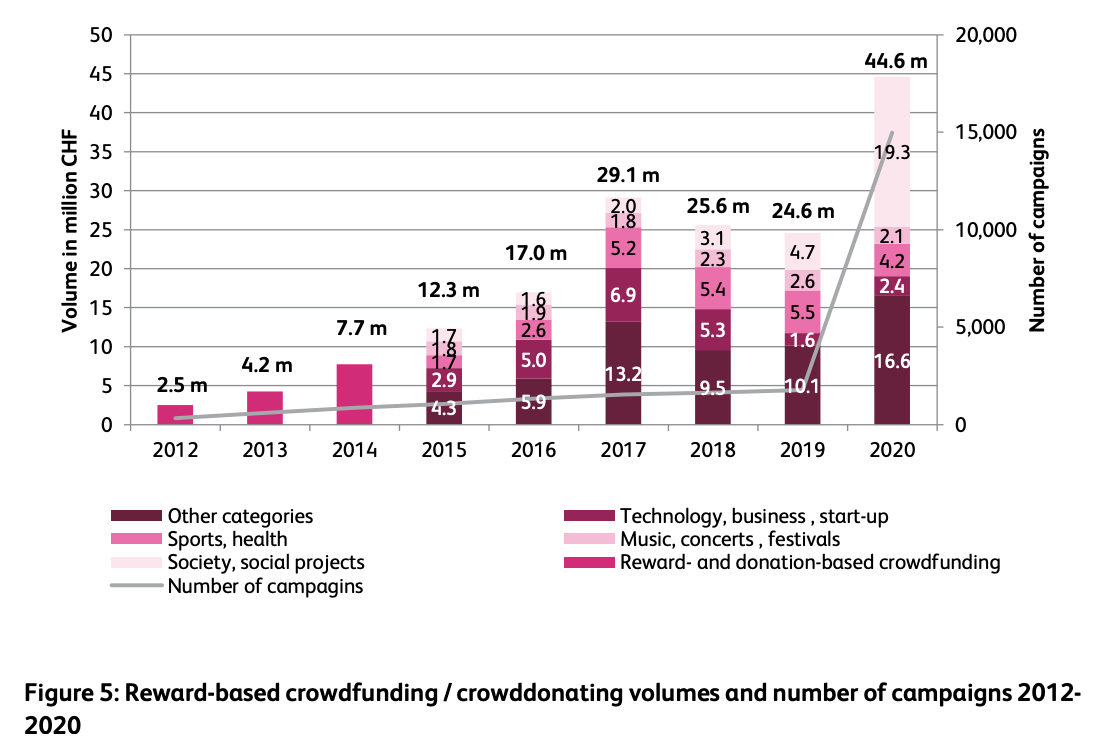

In 2020, Swiss reward-based crowdfunding and crowddonation campaigns skyrocketed in number and volume on the back of soaring solidarity campaigns amid COVID-19, according to the Institute of Financial Services Zug IFZ’s annual crowdfunding research.

2020 saw 14,984 campaigns funded in the reward-based crowdfunding and crowddonation segment generating a volume of CHF 44.6 million. That represents a rise of 747% in the number of campaigns and a 81.6% rise in terms of volume – the highest growth across all crowdfunding segments.

The sharp increase is attributed to the increase in the number of support and solidarity campaigns to gather funds for people impacted by COVID-19. Campaigns under the “Society, social projects” category jumped 308.9% in number to more than 13,000, while volume surged 5,639.9%, the research found.

Reward-based crowdfunding : crowddonating volumes and number of campaigns 2012-2020, Source: Crowdfunding Monitor Switzerland 2021, Institute of Financial Services Zug IFZ

Examples of such initiatives cited in the report include Wemakeit’s “We make solidarity” and “We make tourism”, two channels that let people create campaigns for COVID-19 affected individuals and businesses. Lokalhelden.ch’s #LocalSupport campaign allowed small and medium-sized enterprises (SMEs) to sell vouchers to their loyal customers and collect additional donations to address short-term liquidity issues. And the #zämefüralli fundraising campaign by I Care For You raised CHF 1.7 million from companies, foundations and private donors to support individuals and families in financial distress because of the pandemic.

SME and consumer loans slump

At the other end of the spectrum, significantly fewer business loans were granted to SMEs and consumer loans to private individuals in the crowdlending sector in 2020. These two categories witnessed a decline of 18% and 40% respectively, the research found.

The fall in loans can be partly attributed to the government’s COVID-19 loan program, which allowed businesses to submit streamlined loan applications to banks to bridge liquidity shortages, the report says. These bridging loans aimed at providing enough liquidity for businesses to cover ongoing fixed costs despite revenue losses.

Despite the decline in SME and consumer lending, the overall crowdlending segment recorded a volume growth of 7.1%, reaching CHF 448 million in 2020. This was largely driven by real estate crowdlending, which grew by a high 55.3% in 2020 to CHF 296.7 million. Real estate crowdlending typically involves mortgages for private individuals, interim financing for property developers and mortgage-backed SME loans.

Crowdlending volumes in Switzerland 2012-2020, Source: Crowdfunding Monitor Switzerland 2021, Institute of Financial Services Zug IFZ

Crowdinvesting, which allows customers to acquire a stake in a business or property via equity or mixed forms of equity an borrowed capital, also plunged, declining 26% in value compared to 2019 to CHF 114 million.

Like crowdlending, the bulk of the volume in crowdinvesting came from real estate in 2020, with CHF 69 million raised, thought the business category rose significantly, jumping 37.6% in volume between 2019 and 2020.

Crowdinvesting volumes in Switzerland 2012-2020, Source: Crowdfunding Monitor Switzerland 2021, Institute of Financial Services Zug IFZ

As of the end of April 2021, 38 crowdfunding platforms maintained a domiciled office presence in Switzerland, the research found, though only 28 saw active funding campaigns. These platforms helped raise CHF 606.6 million in 2020, up 2% compared to 2019.

Successfully funded campaigns by funding volume 2008-2020, Source: Crowdfunding Monitor Switzerland 2021, Institute of Financial Services Zug IFZ

SME crowdlending platform Swisspeers compiled these 28 platforms into one infographic, which include Crowdify (reward-based crowdfunding/crowddonation), Funders (crowdlending but also active in reward-based crowdfunding and crowddonation), and Crowdhouse (crowdinvesting).

Crowdfunding platforms in Switzerland (2021), Source: Swisspeers

The study authors Andreas Dietrich and Simon Amrein from the Lucerne University of Applied Sciences and Arts estimate that around 270,000 Swiss people backed crowdfunding projects in 2020, with many doing so for the first time. This indicates that “financing via the Internet has become more widespread,” the authors said in a statement.

The post Crowdfunding Skyrockets in Switzerland Amid COVID-19 Support Campaigns appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments