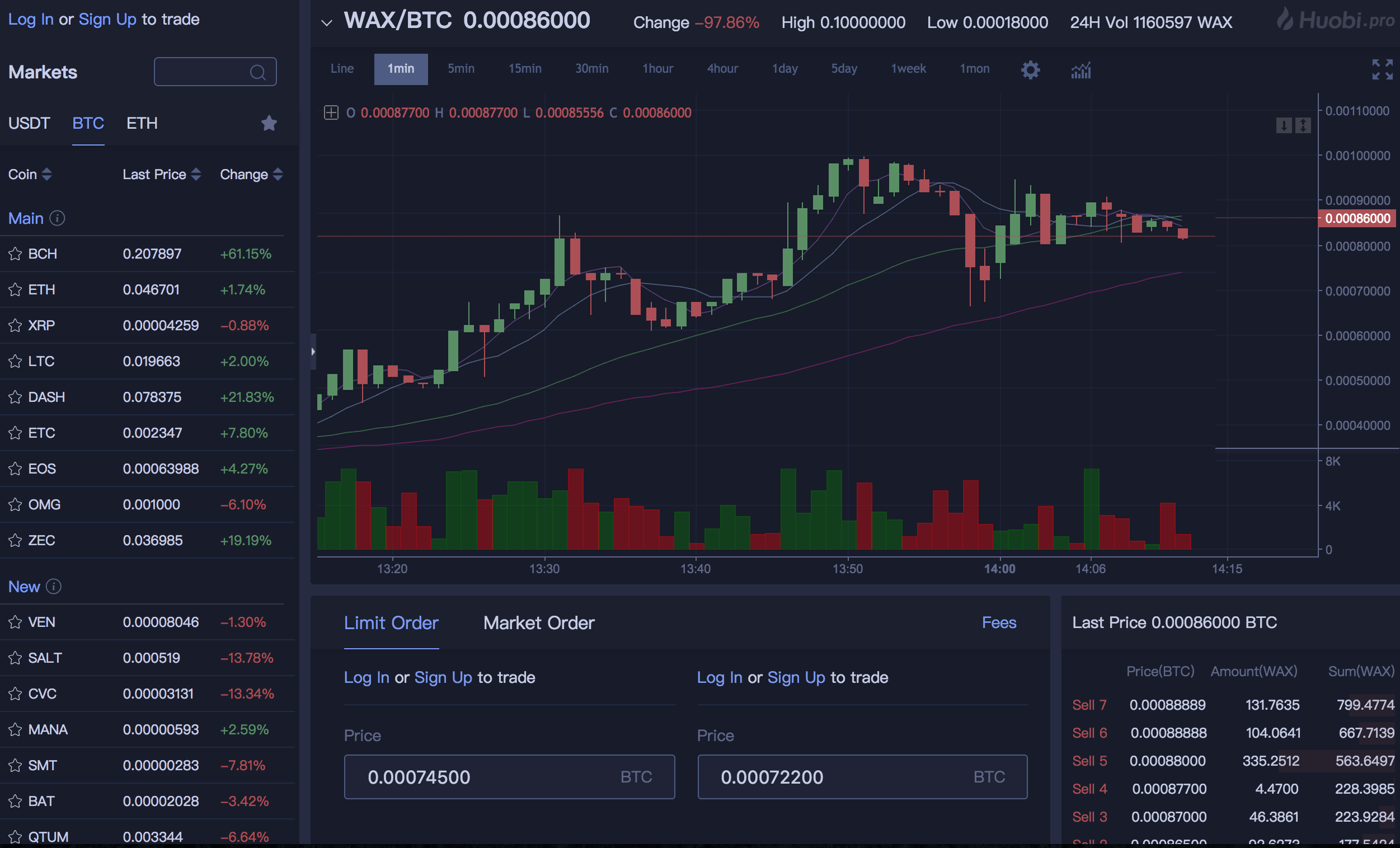

6. Huobi

This Singapore-based exchange is more geared to Asian markets like Hong Kong, Japan, Korea, etc, but can be used in more places. Similar to many of the above listings though, Huobi isn’t available for USA registrants, though Huobi is linked to a USA-based exchange that has just launched named HBUS.

Huobi also offers a pro version, appropriately named Huobi Pro.

The platform’s appeal lies in a comprehensive trading screen that features a convenient trading pair “cheat sheet” on the left side of the screen, while the right side showcases an interactive chart with a range of tools for more technical analyses.

Huobi allows you to purchase cryptocurrency in USD, Chinese Yuan or the Singapore dollars through their over-the-counter service. It has a high number of bitcoin and ethereum pairings with different altcoins.

However, Huobi faces accusations that their trade volumes are falsified.

All fees, taker, and maker, are set at 0.2%.

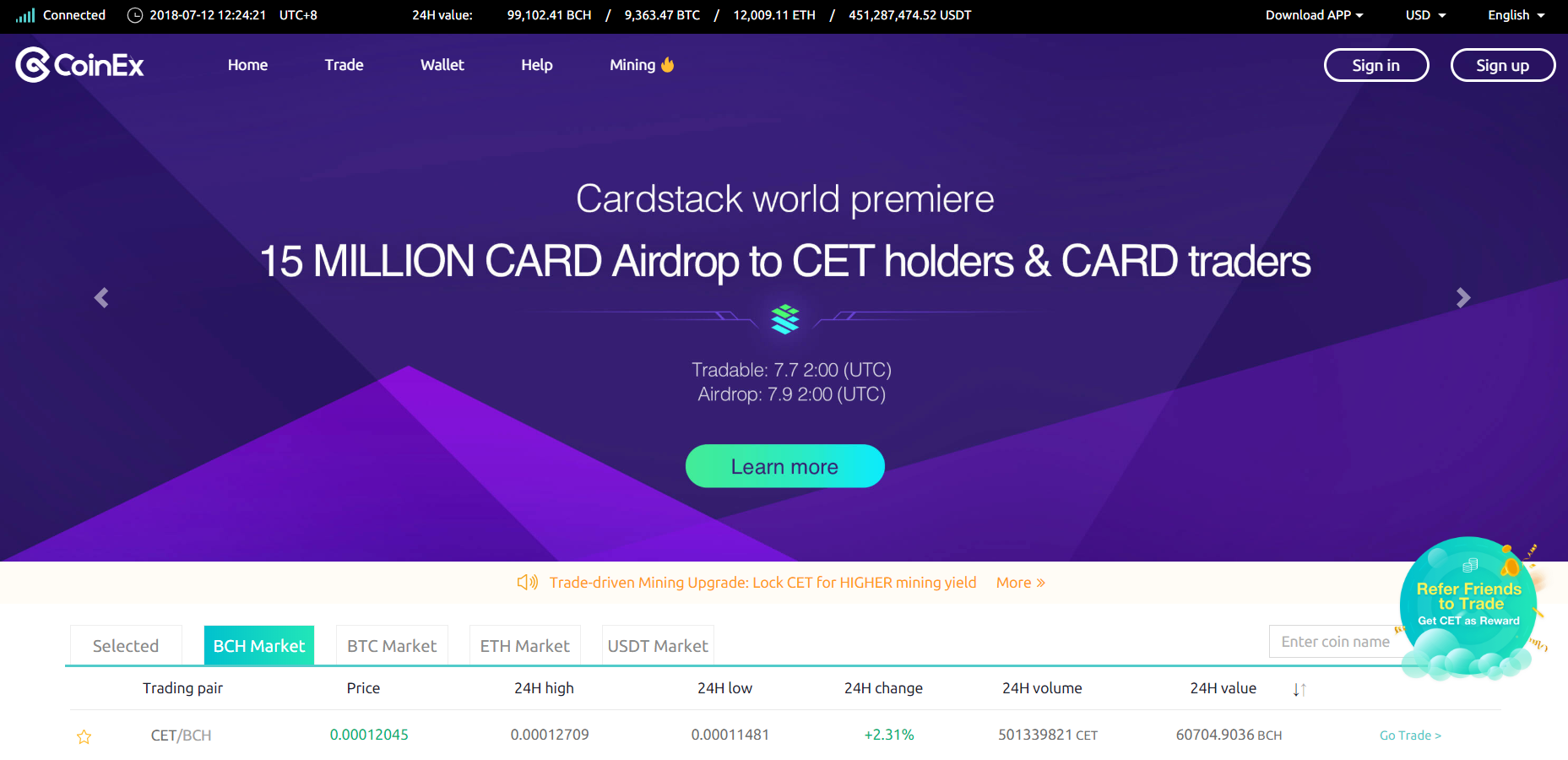

7. CoinEx

This 50-strong company resides in Shenzen, Hong Kong and Singapore. CoinEx has risen from obscurity recently thanks to the introduction of its trade-driven mining concept, trans-mining.

It is a variant of the controversial model used by FCoin, and CoinEx characterises this with the terms “trade-driven mining”, and ‘dividend distribution”.

At the time of writing, CoinEx stands at second place among trans-mining exchanges in terms of volume, below FCoin which we have excluded due to their impression in the market.

Transaction fees on CoinEx are converted into the platform’s own CET tokens which are then distributed back to traders by transaction volumes. This means that users essentially are trading for free—think about it as a form of cashback.

It’s said that most of the trades are being made using Tether.

Similar to the controversy with FCoin though, some are concerned about the possibility of bots “mining” the CET coins.

That being said, CoinEx has certainly garnered interest in the trading circles due to its unusual concept, both positive and negative, and many are watching its movements closely. They’ve made an impact, but whether this impact is sustainable will be another matter entirely.

Featured image via Pexels

The post 7 Major Cryptocurrency Exchanges You Should Know appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments