SWIFT’s FIN traffic rose to an all-time high of 7.1 billion messages in 2017, fuelled by double-digit growth in global payments. While SWIFT’s FIN traffic grew by 9% over the year, FIN Payment traffic rose by 12%, driven by growth across all regions and the adoption of SWIFT’s gpi service.

With an average of 28.14 million messages a day SWIFT also recorded new peak traffic days in 2017, processing 32.84 million FIN messages on 30th November – 8% above the 2016 peak of 30.4 million messages. At the same time, SWIFT continued to deliver on its day-to-day mandate: operational availability performance during 2017 exceeded targets.

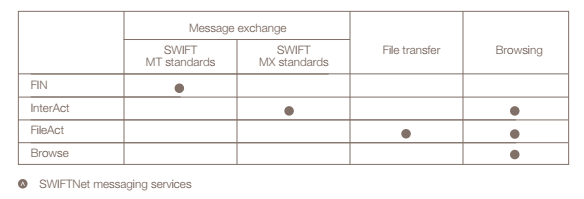

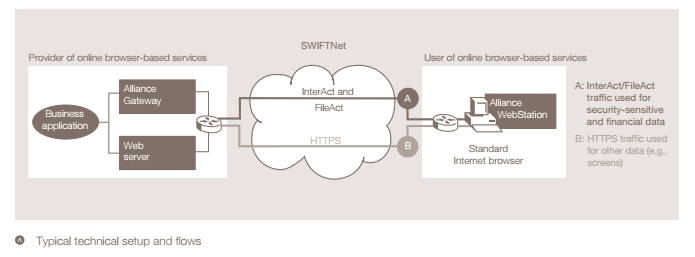

SWIFT achieved 99.999% availability both for FIN and its SWIFTNet messaging services, against the backdrop of growing volumes and the completion of the FIN Renewal project – as well as the roll out of new products and services and the ongoing implementation of the Customer Security Programme.

Gottfried Leibbrandt

“Traffic growth, and payments traffic growth in particular was exceptionally strong in 2017, reflecting the Community’s trust in the cooperative and the wider growth in the global economy”,

said SWIFT CEO, Gottfried Leibbrandt.

“SWIFT maintained the high security and reliability performance our community expects, while investing for the future, developing innovative new services, working to help the community reinforce its security through the Customer Security Programme, and continuing to return the benefits of its economies of scale to users.”

Growth in SWIFT’s payments traffic was strong across all regions as well as in domestic and cross-border segments, both of which experienced double-digit growth during the year. Momentum was partially driven by the go-live of SWIFT’s gpi service in January 2017, which already accounts for nearly 10% of cross-border payment instructions carried on the network.

A total of 100 country corridors are already live with gpi, including all the major country corridors such as the US-China route, where gpi payments already account for 25% of traffic. End-users are already seeing the significant impact of gpi: all gpi payments can be tracked end-to-end and most of them are already credited in a few hours or less.

Luc Meurant

“The success of gpi in 2017 exceeded expectations”,

said SWIFT’s Chief Marketing Officer, Luc Meurant,

“With more banks going live, additional banks signing up to the service, and fast-growing demand from corporates, volumes will continue to rise dramatically. Offering speed, transparency and safety, we expect gpi will become the new norm within the next two to three years.

SWIFT has led the way in innovation, to provide our customers with an enhanced level of performance, and will continue to be at the forefront of introducing new technological solutions. The gpi service, combined with ourFinancial Crime Compliance suite and the Customer Security Programme, will transform international payments.”

In SWIFT2020, SWIFT’s strategic five year plan, the cooperative committed to a new long-term, structural price reduction programme. In 2017 SWIFT made measurable progress in delivering on that commitment, reducing average message prices by 12% year-on-year. This resulted in an overall 20% price reduction just two years into the 5-year programme.

The post Can Blockchain handle this too? SWIFT Annual Payment Traffic To Exceed 7 Billion Message Mark appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments