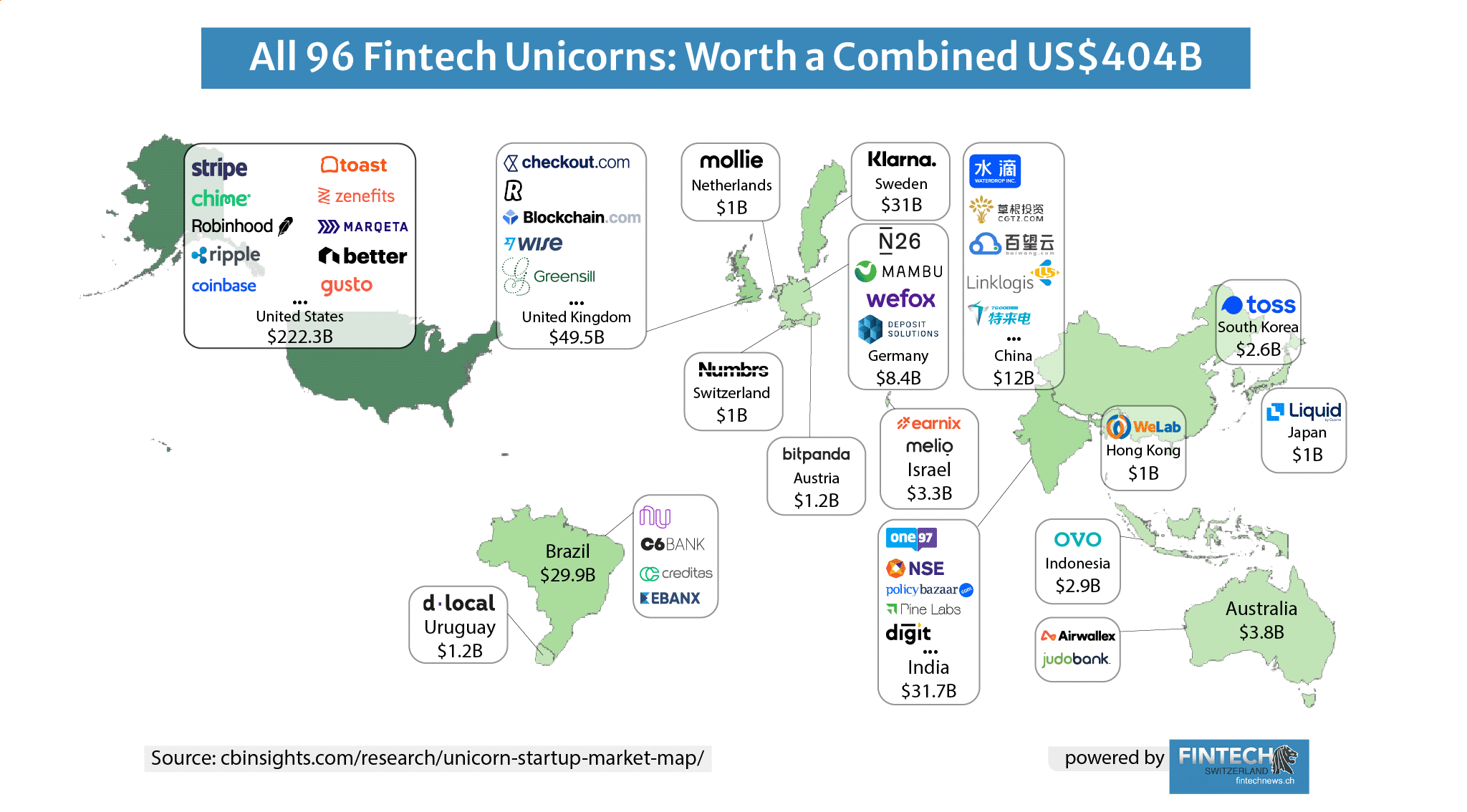

There are 96 fintech unicorns around the world that are worth collectively an estimated US$404 billion, according to data from CB Insights.

Nearly half (46) of them are from the US, making it the largest hub for fintech unicorns in the world. The US is home to some of most valued fintech private companies, including Stripe (US$95 billion), Chime (US$14.5 billion), Robinhood (US$11.7 billion), Ripple (US$10 billion) and Coinbase (US$8 billion).

After the US, the UK has the second largest community of fintech unicorns with 13 players, among which names such as Checkout.com, the UK’s most valuable fintech at US$15 billion, Revolut (US$5.5 billion), and Wise, formerly TransferWise (US$5 billion). It’s followed by China (8) and India seven (7).

Regional distribution of fintech unicorns

Regionally, the fact that the US is single-handedly home to 46 fintech unicorns, makes North America the top region when it comes to fintech unicorns. Add to this the five fintech unicorns that make up Latin America – dLocal, Ebanx, Creditas, C6 Bank and Nubank – , and you get a total number of 51 for the Americas.

Regionally, the fact that the US is single-handedly home to 46 fintech unicorns, makes North America the top region when it comes to fintech unicorns. Add to this the five fintech unicorns that make up Latin America – dLocal, Ebanx, Creditas, C6 Bank and Nubank – , and you get a total number of 51 for the Americas.

After the Americas, Asia Pacific (APAC) is the world’s second largest hub for fintech unicorns with 21 companies. 15 of these companies are either based in China and India, the two biggest locations, ahead of Australia (2), and Japan, South Korea, Indonesia and Hong Kong, all with one unicorn each. APAC fintech unicorns include Pine Labs, PolicyBazaar, Ovo, Viva Republica and WeLab.

Europe is the world’s third largest hub with 20 fintech unicorns. UK companies make up for more than half of the region’s total number of fintech unicorns with 13, followed by Germany with four unicorns, and Switzerland, Austria, the Netherlands and Sweden with one fintech unicorn each. These players include Starling Bank, Blockchain, Rapyd, Numbrs and Wefox.

2021 trends

So far, 2021 has seen the addition to 20 fintech unicorns. That’s more than the 19 fintech companies that joined the unicorn club during the whole year 2020, but less than 2019’s all-time high figure of 27.

Among the 20 fintech companies that reached unicorn status in 2021, 10 are from the US, and four are from the UK. Israel and Austria welcomed their first fintech unicorns this year: Melio, a digital payment startup, and Earnix, a software provider, both from Israel, and BitPanda, a crypto startup from Austria.

Robinhood rival WeBull turned into an unicorn last month when it raised a US$150 million funding round. The Chinese-owned brokerage, which runs one of the fastest-growing trading platforms in the US, has been riding the retail trading frenzy, successfully positioned itself as the go-to platform for disgruntled users of Robinhood. Like Robinhood, WeBull offers a commission-free trading platform with a smooth and polished online interface.

There are currently more than 600 private companies with billion-dollar valuations. These tech startups are worth over US$2 trillion and have raised a combined total of US$426 billion. Across all segments, fintech and Internet software and services are the most represented categories, accounting for 15% of all unicorns each. They are followed by e-commerce and direct-to-consumer (12%) and artificial intelligence (8%).

Currently, ByteDance is the only private company considered to be a “hectocorn” that’s worth US$100 billion or more. ByteDance, the tech company behind TikTok, has been named the most valuable startup in the world.

31 private companies are “decacorns” worth US$10 billion or over. Decacorns in fintech include Stripe, which is on track to reach hectocorn status, Klarna (US$31 billion), Nubank (US$25 billion) and One97 Communications (US$16 billion), the operator of India’s largest mobile payments and commerce platform Paytm.

The post All 96 Fintech Unicorns: Worth a Combined US$404B appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments