The COVID-19 pandemic and its many repercussions have dramatically changed consumer behaviors, accelerating the move from physical to virtual banking and boosting digital payments, according to a new report by McKinsey.

All forms of electronic payments, whether peer-to-peer (P2P) or consumer-to-business, have been boosted amid the public health crisis. In Switzerland, share of debit card spending grew from 65% to 72% between January and May 2020, while in Asia, alternative payments, including instant and mobile payments, have witnessed a significant surge, the consulting firm says in its 2020 McKinsey Global Payments Report.

Digital commerce boom

The rise of digital and electronic payments has occurred on the back of changing buying habits and booming e-commerce activities, the report says.

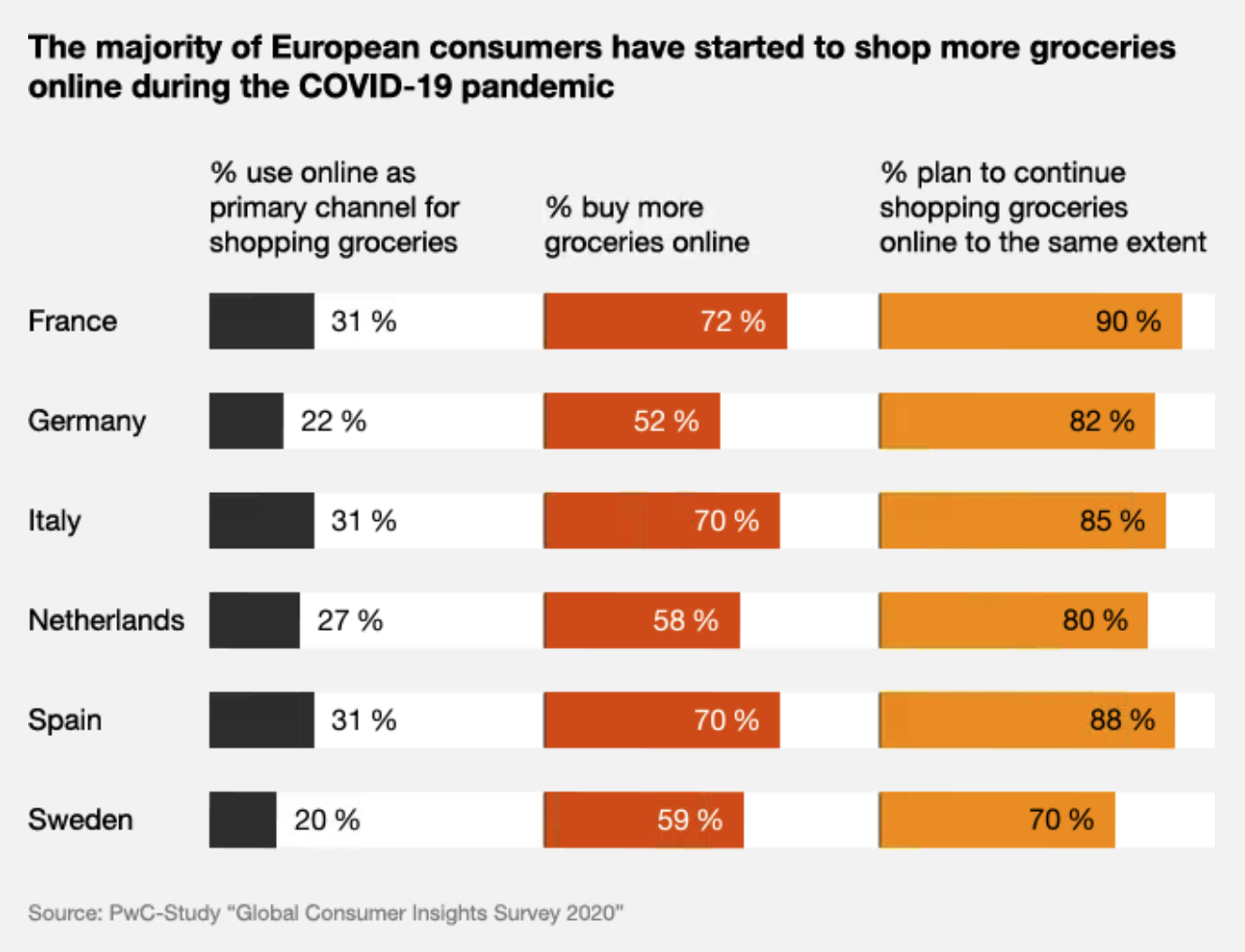

In the first six months of 2020, consumers spent US$347 billion online with US retailers, up 30% from the same period in 2019. And in Europe, 28% of consumers who live in urban areas used online shopping as the main channel for buying groceries during the lockdown, an increase of 10% compared to before the pandemic, according to a PwC study. More than 80% of consumers who started buying groceries online during the pandemic are planning to continue to do so, the survey found.

Image: Online grocery shopping in Europe, Source: PwC Study Global Consumer Insights Survey 2020

Across geographies, small businesses are moving to the digital space, mostly through marketplace platforms like Amazon, eBay, Etsy, Flipkart and Shopify, which have seen seller sign-ups increase by 70 to 150% since the start of the pandemic, the McKinsey report says.

Cash usage will continue to decline

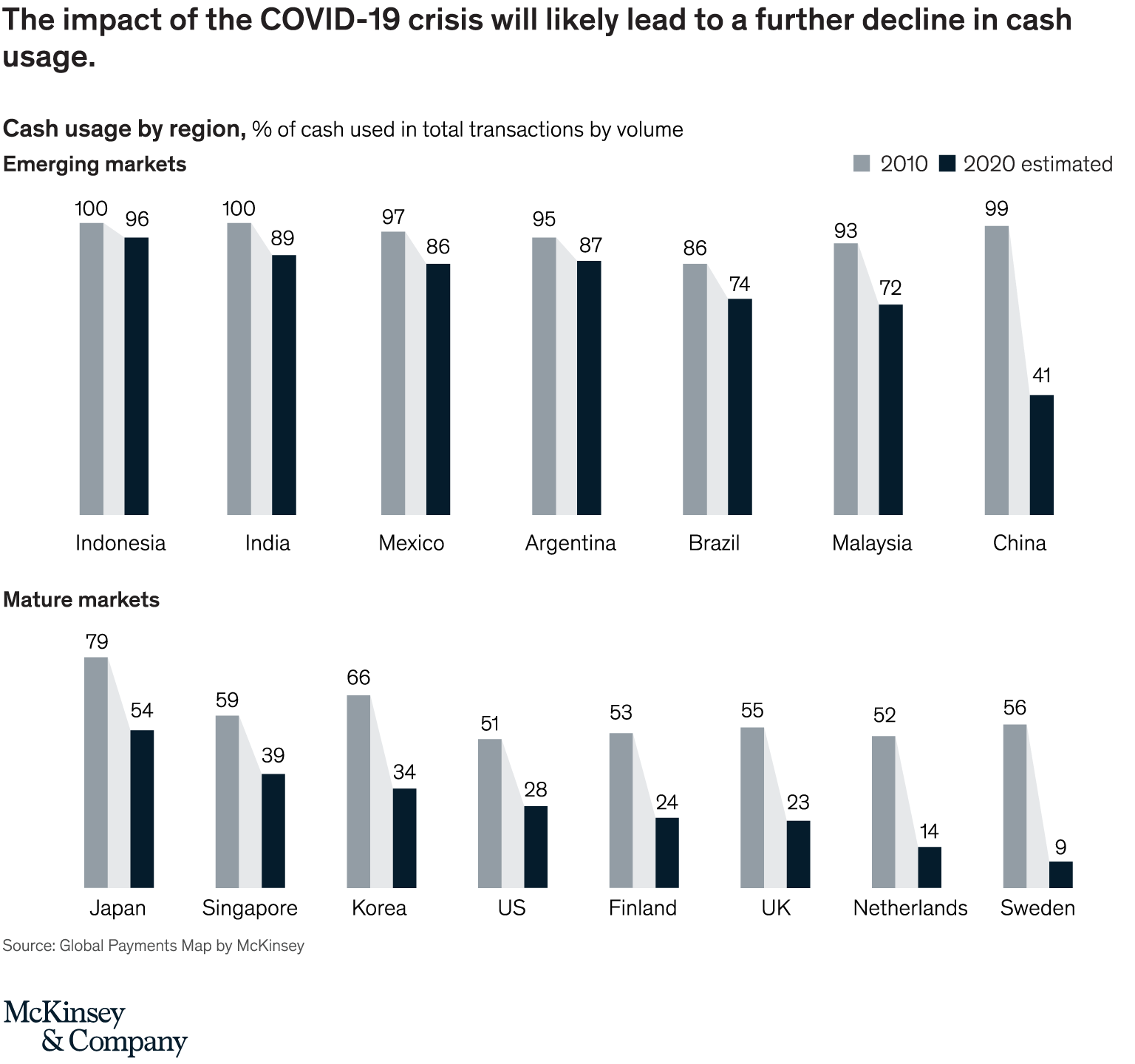

While e-commerce activity and electronic payments have surged amid the pandemic, cash usage on the other hand has declined as customers favor payment journeys that do not require physical contact.

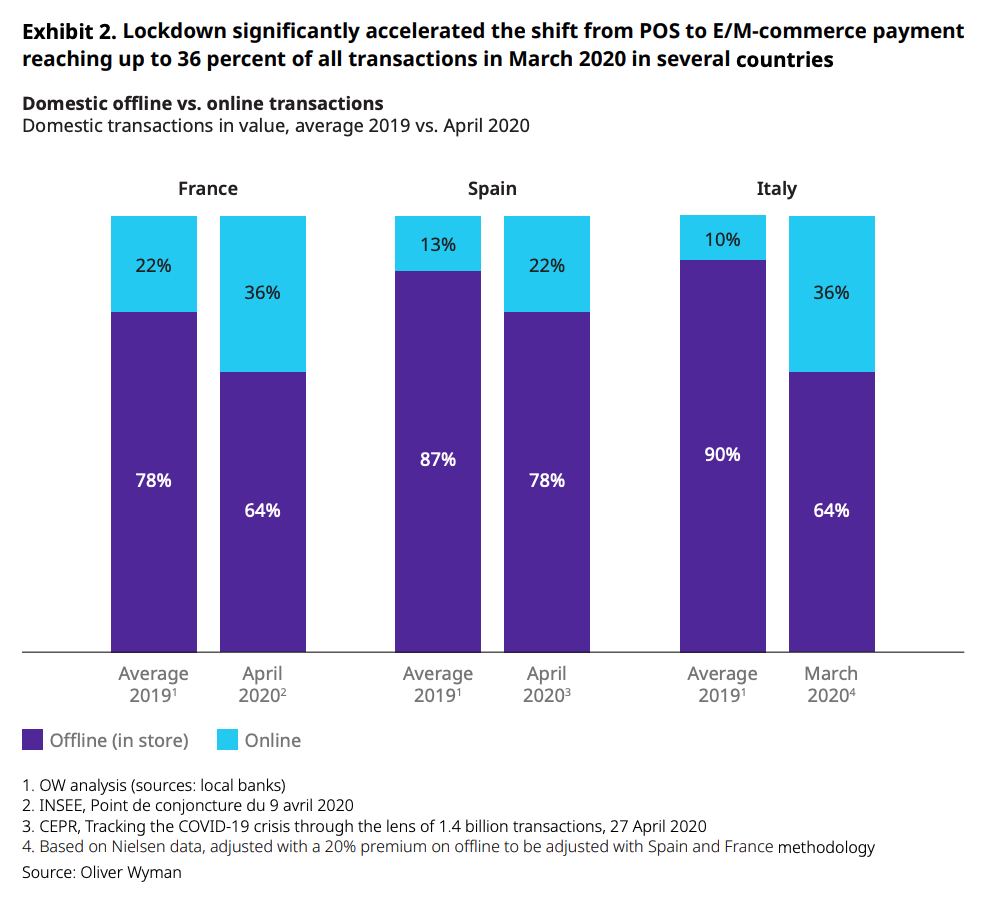

In Western European countries heavily affected by the pandemic, offline transactions decreased by 60% YoY after the lockdown, according to an analysis by Oliver Wyman.

Image: Domestic offline vs. online transactions, Source: Oliver Wyman

In India, ATM usage fell by 47% in April, while in the UK, ATM usage per month experienced 46% declines on average from March to July 2020.

By the end of 2020, McKinsey expects cash usage to decline by four to five percentage points in the share of global payment transactions compared to 2019 fueled by evolving behavior.

Image: Cash usage by region, Source: Global Payments Map by McKinsey

Virtual banking on the rise

In parallel to rising digital payments, virtual banking has also grown. Around the world, banks are closing branches and focusing on their digital offering.

In India, banks stepped up their digital propositions, integrating bill payments, e-commerce links and the national real-time payment system, Unified Payments Interface (UPI), into mobile banking apps. UPI spending increased by about 70% over the first seven months of 2020.

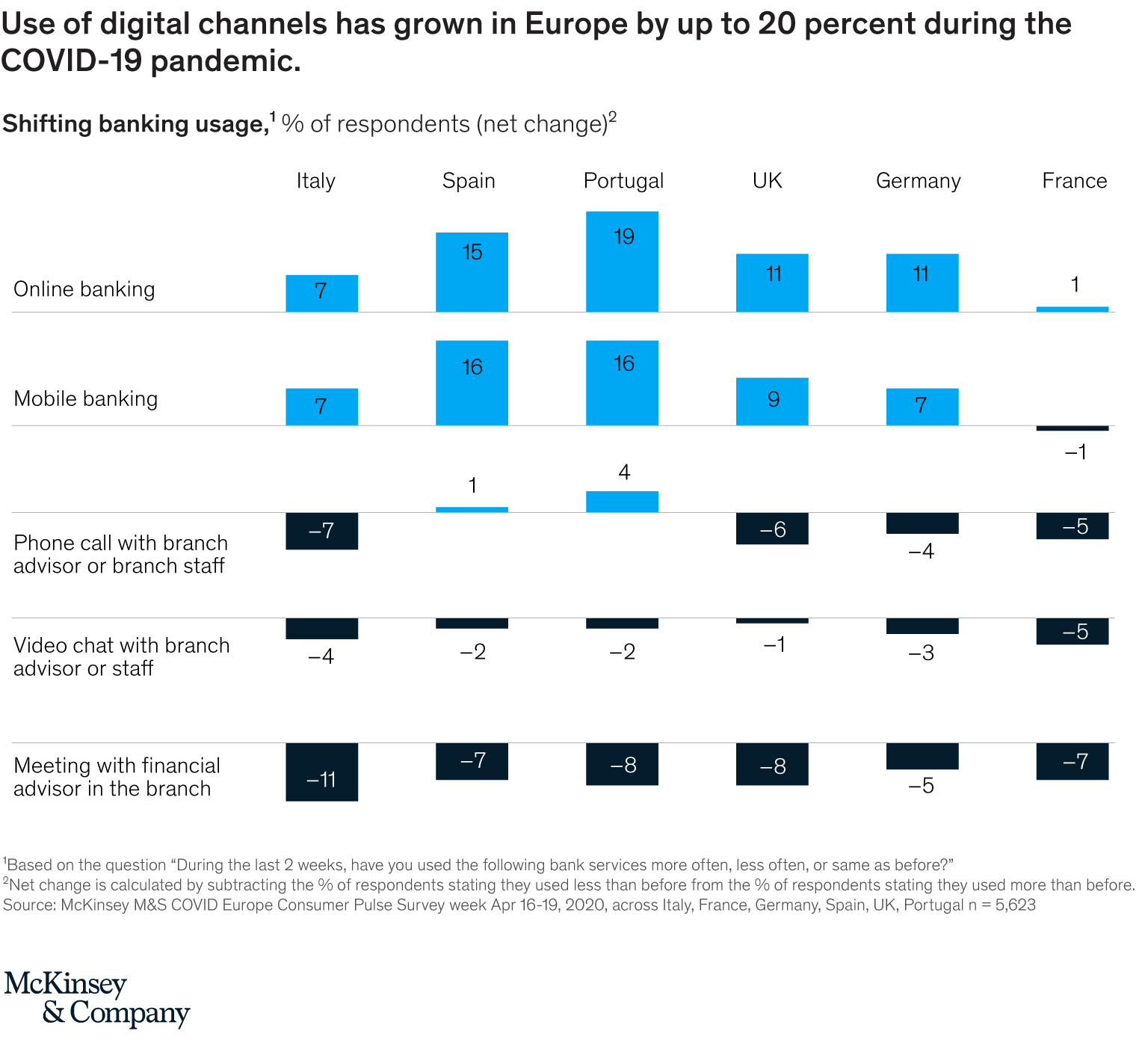

In Europe, customers’ adoption of digital banking has leapt forward by a couple of years in just a couple of months. A recent customer survey conducted by McKinsey showed a 10 to 20% rise in digital banking use across Europe in April.

Image: Shifting banking usage, Source: McKinsey M&S COVID Europe Consumer Pulse Survey week Apr 16-19, 2020

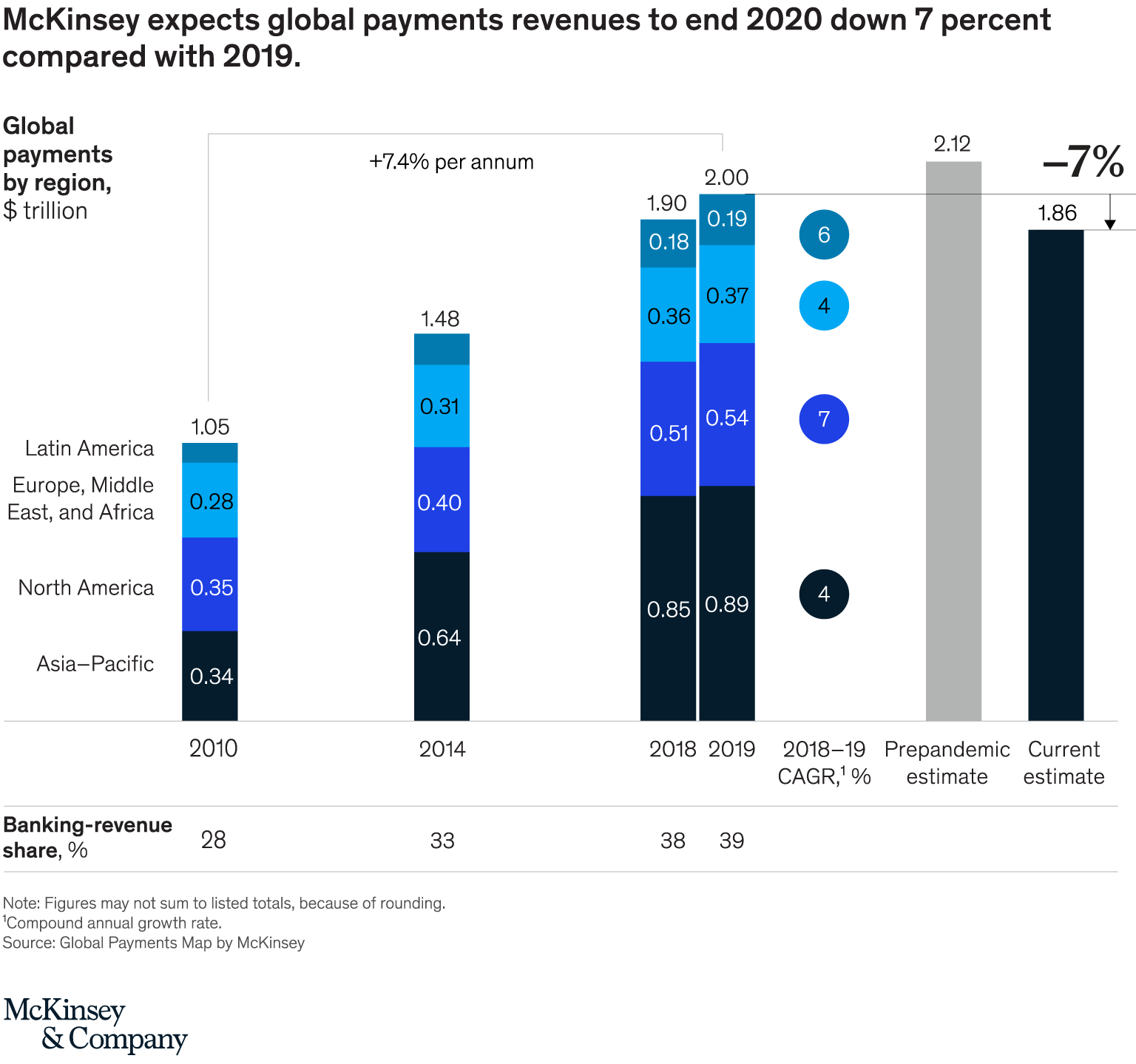

The COVID-19 pandemic has put a stop to payments revenues’ growth. Over the past several years, revenues had grown by roughly 7% annually, but in the first six months of 2020, global revenues declined by an estimated 22% compared with the same period in 2019.

McKinsey expects revenues to recover to a certain degree in the second half of 2020, ending 7% lower than full-year 2019.

Image: Global payments revenues growth, Source: Global Payments Map by McKinsey

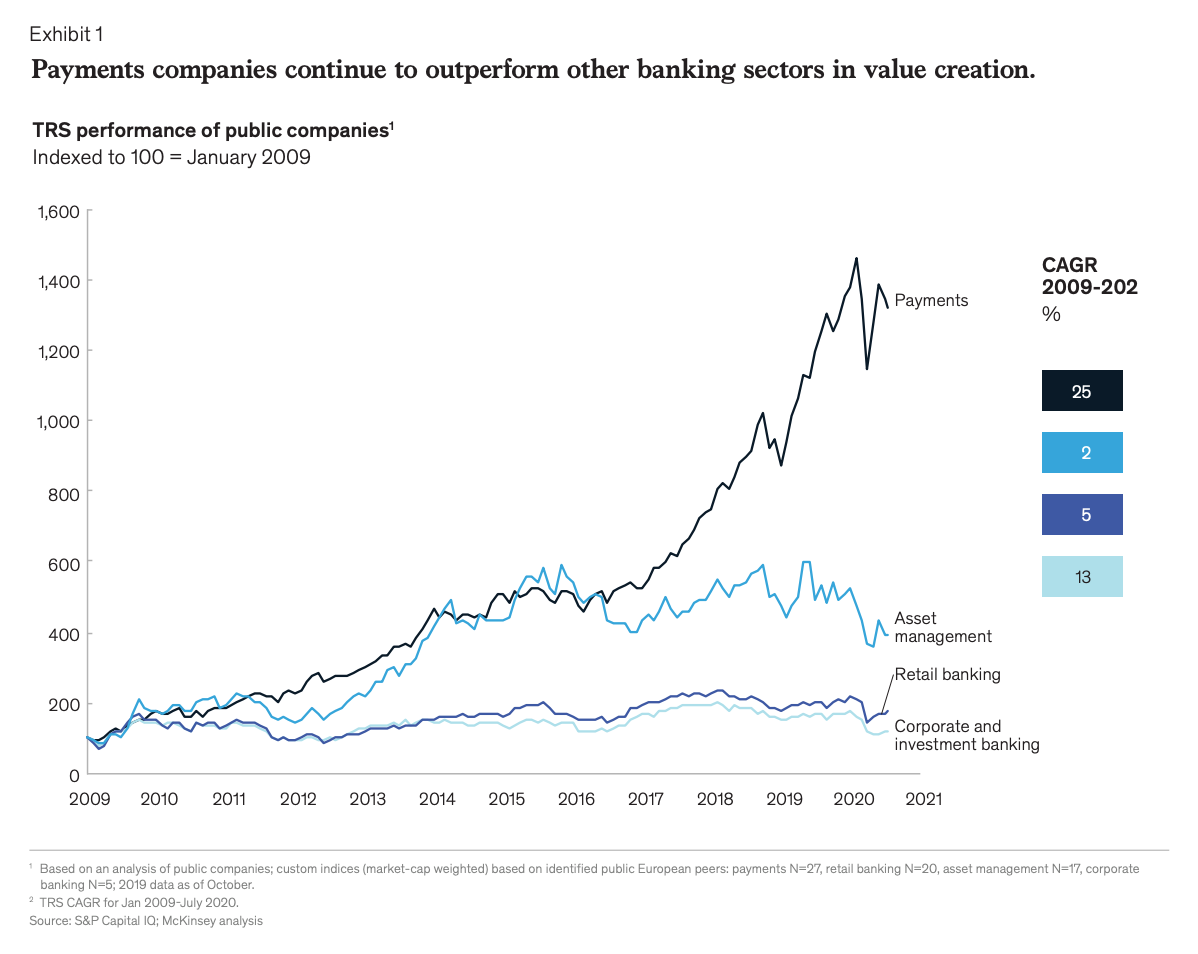

Despite the direct impact of COVID-19, payments remain amongst the best-performing financial services product segments, and McKinsey expects the momentum to persist as a next normal develops.

Image: Payments companies performance, Source: S&P Capital IQ; McKinsey analysis

The post COVID-19 Accelerates Shift to Digital Payments, Virtual Banking: McKinsey appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments