COVID-19 is impacting businesses of all sizes and from all industries. In Switzerland, gross domestic product (GDP) is expected to contract by around 6% this year in one of the strongest declines since the oil crisis in the 1970s, the Swiss National Bank (SNB) said on June 18. For the year as a whole, the State Secretariat for Economic Affairs (SECO) forecasts unemployment to hit 3.8% year-on-year, compared with 2.3% in 2019.

To limit the human and economic impact of the pandemic, the Swiss federal government and cantons have launched a package of measures worth more than CHF 60 million that’s intended at enabling the economy to recover in the second half of 2020 and eventual regain solid growth in 2021.

To support the fintech startup community in these turbulent times, the Fintech News Network has committed to covering each week a promising Swiss fintech startup that deserve the spotlight.

So far, startups including Gentwo Assets, a securitization specialist for bankable and unbankable assets, Vestr, an end-to-end digital platform for investment certificates, and Vlot, an insurtech startup providing holistic life risk assessment, have been part of the series with more to come.

For this week, we look at b-sharpe, a startup specializing in foreign exchange (FX) and international transfer services.

b-sharpe: FX transactions five to ten times cheaper than a bank

Based in Geneva, b-sharpe is an online currency exchange and international transfer services company that helps people and businesses manage their currency needs in a fast, fair and user-friendly manner.

The startup offers exchange rates to individuals and small and medium-sized enterprises (SMEs) which banks normally reserve for large international groups and their largest customers, promising FX transactions that cost between five and ten times less than with a traditional bank.

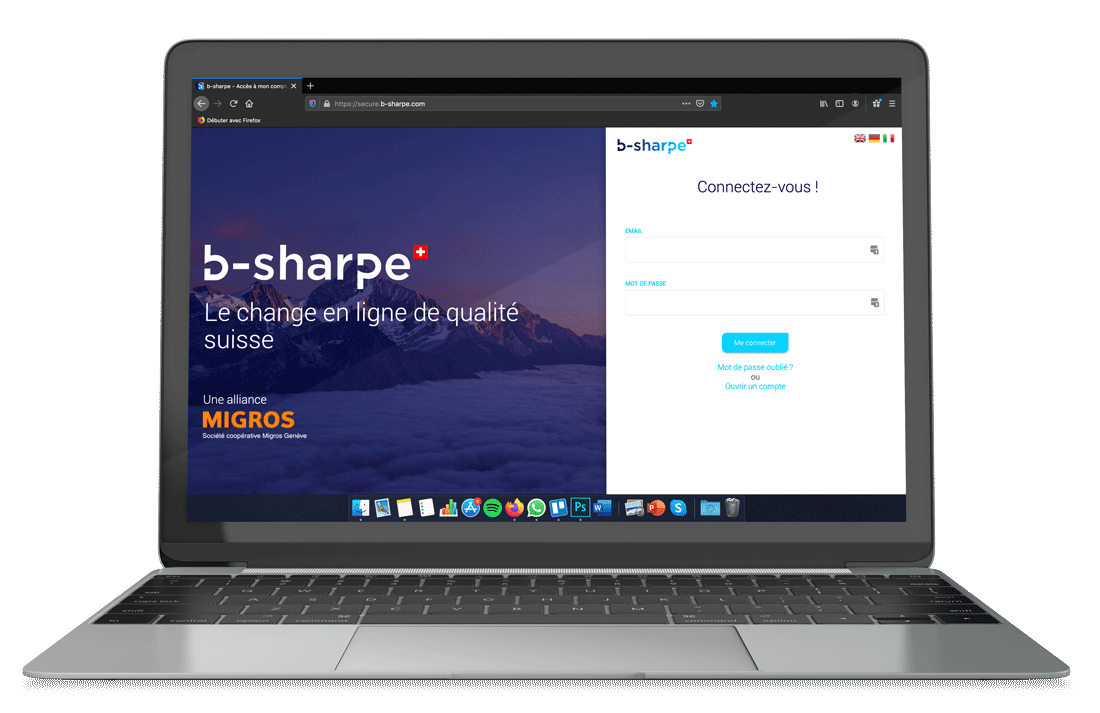

b-sharpe illustration, Source: b-sharpe.com

b-sharpe is able to provide much cheaper forex transactions because the startup pools clients’ transactions, according to its website, and because its personnel is composed of forex market and web professionals with direct access to trading rooms, and therefore, the best available exchange rates.

Additionally, b-sharpe says it has developed a platform that allows the same manager to handle a client’s operations from start to finish, eliminating the need to rely on several departments and staff members like a bank would to conduct these transactions, thus reducing b-sharpe’s fixed costs and passing them on to customers.

For each of its transactions, b-sharpe uses the real-time interbank exchange rate at the time at which the company receives the funds. Customers can conduct their forex transactions using the startup’s multi-currency platform or by telephone.

b-sharpe currently supports over 20 currencies including CHF, EUR, USD, GBP and JPY. The startup charges a transfer fee of CHF 5 per transaction for transactions below CHF 5,000, or the equivalent. No fees are charged for transactions exceeding CHF 5,000.

b-sharpe also offers a quick and seamless onboarding experience that takes customers less than 10 minutes to register and get verified. This is done by leveraging Onfido’s award-winning global identity verification platform.

The process requires customers to take a selfie as well as a photo of an ID. Onfido then checks that the government ID is genuine and matches it to the user’s face to ensure the person is physically present.

Founded in 2006 as an institutional consultancy services provider specialized in exchange rate management, b-sharpe launched its FX platform in 2013.

Since then, the startup has conducted CHF 1.3 billion worth of transactions, helping its 16,000+ customers save more than CHF 8 million, it claims. b-sharpe raised an undisclosed funding in November 2019 from Migros Genève.

b-sharpe is one of the numerous startups in Switzerland transforming the FX landscape. Other players include Amnis Treasury Services, an online FX market platform, and Exchange Market, which specializes in the online exchange of CHF and EUR.

The post b-sharpe: FX Transactions 5 to 10 Times Cheaper than a Bank appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments