Around the world, non-financial companies are increasingly integrating financial products into their service offerings. This emerging trend, referred to as embedded fintech, is becoming more and more apparent, according to a CB Insights report.

In its State of Fintech Q2’20 Report, the market intelligence firm shares findings from funding data from Q2, stating that the trend towards embedded fintech applications is rapidly gaining traction around the globe and across applications.

The report cites the examples of human resources (HR) platform Gusto, which offers Cashout, a service that grants employees paycheck advances, automakers like Toyota and Ford, which are using data to improve embedded insurance offerings, as well as real estate and rental marketplace Zillow, which has integrated fintech services within its services.

Further highlighting this trend is the number of deals and amount of funding in Q2’20 that went towards companies enabling embedded fintech. These include Airwallex, a business-to-business (B2B) payment services provider which raised US$160 million, Checkout.com, a paytech company serving merchants from London which raised US$150 million, and States Title, a proptech startup from the US facilitating mortgage closings which raised US$123 million.

The concept of embedded fintech is that financial services, rather than being offered as standalone products, will become part of the native user interface of other products, becoming thus embedded.

This trend has emerged over the past few years, with Apple, for example, launching the Apple Card in the US in August 2019. Amazon offers products and services in payments, lending, insurance, and more. Facebook provides payments services and has been working on its Libra stablecoin project.

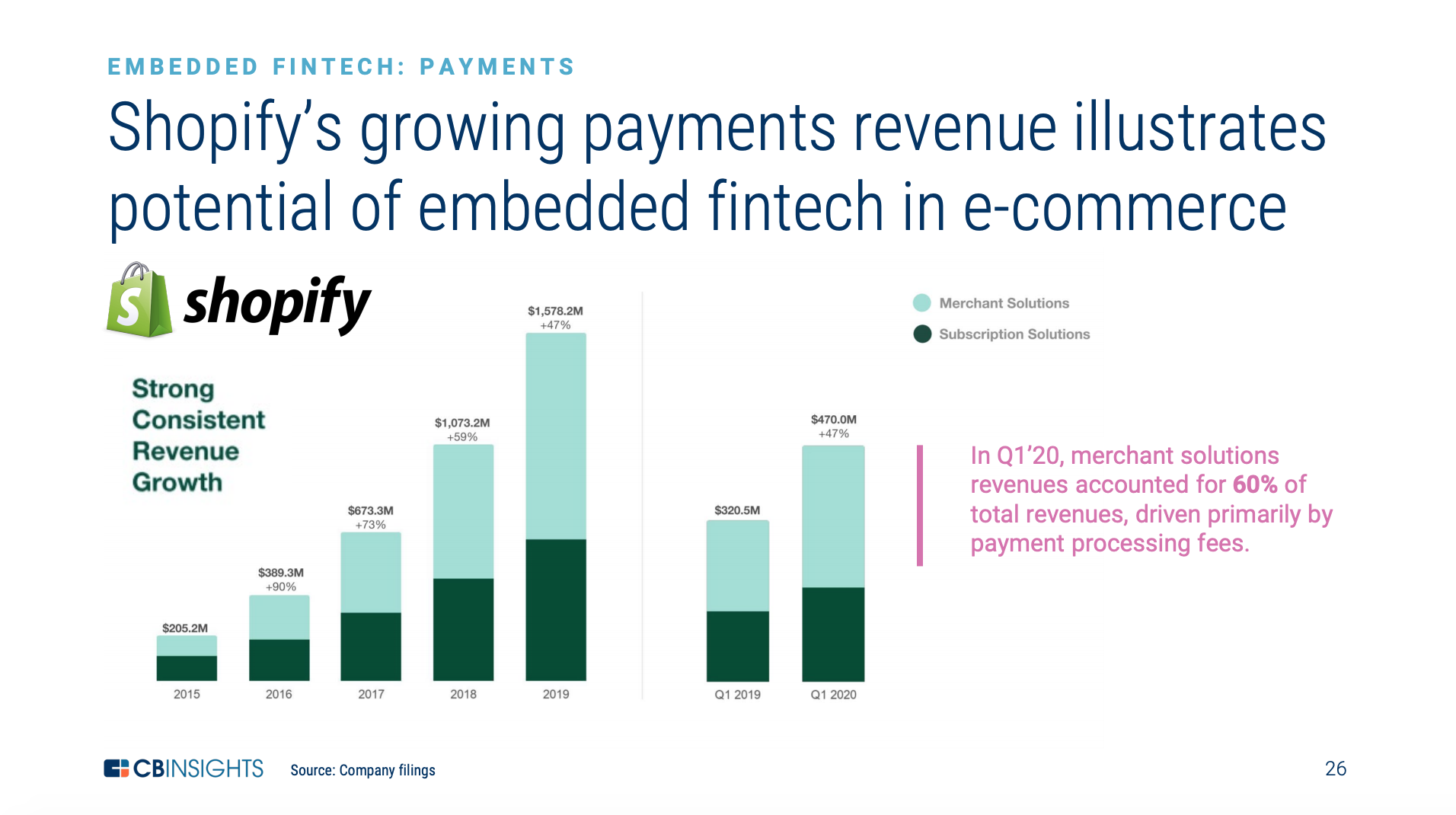

Shopify, a leading e-commerce platform, launched a payment solution called Shopify Payments in August 2013. Since its introduction, Shopify’s payments revenue has grown tremendously, a clear proof that embedded fintech in e-commerce works and can be very lucrative.

Shopify’s payments revenue growth, The State of Fintech Q2’20 Report, CB Insights

Another key trend in Q2’20 was open banking. New banking tech providers, including open APIs provider Setu and open banking platform Yapily, received notable investments, and incumbents began providing open banking services, the report says.

Q2’20 also saw notable growth in the e-commerce sector amid the COVID-19 pandemic, as well as further consolidation in the retail wealth management sector with the acquisitions of Personal Capital, Folio Investing, and AdvisorEngine, the report says.

Multiple fintech companies filed to go public in Q2’20, possibly signaling a shift in attitudes towards initial public offerings (IPOs) among mature fintech companies, the report says.

Fintech companies that filed to go public in Q2 include Lemonade, a digital renter and homeowner insurance company, nCino, which offers cloud-based operating software to banks, SelectQuote, a 30-year old insurtech, and Shift4Payments, an online point of sale (POS) provider.

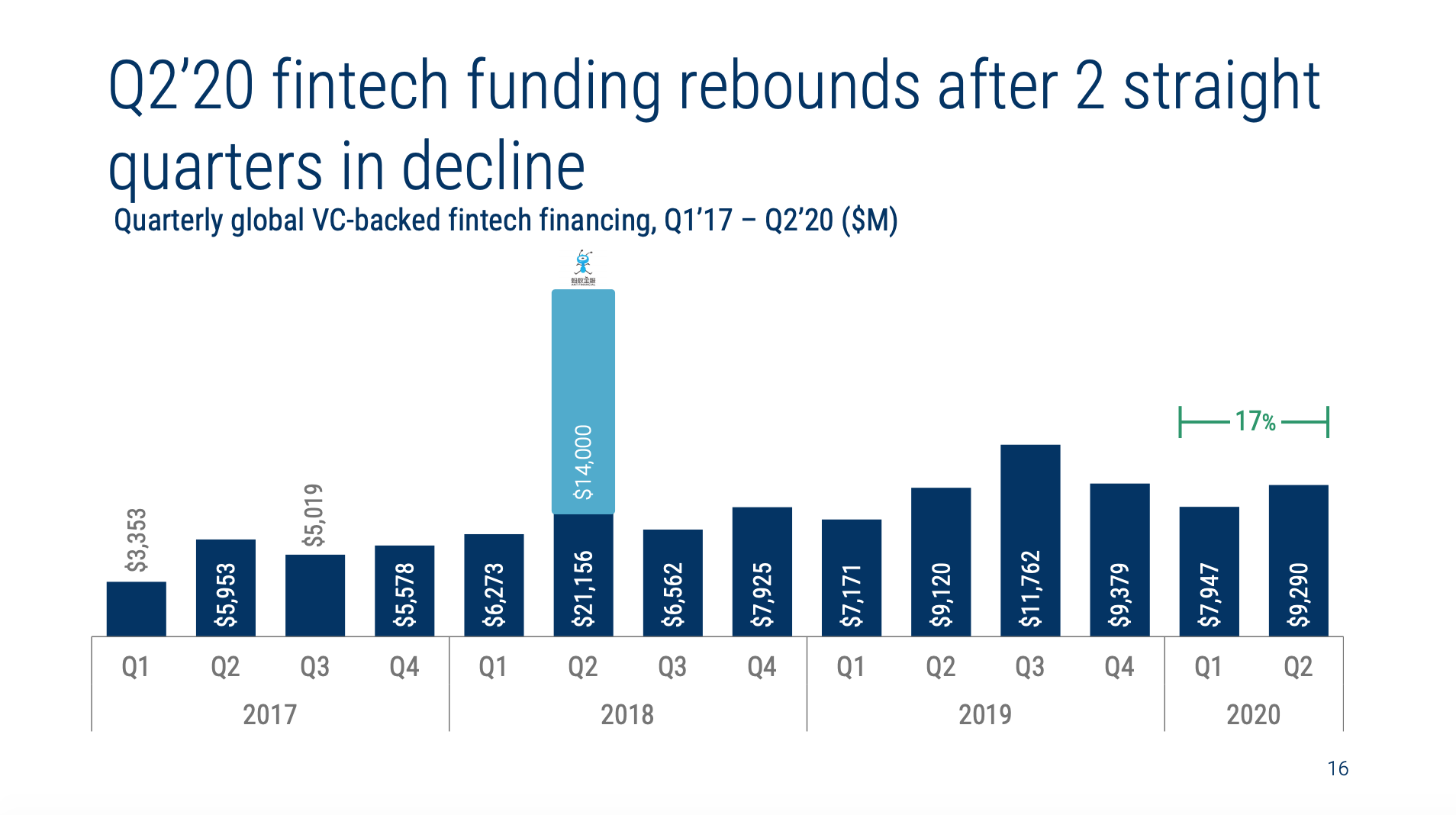

Fintech funding rebounded in Q2’20, increasing 17% quarter-over-quarter (QoQ) to US$9.3 billion.

Quarterly global VC-backed fintech financing, Q1’17 – Q2’20 ($M), The State of Fintech Q2’20 Report, CB Insights

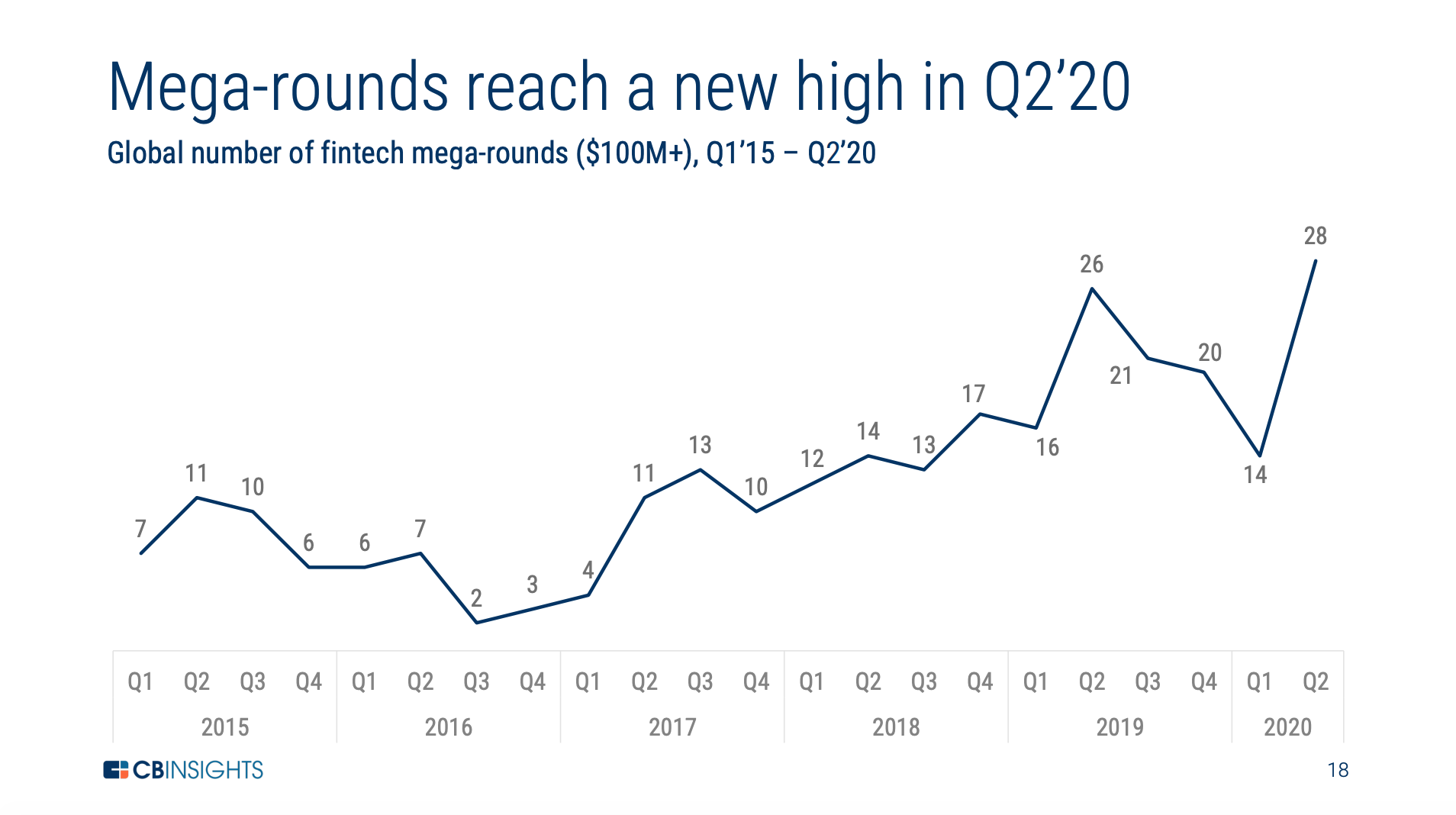

Mega rounds of US$100 million and more hit a new quarter high of 28, with some of these possibly going towards companies with high cash-burn rates to help them get through the ongoing economic uncertainty induced by the COVID-19 pandemic, the report says.

Global number of fintech mega-rounds ($100M+), Q1’15 – Q2’20, The State of Fintech Q2’20 Report, CB Insights

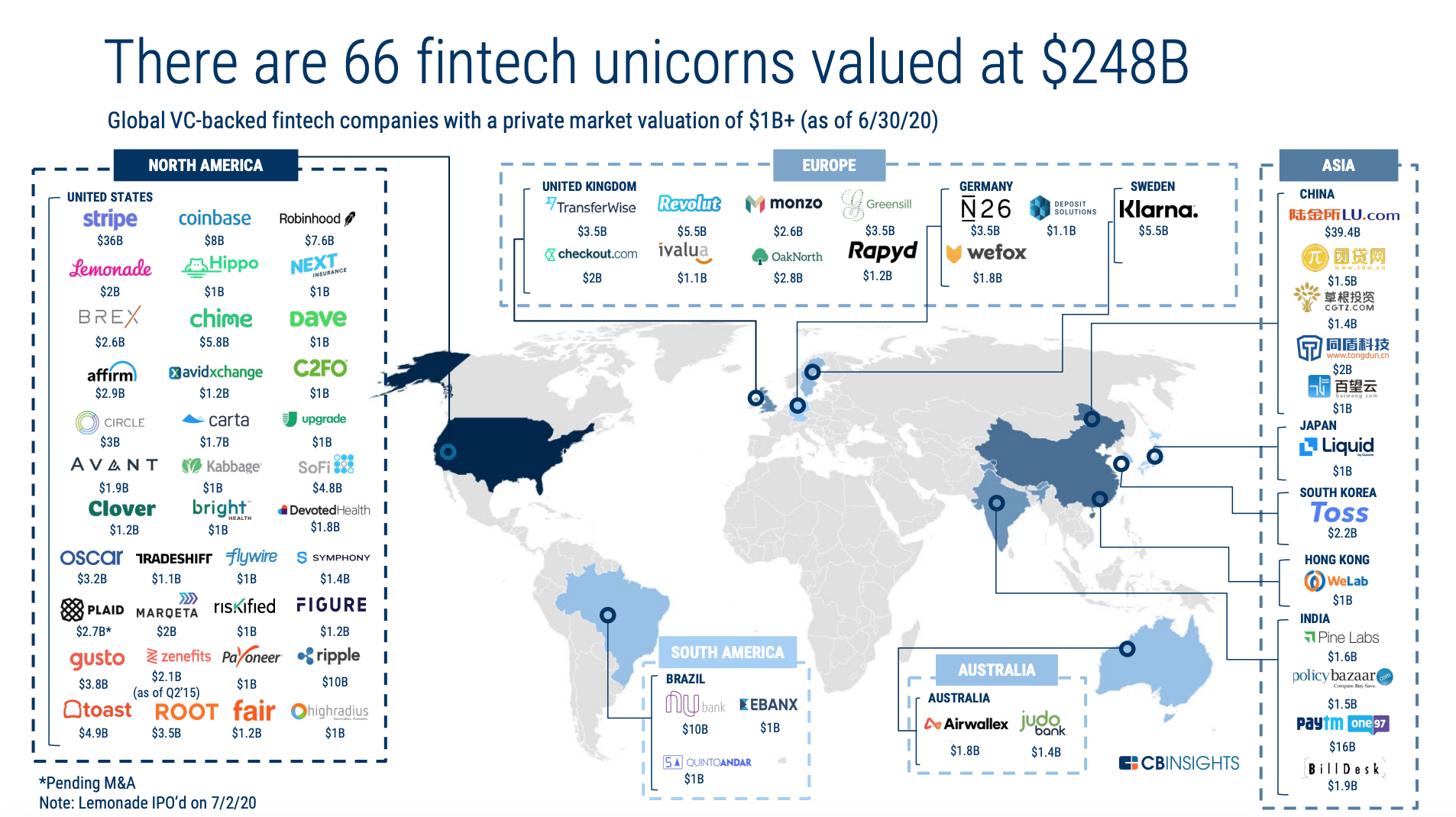

Q2’20 saw the birth of one new fintech unicorn, Upgrade, a neobank. The addition brought the total number of VC-backed fintech unicorns to 66 that are worth a combined US$248 billion.

66 fintech unicorns as of June 6, 2020, The State of Fintech Q2’20 Report, CB Insights

The post CB Insights Report: Embedded Fintech Gaining Traction appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments