Professors from ETH Zürich are proposing the formation of a non-interest-bearing central bank digital currency (CBDC) called “eFranc”.

Hans Gersbach (Professor for Macroeconomics – Innovation and Policy) and Roger Wattenhofer (Professor at the Distributed Computing Group) suggested amending the current monetary system in Switzerland by creating a CBDC that is accessible to the public.

The eFranc will be a digital form of banknotes, a currency that would be held and traded on a distributed ledger for decentralised transaction validation. It would be an accepted form of legal tender and would be introduced as follows – the eFranc to be created by the Swiss National Bank (SNB) and commercial banks could obtain it from the SNB against eligible collateral or banknotes.

After an introductory period, there would be free conversion of eFrancs to bank deposits and banknotes and vice versa, subject to the commercial bank’s ability to acquire the corresponding amount of eFrancs from the SNB.

Advantages of eFranc

Hans Gersbach and Roger Wattenhofer see several advantages in the introduction of eFranc where it would complement the Swiss monetary system by a digital form of legal tender for the public that is safe and default-free.

Also, an eFranc that is solely controlled by SNB would thus enhance money creation discipline and help to keep the Swiss currency stable when the use of banknotes as a medium of exchange declines.

It would also reduce the costs associated with printing, storing, distributing, and protecting physical banknotes.

In addition to that, it could ensure high levels of anonymity, close to the level provided by banknotes, as tracing transactions back would only be possible in very few, legally well-defined circumstances dictated by money-laundering laws.

Lastly, its transaction system could be entirely separate from the existing payment system, representing a secure parallel payment infrastructure if the present infrastructure should defaulting. The so-called “smart contracts” feasible with a blockchain would permit the automatic execution of contract clauses.

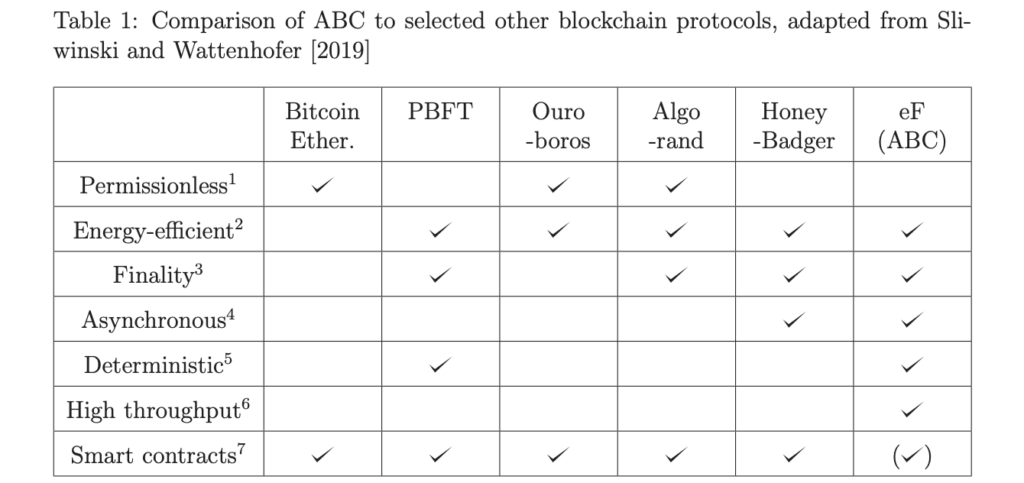

With regard to technical implementation, the professors suggest a two-layer system. The first (base) layer should be a permissioned asynchronous blockchain without consensus providing a secure environment for validating transactions.

With regard to technical implementation, the professors suggest a two-layer system. The first (base) layer should be a permissioned asynchronous blockchain without consensus providing a secure environment for validating transactions.

The second (top) layer would provide a peer-to-peer payment network. Together, these two layers would sustain an eFranc that complies with the principles of security, throughput, accessibility, low cost, and programmability.

Establishing a functioning blockchain infrastructure takes time. Moreover, concern for financial stability necessitates a step-by-step integration of the eFranc into the monetary system.

But the introduction of the eFranc will ensure that the Swiss monetary system can continue to function well at the cutting edge of technological and economic developments in the 21st century.

This suggestion is based on Hans Gersbach’s and Roger Wattenhofer’s corresponding policy paper.

Featured image: Edited from Unsplash

The post ETH Zürich Professors Release Proposal For Swiss Digital Currency Called eFranc appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments