So-called digital banking champions are delivering the best UX in account opening, transfers and buying a credit product. They are also leading their peers in products and personal finance management, as well as in expanding their digital functionalities to provide the widest range of products, according to a new report by Deloitte.

In its Digital Banking Maturity 2020 report, the firm shares findings from the largest global benchmarking of digital retail banking channels, and provides an overview of the areas where digital champions are putting their focuses on.

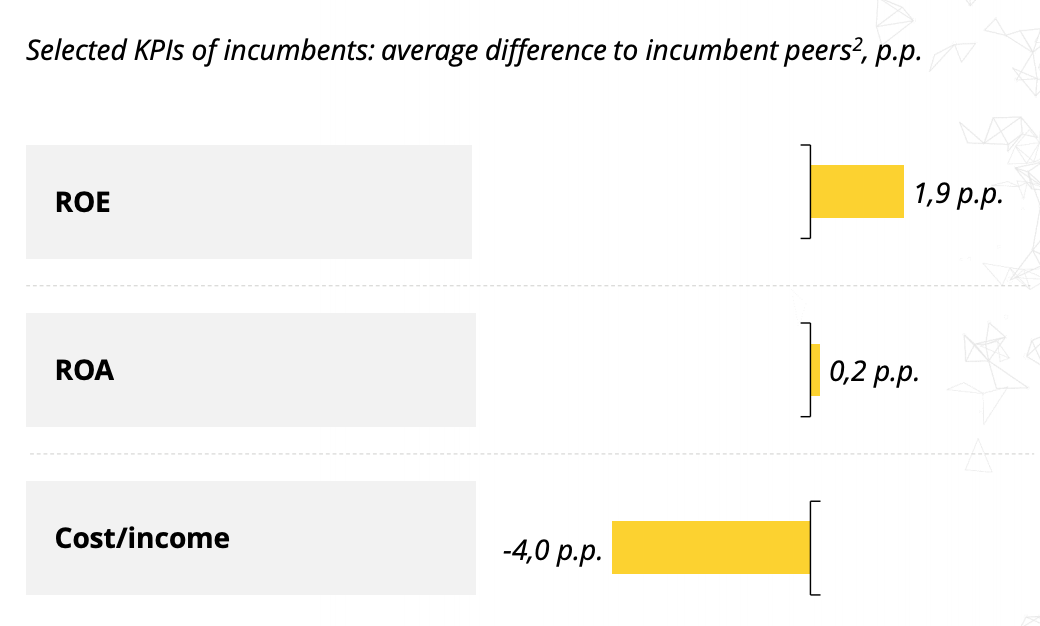

According to the report, digital champions, which offer a wide range of functionalities and a compelling user experience (UX), lead their peers in the number of digital functionalities along the customer journey, and, in the case of incumbent champions (81% of all digital champions), these outperform other incumbents in their country on average on both cost-to-income ratio (-4.0 percentage point (p.p.)) and return on equity (ROE) (+1.9 p.p.).

Selected KPIs of incumbents- average difference to incumbent peers, p.p., Digital Banking Maturity 2020, Deloitte, Oct 2020

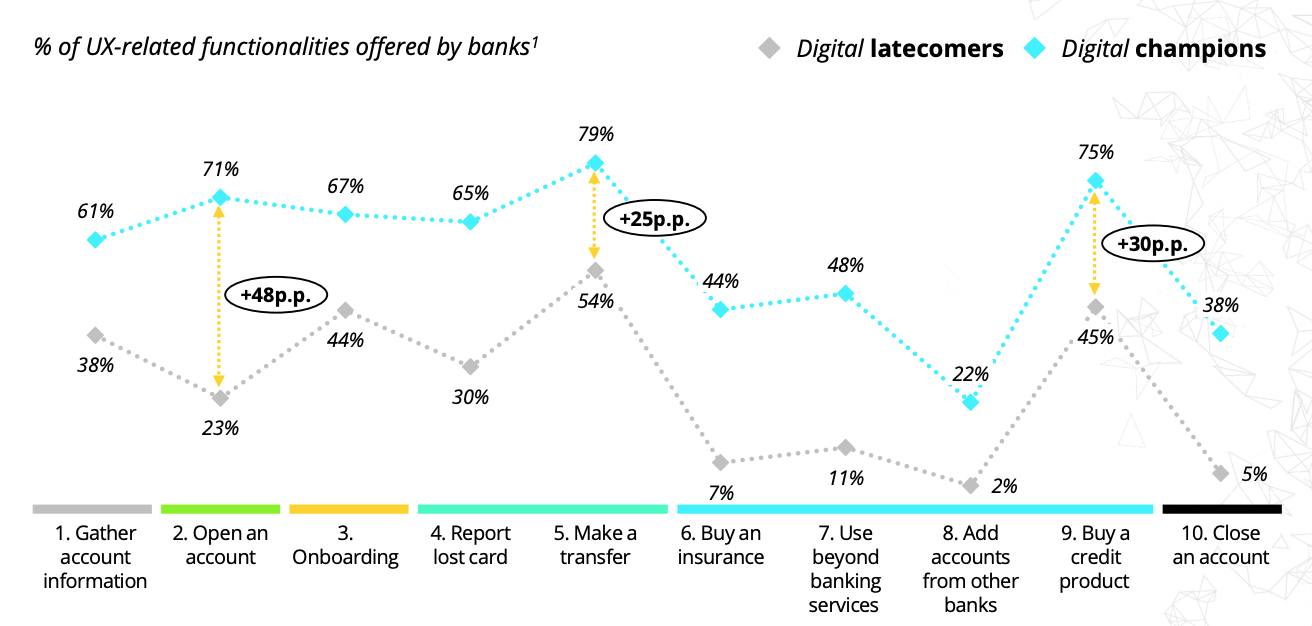

Digital champions understood early on that UX is a key differentiator driving customer satisfaction, and today 65% of them ranked in the top 10% for analyzed UX scenarios, the research found. In particular, they excel in account opening (71% versus 23% for digital latecomers), transfers (79% versus 54%) and buying credit products (75% versus 45%).

% of UX-related functionalities offered by banks, Digital Banking Maturity 2020, Deloitte, Oct 2020

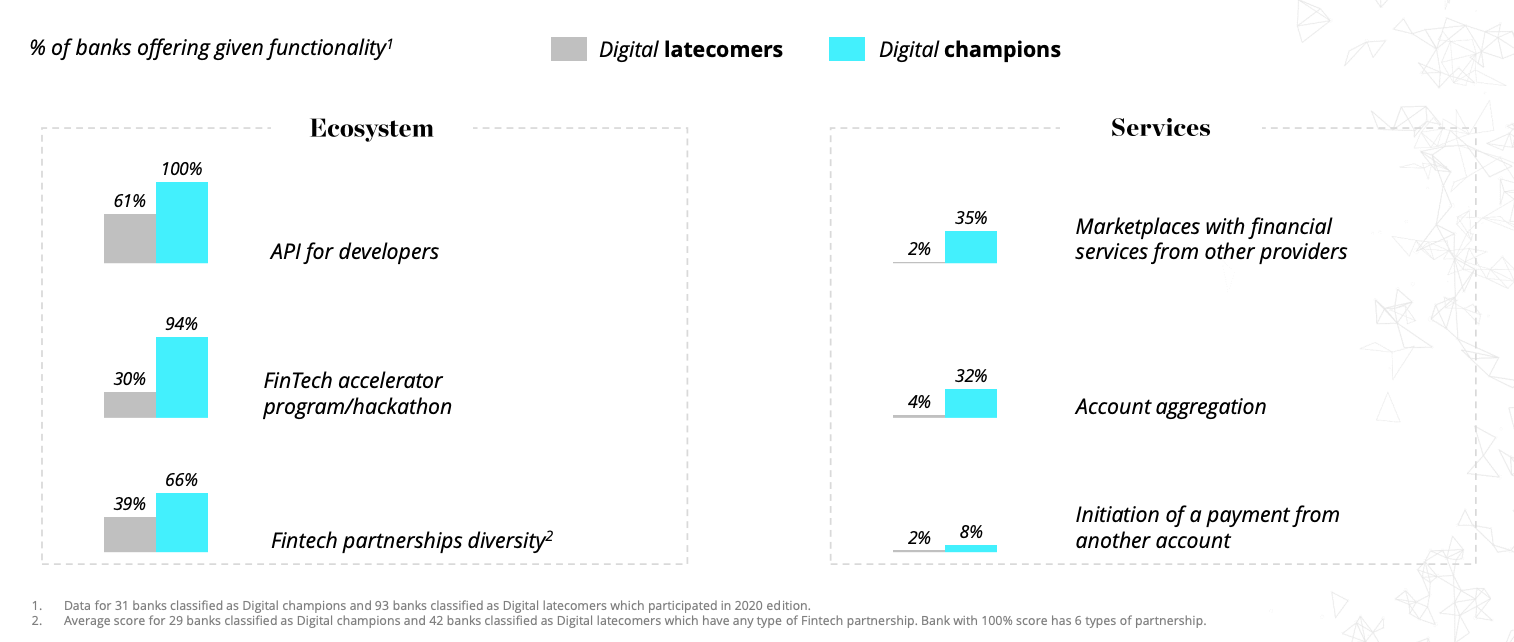

Digital champions are also actively developing ecosystems, whether that’s by making APIs available for developers (100% versus 61% for digital latecomers), being involved in fintech accelerator programs and hackathons (94% versus 30%), or pursuing varied types of fintech partnerships (66% versus 39%).

% of banks offering given functionality, Digital Banking Maturity 2020, Deloitte, Oct 2020

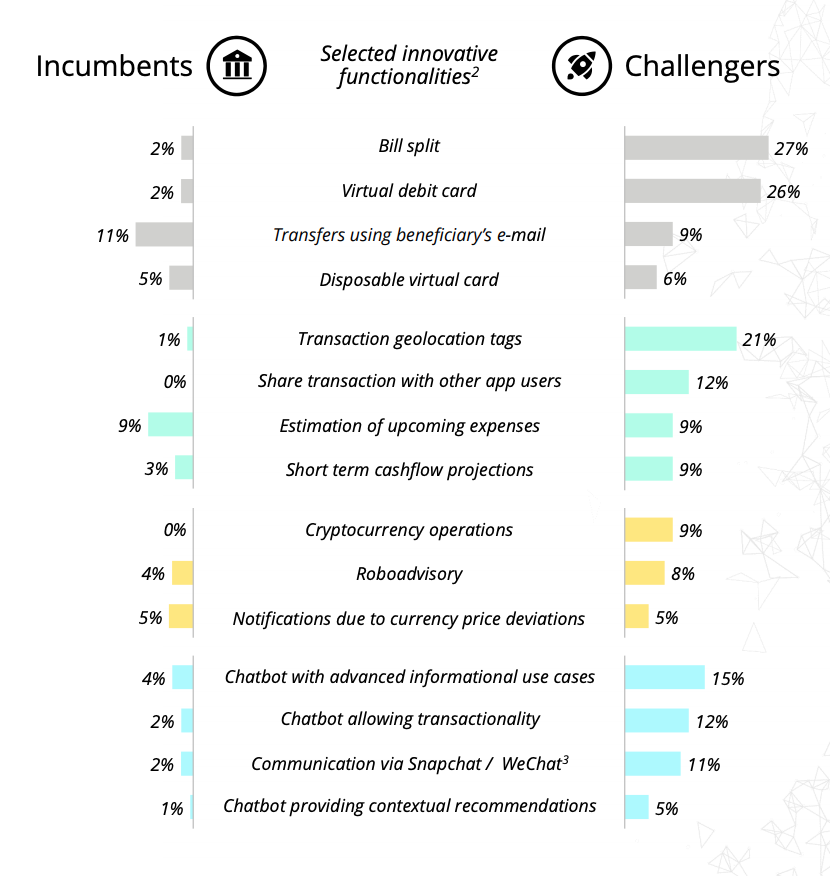

Unsurprisingly, challenger banks were found to be faster than incumbents to adopt new trends and innovations, with the most notable gaps being in bill splitting (27% versus 2%), virtual debit card (26% versus 2%), transaction geolocation tags (21% versus 1%), cryptocurrency operations (9% versus 0%), and chatbots with advanced use cases (15% versus 4%).

% of banks offering given innovative functionality, Digital Banking Maturity 2020, Deloitte, Oct 2020

With a digitally-focused, seamless customer experience and a value proposition that resonates with a specific target segment, challenger banks have been able to acquire a significant customer base around the world.

UK-headquartered Revolut claims it has over 12 million individual customers and recently expanded into the US and Asia Pacific (APAC). Monzo, another challenger bank from the UK, counts 4.75 million customers. In the UK, challenger banks like Revolut, Monzo, but also Starling and Tide, hold a market share of more than 14% for primary accounts being switched.

In Brazil, NuBAnk, an app-only bank for the unbanked, is now the largest challenger bank in the world with over 15 million unique customers after growing 200% year-over-year in 2019.

COVID-19 changing consumer behavior

2020 has been a challenging year for the banking sector as the COVID-19 pandemic forces incumbents to implement digital processes, embrace contactless payments methods, and overall, fast-track their digital transformation.

In the US, teller transactions are down 30 to 40% this year as a result of the pandemic. Michael Perito, regional bank analyst for investment bank Keefe Bruyette & Woods, predicts that some 20,000 bank branches, if not more, could close after COVID-19.

On the other end of the spectrum, mobile and digital adoption has been on rise. Bain & Company’s recent survey of roughly 10,000 consumers found that 30% reduced or stopped using a traditional payments method such as cash during the pandemic, a trend that will likely continue.

In Italy, Spain and the US, 15 to 20% of customers surveyed by McKinsey expect to increase their use of digital channels once the crisis has passed. In Western European markets, preference for handling everyday transactions digitally is as high as about 60 to 85%, even for customers 65 years of age or older.

The post Digital Banking Champions Lead in UX, Functionalities and Ecosystem Building appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments