The COVID-19 pandemic has caused significant changes in the ways consumers and businesses carry out their financial transactions, and though some cash-strapped fintechs might struggle in the short term, new opportunities will arise for those that manage to adapt their business models, according to a paper by the Boston Consulting Group (BCG).

In a white paper released in May titled Adapt, Interact, Collaborate: What the COVID-19 Crisis Means for Fintech, BCG examines the impact that COVID-19 has had on the fintech industry and shares how it believes the present crisis will likely to play out for different fintech verticals.

According to the paper, although COVID-19 has undeniably had an impact on all fintech players, those that have been around longer, with an established product market and higher cash reserves, are better positioned than those that are still in the exploration phase.

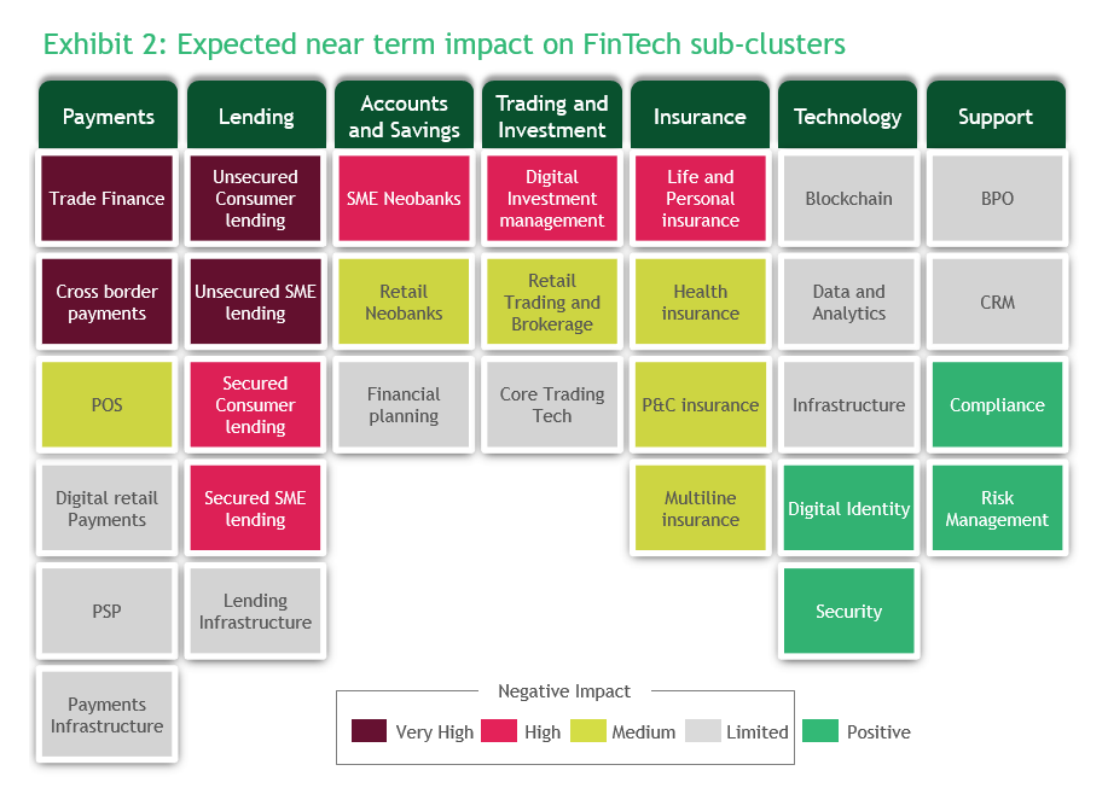

In the near term, fintechs that focus on international businesses and payments, alternative unsecured financing, and subscription-driven businesses, as well as those sensitive to the increased risk levels in financial activity, will be the most severely impacted.

On the other end of the spectrum, fintech players that primarily focus on business-to-business (B2B) models will be less exposed to an immediate downturn, the paper says.

Expected near term impact on fintech sub-clusters, May 2020, Source: Adapt, Interact, Collaborate: What the COVID-19 Crisis Means for Fintech, May 2020, Boston Consulting Group

Breaking down the different verticals, the report says that payment fintechs and point-of-sale (POS) providers will continue to face challenges from the reduction in consumer and business activity in the short term. Similarly, fintechs that specializes in trade finance will continue to see a steep decline in business due to supply chain challenges and fewer cross-border transactions. In the long term, however, payment service providers (PSPs) like Stripe and Adyen will have an important role to play in the post-COVID-19 world.

Fintech lenders will too face significant challenges in the short term, driven by heightened risk, the likely downturn in both private and institutional investor funding, and limited access to government programs.

Accounts and savings players, including neobanks, will struggle as consumers spend less and turn to traditional institutions which they view as more trustworthy. Neobanks will need to become ingenious and come up with new products and services in order to gain traction from their existing clients.

Trading and investment fintech providers have enjoyed the subsequent market volatility but in the long term will need to further develop their offering to meet rapidly changing expectations. Hybrid models that combine advanced digital offering with human support might emerge as the preferred choice, the paper says.

In the insurance sector, COVID-19 has showcased the need for greater digitalization of processes. A number of insurtech stand to benefit this trend. Similarly, fintech enablers and technology and support players will have a key role to play in the long term as the economy gradually pivots towards greater digitalization.

Industry shake-up

COVID-19 has put the brakes on fintech funding, with total deals and dollars to fintech companies down sharply since the end of 2019, according to CB Insights.

Numerous experts and industry observers expect a trend towards consolidation within the sector with CB Insights foreseeing a “fintech M&A” spree in the second half of 2020.

According to BCG, this would provide established fintechs as well as incumbents with the opportunity to explore growth by accessing to new products and client segments, powering up their tech infrastructure, or strengthening their market position.

In the banking industry, COVID-19 will have a long-term effect on customer expectations and demand with findings from a survey conducted in April by BCG suggesting that the pandemic will most likely accelerate digital transformation in retail banking.

According to the survey, 24% of customers are planning to either use branches less or stop visiting branches altogether after the crisis. Millennial and Gen-Z consumers in particular have warmed up to digital channels during the crisis, with 44% of participants aged 18 to 34 enrolling in online or mobile banking for the first time, the research found.

The post COVID-19 Brings Both Opportunities and Challenges for Fintechs: BCG Paper appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments