The Bank for International Settlements (BIS) said in an annual report that it backs the development of central bank digital currencies (CBDCs).

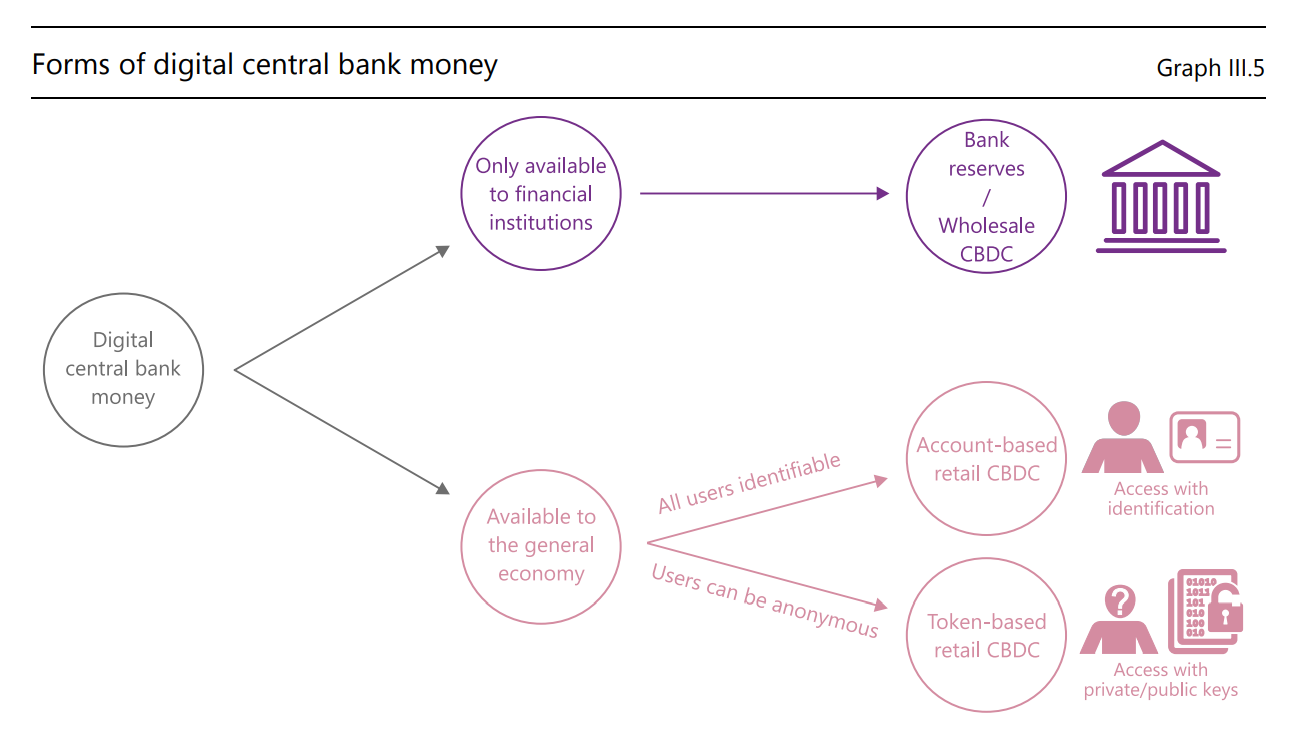

The Annual Economic Report 2021 said that CBDCs are “moving from concept to practical design and renew the institution of money in a new form designed for the digital age” and lays out the design choices for CBDCs.

BIS analysis finds that CBDCs would best function as part of a two-tier system where the central bank and the private sector work together to do what each does well.

The central bank would operate the core of the system and ensure its safety and efficiency, while the private sector, such as banks and payment service providers, would use its innovative capacity to serve customers.

The central bank would operate the core of the system and ensure its safety and efficiency, while the private sector, such as banks and payment service providers, would use its innovative capacity to serve customers.

From a practical perspective, the BIS says the most promising CBDC design would be one tied to a digital identity, requiring users to identify themselves to access funds.

A careful design would balance protecting users against the abuse of personal data with protecting the payment system against money laundering and financial crime.

In addition, the BIS says international cooperation on design will be vital if central banks are to harness the full benefits of CBDCs, and to improve cross-border payments while countering foreign currency substitution.

The BIS’s Innovation Hub (BISIH), the Swiss National Bank (SNB) and the financial infrastructure operator SIX had recently announced the successful completion of a joint proof-of-concept for its wholesale CBDC dubbed as Project Helvetia.

Hyun Song Shin

“CBDCs are a concept whose time has come. They open a new chapter for the monetary system by providing a technologically advanced representation of central bank money.

In doing so, they preserve the core features of money that only the central bank can provide, anchored in the foundation of trust in the central bank.”

said Hyun Song Shin, Economic Adviser and Head of Research of the BIS.

Benoît Cœuré

“CBDCs could form the backbone of a new digital payment system by enabling broad access and providing strong data governance and privacy standards.

They are the best way to promote the public interest case for digital money.”

said Benoît Cœuré, Head of the BIS Innovation Hub.

Featured image: Hyun Song Shin, Economic Adviser and Head of Research of the BIS, screengrab from Youtube

The post BIS Backs the Development of Central Bank Digital Currencies appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments