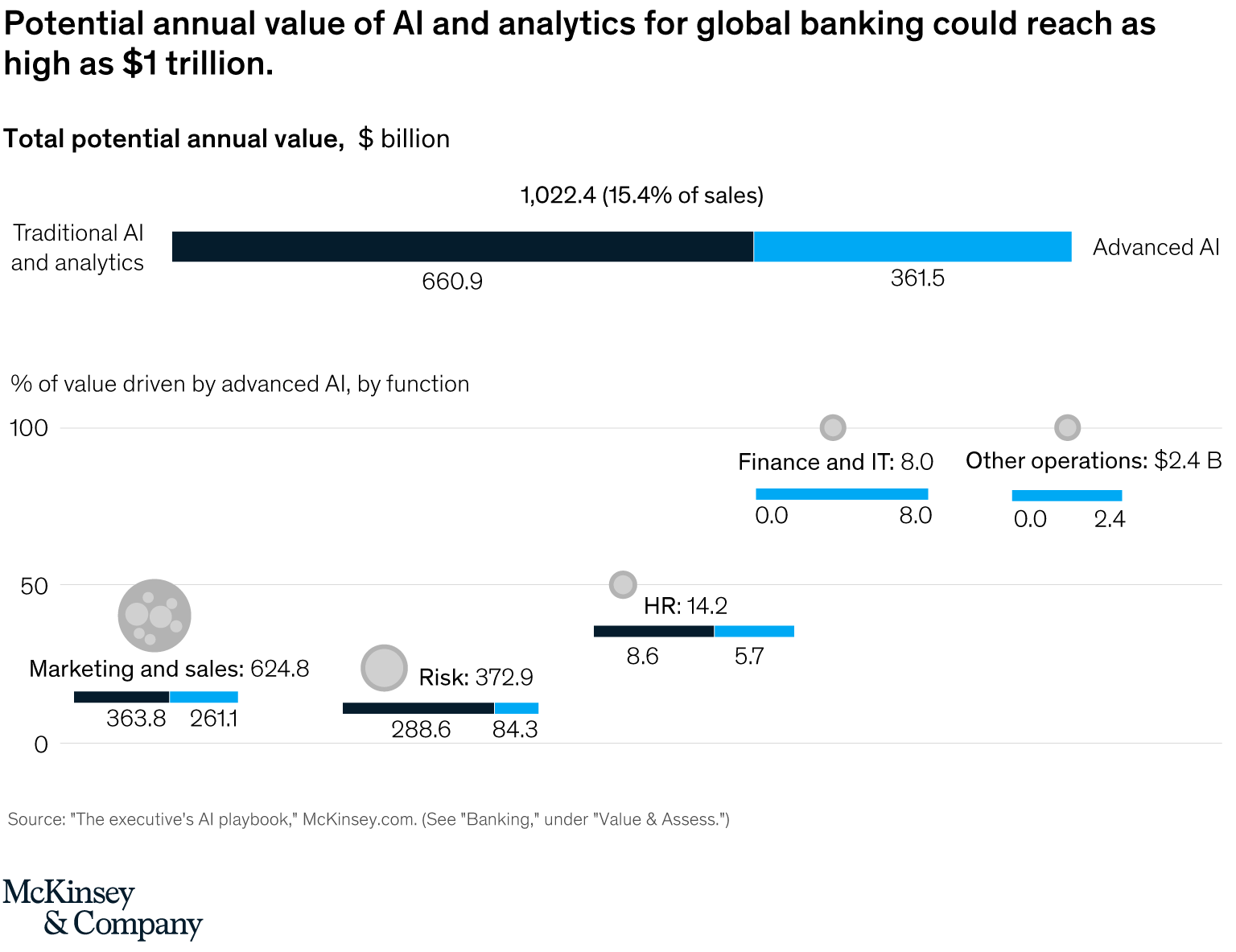

For global banking, artificial intelligence (AI) could potentially deliver up to US$1 trillion of additional value each year, boosting revenues through increased personalization of services, lowering costs through efficiencies, and uncovering new and previously unrealized opportunities through the use of data, says McKinsey & Company.

Total potential annual value, $ billion, Source: The executive’s AI playbook, McKinsey.com

In a post titled AI-bank of the future: Can banks meet the AI challenge?, McKinsey says that banks have continuously adapted to the latest technology innovations throughout the years, and as the industry heads towards the AI-powered digital age, incumbents must adopt AI at scale and become so-called “AI-first banks.”

Several trends are accelerating banks’ transition towards becoming AI-first, it says, with the first one being customers’ rapid adoption of digital banking. COVID-19 has further boosted the adoption of digital banking with use of online and mobile banking channels surging an estimated 20 to 50% in the first few months of the pandemic.

The emergence of digital ecosystems and so-called “super apps” is also changing the way consumers discover, evaluate and purchase banking products and services, it says. Across countries, non-banks businesses, and tech giants in particular, are embedding financial services and products in their journeys, delivering exceptional experiences for customers and disrupting traditional methods.

Bigtech players have major market advantages, McKinsey says, including a large and engaged customer network, troves of data, access to low-cost capital and tech expertise. Many have gained a foothold in domains such as payments, lending and insurance, and will continue to expand.

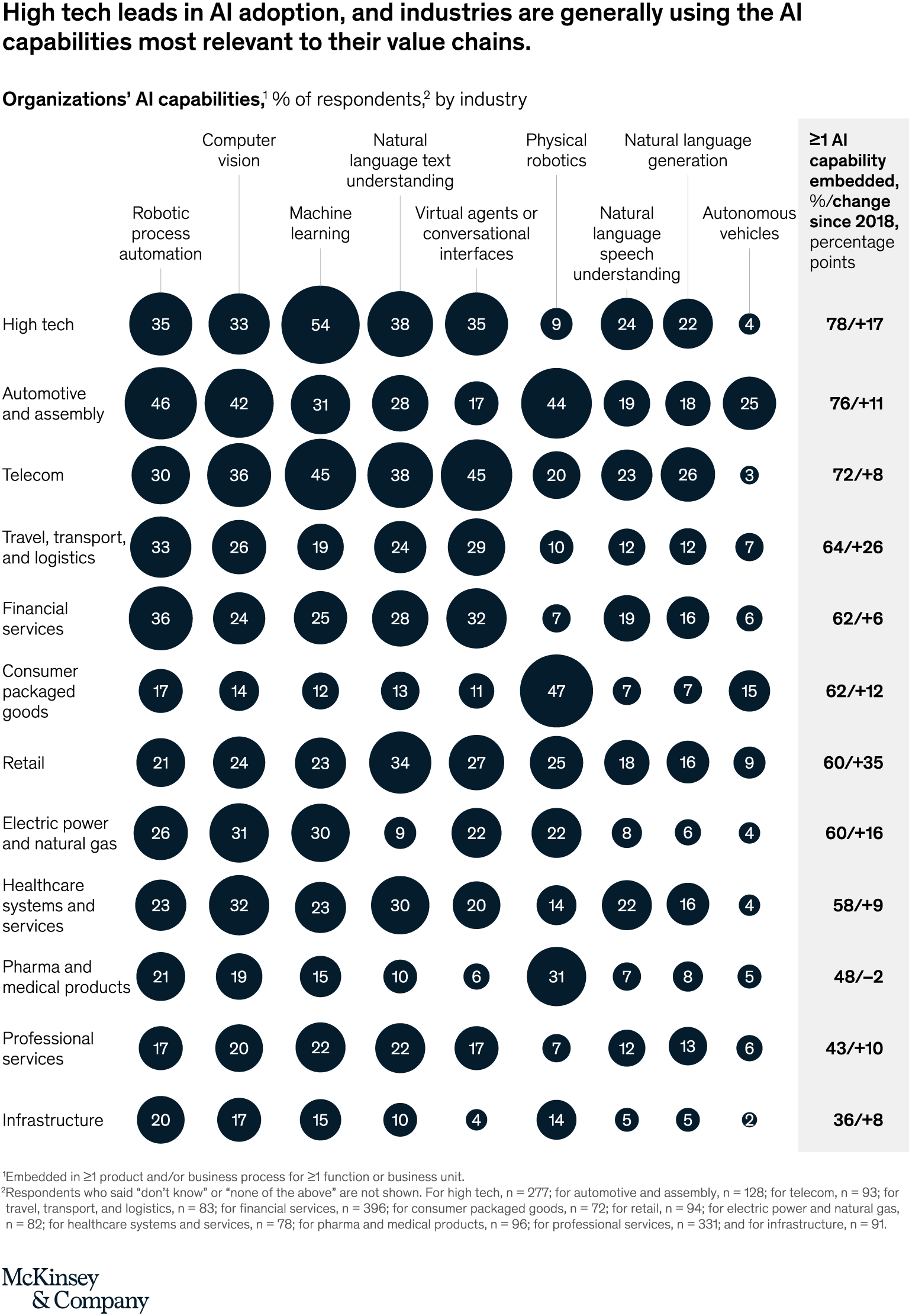

McKinsey notes that around the world, leading financial institutions are increasingly using advanced AI technologies. McKinsey’s Global AI Survey report, released in November 2019, found that about 60% of financial companies had embedded at least one AI capability.

Robotic process automation (36%) was found to be the most widely adopted AI capability in financial services, followed by virtual agents or conversational interfaces (32%), and natural language text understanding (28%).

Organizations’ AI capabilities, % of respondents, by industry, McKinsey’s Global AI Survey, November 2019

The AI-bank of the future

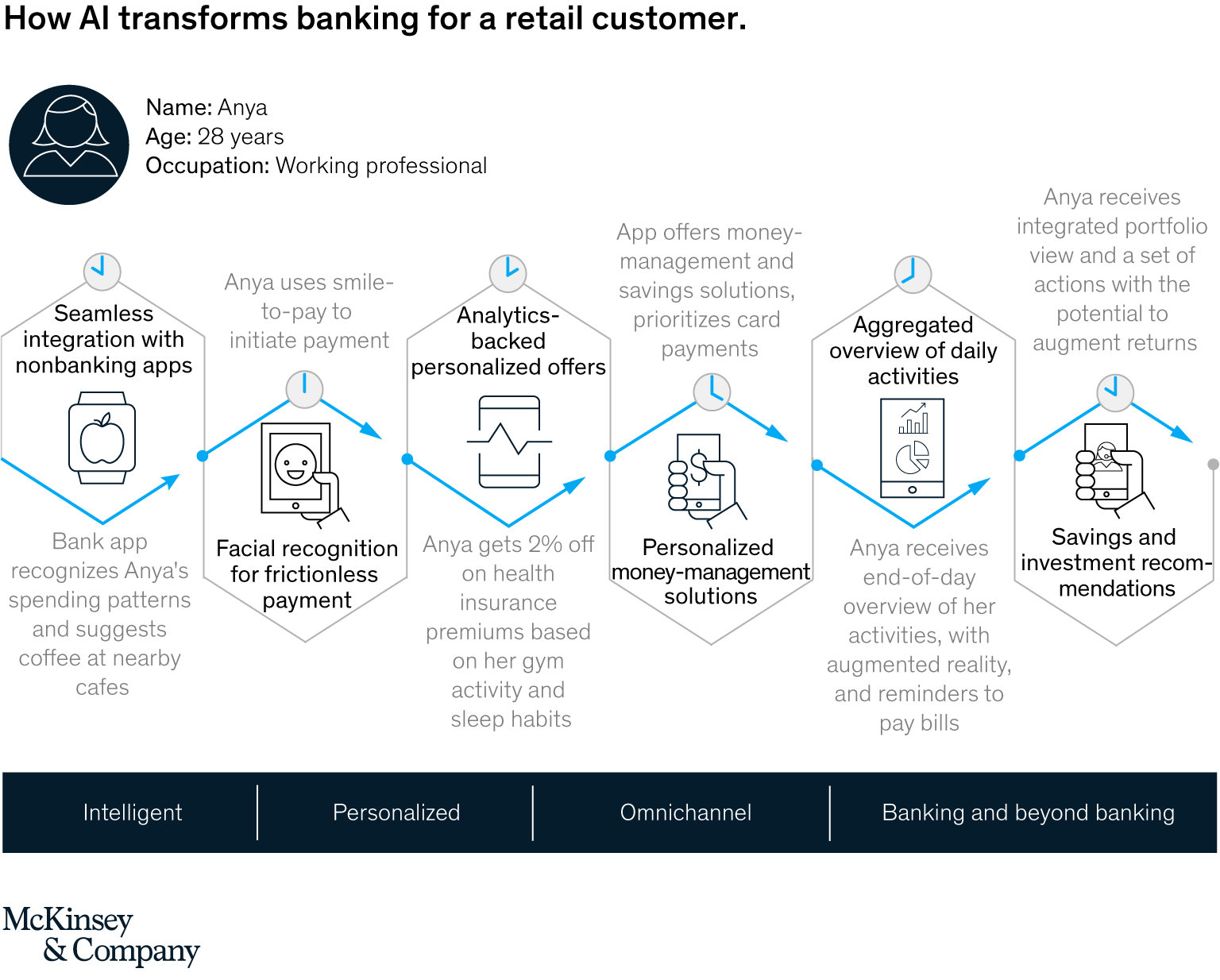

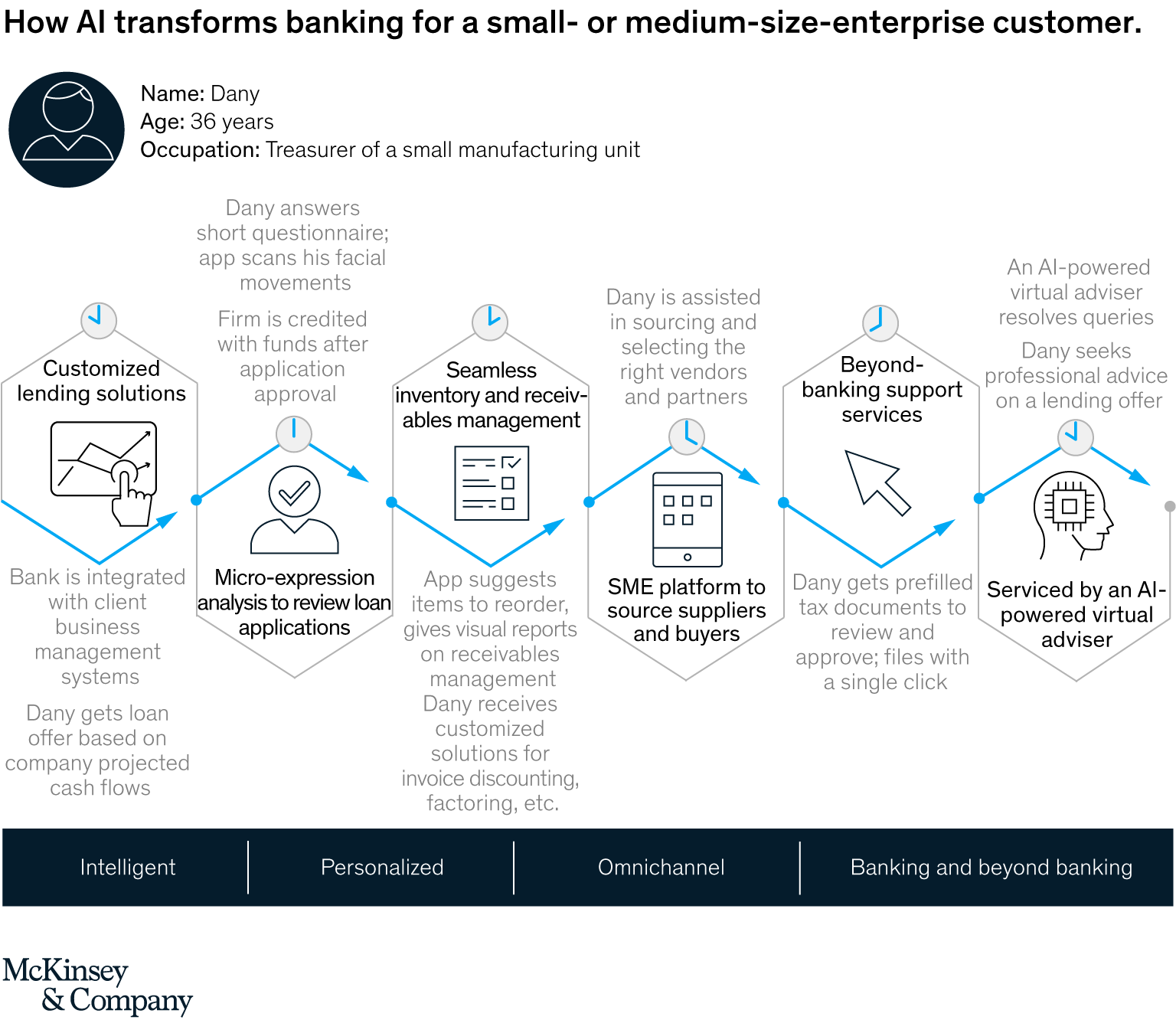

According to McKinsey, the AI-first bank will integrate AI and analytics capabilities into diverse core systems and delivery platforms to offer intelligent, personalized and truly omnichannel propositions and experiences.

These intelligent propositions will be made accessible not only on the bank’s own platforms but also in other ecosystems that its customers are part of.

Tech giants that have successfully developed extensive ecosystems include Alibaba, Baidu, and WeChat in China, and Amazon, Facebook, and Google in the US, McKinsey notes.

AI-first banks will also blend banking capabilities with relevant products and services beyond banking, and will collaborate extensively with partners to deliver new value propositions. They will be as fast and agile as digital-native companies, and will be able to launch new features in days or weeks instead of months.

How AI transforms banking for a retail customer, AI-bank of the future: Can banks meet the AI challenge, McKinsey & Company, September 2020

How AI transforms banking for a small- and medium-sized enterprise customer, AI-bank of the future: Can banks meet the AI challenge, McKinsey & Company, September 2020

Internally, AI-first institutions will be optimized for operational efficiency, turning to extreme automation of manual tasks as well as replacing/augmenting human decisions utilizing advanced diagnostic engines, McKinsey says.

According to a survey jointly conducted by the Cambridge Centre for Alternative Finance and the World Economic Forum in Q2-Q3 2019, incumbents expect AI to replace nearly 9% of all jobs in their organization by 2030.

AI is expected to become a key lever of success for specific financial services sectors, including asset management, lending and payments, the research found.

Nearly half of all the survey participants, which comprised 151 fintech companies and financial institutions, regard bigtechs leveraging AI capabilities to enter financial services as a major competitive threat.

The post AI to Unlock US$1T of Additional Value Each Year for Banks: McKinsey appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments