Despite plunging investments, the digital banking sector witnessed increased innovation and dynamism in 2023.

New neobanks were launched to address specific needs, banking incumbents introduced digital banking arms to keep up with the changing competitive landscape, and market leaders expanded their global foothold in emerging markets, a new analysis by French fintech-focused research C-Innovation reveals.

The report, released in January 19, 2024, explores the global neobanking scene, delving into the sector’s key players and their growth strategies, investigating the main trends observed in 2023 and sharing predictions about what lies ahead for the industry.

According to the report, 2023 saw funding to digital banking companies decrease substantially, plummeting by 65% from US$10.9 billion in 2022 to US$3.8 billion in 2023 amid lingering inflation, hawkish monetary policies, and supply chain disruptions. The dip is reflective of the broader pullback observed in the global fintech industry, which saw fintech investments decrease by 52% year-over-year (YoY) to US$44.9 billion.

Yearly digital banking venture capital investment (2019-2023), Source: C-Innovation, Jan 2024

Looking at regional investment trends, the analysis found that Oceania was the hardest hit, recording no digital banking investment at all, followed by North America which experienced a significant decrease of 74% in venture capital (VC) funding.

Europe and Asia showed some resilience by securing substantial funding of US$1.2 billion and US$1.1 billion, respectively. This trend was driven by strong VC investment activity in eight countries, namely Finland, Israel, Italy, Japan, Netherlands, Singapore, South Africa, and South Korea, where VC funding defied the odds and recorded an increase in funding to the digital banking segment.

Global digital banking funding in 2023, Source: C-Innovation, Jan 2024

A new wave of neobanking players

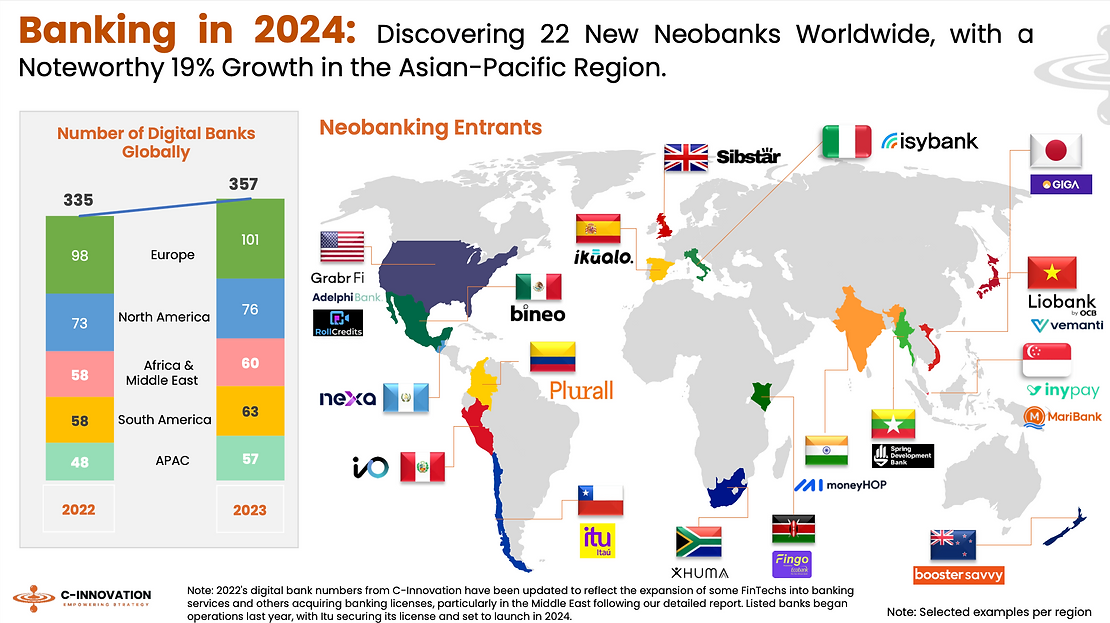

Despite the funding downturn, the C-Innovation analysis reveals that the global digital banking segment expanded in 2023 by adding more than 20 market entrants, bringing the total number of neobanks available around the world to 354.

These new players are catering to various market niches across different regions and spearheading a shift towards more accessible, inclusive and user-focused financial services.

Number of digital banks globally, Source: C-Innovation, Jan 2024

In Asia-Pacific (APAC), new market entrants are addressing specific needs by providing competitive interest rates and multi-currency accounts, and by targeting migrant populations. In Singapore, Maribank offers a highly competitive rate of 2.88% per annum for personal savings accounts, and an appealing 2.5% interest rate on business accounts. In Myanmar, Spring Development Bank lets customers enjoy the flexibility of a multi-currency account, supporting transactions in up to 10 different currencies.

In South America, innovation in the neobanking space is being largely driven by banking incumbents and traditional financial institutions, with notable examples of solutions that have hit the market over the past year or so including Bineo from Grupo Financiero Banorte in Mexico, Io from Banco de Credito (BCP) in Peru, and Itu from Itau in Chile.

Bineo aims to offer savings accounts and personal loans with seeks to add 2.8 million new clients in the next five years; Io is a digital banking offering that comes with virtual and physical Visa-backed consumer credit cards with no onboarding fees; and Itu is a digital banking venture initially offering a virtual account and a Mastercard debit card.

Other neobanks are expected to hit the South American market soon, including the Openbank digital banking service by Santander Mexico, and Hey Banco, which is backed by Banregio Grupo Financiero.

In Europe, UK-based company Sibstar launched in March 2022 a neobanking offering comprising a debit card and an app designed to help people living with dementia and their families to safely manage everyday spending. The Mastercard debit card is pre-loaded with funds, then how and where the money is spent can be managed through the Sibstar app. The app’s money management controls include spend limits, ATM, online, phone switch on/off, instant freeze, auto top up, and real time notifications which can be changed instantly and remotely.

In the realm of emerging markets, UK-based firm Fintech Farm continued to pursue its global expansion plans, launching in 2021 Leobank in Azerbaijan and opening Liobank in Vietnam in 2023. Targeting underdeveloped banking sectors and markets with large underbanked populations, Fintech Farm aims to launch neobanks in India and Nigeria this year.

Fintech Farm secured a US$22 million Series B funding round in April 2023 to fuel its growth and create user-friendly mobile apps and credit products for the underserved. The round, which comprised a combination of equity and convertible loan, valued Fintech Farm over US$100 million, according to online publication AIN.Capital.

Predictions for 2024

Looking ahead to 2024, C-Innovation expects the global digital banking landscape to continue to evolve, shaped by the interplay of traditional financial institutions, established neobanks, and new market entrants.

Traditional banks are set to continue their digital journey, focusing on refining digital transformation strategies. This may entail enhancing digital interfaces, integrating technologies like artificial intelligence (AI) and blockchain, and offering personalized financial services to retain and attract tech-savvy clients.

Established neobanks are likely to maintain or enhance their market share through agility, innovative products, and customer-centric approaches. To sustain profitability, they may expand into lending services, tapping into personal and business loan markets to diversify revenue streams.

Finally, new neobanking companies entering the market in 2024 are expected to target specific market gaps, such as underserved demographics and niche financial products. Their success will depend on their ability to differentiate themselves in an increasingly crowded market and their capacity to swiftly adapt to regulatory and economic shifts, the report says.

With VC funding drying up for tech startups, companies in the neobanking industry are shifting their priorities from rapid expansion to profitability. Data released in November 2023 by strategy consulting firm Simon-Kucher indicate that this strategy has so far paid off, with an increasing number of neobanks reaching profitability and industry revenues growing by about 43% over the past two years or so. As of October 2023, the global neobanking sector served roughly 1.1 billion clients, a figure which represents an impressive increase of more than 30% between mid-2022 and Q4 2024.

Featured image credit: edited from freepik

Comments