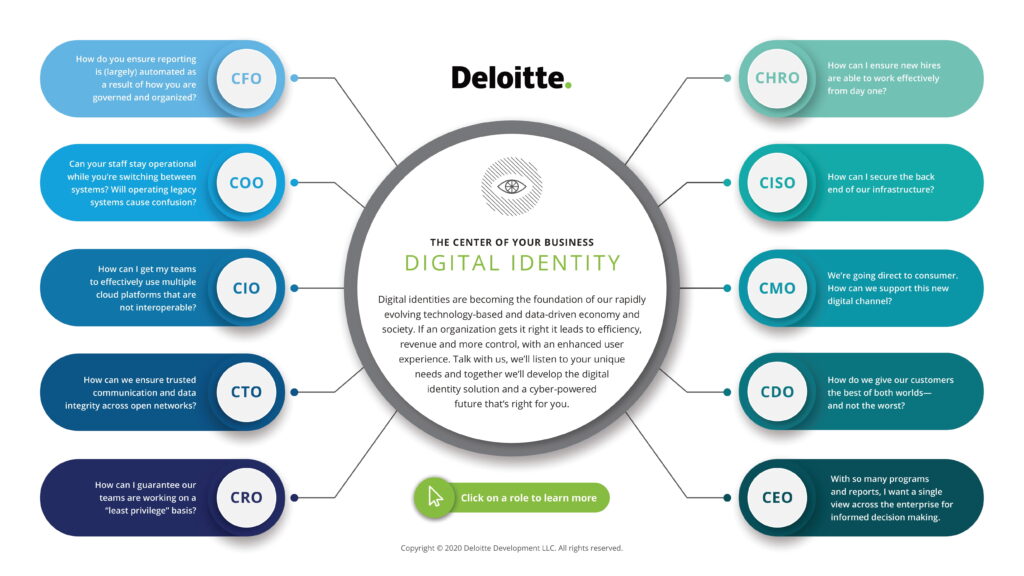

Digital identity, one of the most significant technology trends, is becoming increasingly essential for organizations of all kinds, from private companies to government agencies and civil organizations, and for the people and organizations they serve.

These organizations are now relying on a range of digital identities not only for themselves and their employees, but also their co-workers, customers and citizens, as well as for their Internet-connected devices and applications, according to a new paper by Deloitte.

In a new paper titled The Future of Digital Identity: What does it mean for you?, the consulting firm delves into the different forms of digital identities.

The first kind of digital identities outlined in the paper are digital identities for customers. When properly managed, these can lead to increased customer loyalty and revenue. Not only that, but with the acceleration of digitization, customer requirements around digital experiences have changed, and are now defined by identity management, the paper says.

The Future of Digital Identity, Deloitte

In the future, Deloitte predicts that customers will expect organizations to have a single digital identity for them. This would provide them a seamless hybrid experience that connects their physical and digital behavior not only within individual organizations, but also across multiple organizations and governments.

The second kind of digital identities outlined are those for devices and applications. As societies move towards artificial intelligence (AI)–based decision-making, traditional ways of organizing and accessing data will not be sufficient.

AI and machine learning (ML) help organizations create and adopt automated processes across industries. Ultimately, these technologies will augment and replace low-level or non-scalable human decision making with machine-made decisions.

But in order for organizations to fully leverage automated decision-making, AI and machine-to-machine activity, they must analyze which operational processes require human access, which data is involved, and where privileged access is needed. This will require them to modernize their infrastructure, the paper says.

Finally, the third kind of digital identities outlined are those for employees and third-party co-workers. In this scenario, the purpose is to both facilitate employees and the organization in leveraging technology and data with low friction, and to protect the organization since with digital identities, organizations know and control who has access to which systems and data, and with which rights.

Ramping up national digital identity efforts

Unlike a paper-based identification such as most driver’s licenses and passports, a digital identity can be authenticated remotely over digital channels. It can be issued by a national or local government, a consortium of private or nonprofit organizations, or an individual entity.

Around the world, jurisdictions are introducing national digital identity schemes to simplify the use of online services offered by commercial businesses, facilitate contact with public institutions via e-government channels, and boost digital banking.

In India, the Aadhaar system provides each citizen with a unique 12-digit identification number that can be used to access a range of services.

Aadhaar has been combined with an ambitious financial development policy to provide a bank account to all households in India. In just one year, 166 million people had opened accounts as part of the program, and by 2019, that number had risen to almost 384 million. Today, more than 80% of all Indians have a bank account, up from half that level when the program started back in 2009.

In the European Union (EU), the European Commission (EC) released in June a framework for a digital identity scheme for all citizens, residents and businesses, allowing anyone in the bloc to prove their identity, share electronic documents and access online services from any device.

The European Digital Identity would allow EU citizens to access public and private services anywhere in the bloc as easily and conveniently as they would in their home country, whether that’s renting a flat, opening a bank account, enrolling at a European university, or checking in at the airport.

End-users would use digital wallets offered by their member states to store identity documents and other attributes including driving licenses, diplomas and bank accounts.

In Switzerland, a digital identity scheme is currently in the works despite recent setbacks.

In March, voters threw out a law governing a proposed digital identity system over data privacy concerns. The proposed digital identity verification system was to be licensed and controlled by the state but provided mainly by private companies.

Voters did not come out against a digital identity scheme in general but rather against the proposed solution, with many citing the need for a national digital identity scheme provided only by the government and under democratic control.

“We have no choice and must work towards a new solution, even if it takes several attempts,” Justice Minister Karin Keller-Sutter said during a news conference. “It is key for Switzerland to catch up with other countries when it comes digitalization.”

Featured image: Technology photo created by rawpixel.com – www.freepik.com

The post Digital Identity: the Foundation of a Tech-Based, Data-Driven Economy appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments