According to a global study by Finastra, Banking-as-a-Service (BaaS) and inclusive banking services will have a significant impact on the industry over the next twelve months.

While this trend is expected worldwide by 85 percent of the surveyed global financial institutions – Hong Kong (with 92 percent), the UAE (with almost 90 percent) and Singapore (87 percent) assume the greatest effects.

Germany is taking a somewhat more cautious, but still significant, approach (with 80 percent).

Open banking gains traction

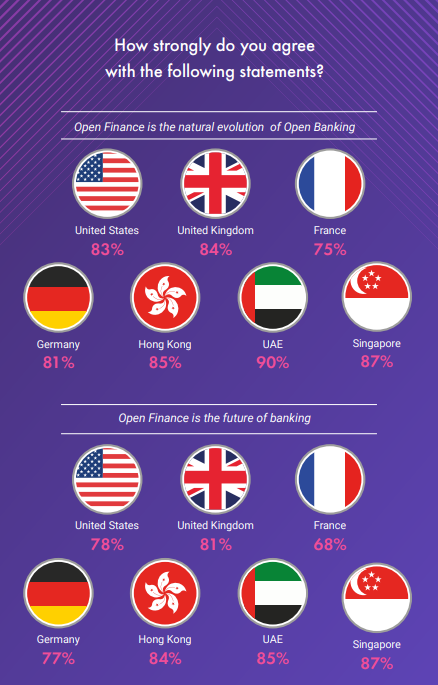

The ” Financial Services: State of the Nation Survey 2021″ study also shows that most companies are now taking advantage of open banking and open finance, with the latter seen as the natural evolution for the sector.

Globally, 94 percent of respondents agree that open banking is important for their company, in Germany the figure is as high as 96 percent.

Compared to the global average of 63 percent, Germany, at 77 percent, found an improvement in customer experience thanks to Open Banking, well above this average.

The study was conducted in March this year. A total of 785 experts from financial institutions and banks in the USA, Great Britain, Singapore, France, Germany, Hong Kong and the United Arab Emirates were interviewed, 108 of them experts from Germany.

The study examines the open banking and finance landscape, technologies and initiatives that will impact financial services over the next year, and what impact COVID-19 has had on the industry to date.

- In addition to BaaS, mobile banking and artificial intelligence were identified as further top technologies that are to be further developed and implemented over the next 12 months. 95 percent of companies predict that they will be looking for further optimizations or implementations of these technologies within the next year. The United Arab Emirates (44 percent) and Hong Kong (42 percent) lead the way when it comes to interest in mobile banking, compared with an average of 36 percent across all seven markets including Germany.

- Open banking will have the greatest impact on private customer business, according to almost half (48 percent) of those surveyed in Germany. This was also the consensus (compared to other areas) in the UK (56 percent), the US (49 percent) and Hong Kong (49 percent). Directly behind this is the area of payment transactions in Germany, which 47 percent of the respondents see as being more influenced by open banking.

- Cooperations are still important for 94 percent of financial service providers. Complex regulations were identified as the greatest obstacle to cooperation in Germany (with 44 percent) and can also be found in Singapore (with 45 percent) and France (with 47 percent). Banks in the US, Hong Kong and the United Arab Emirates (each with 40 percent) cited increased security risk as the greatest barrier, while legacy systems and IT in the UK (48 percent) were cited as the greatest obstacle to cooperation.

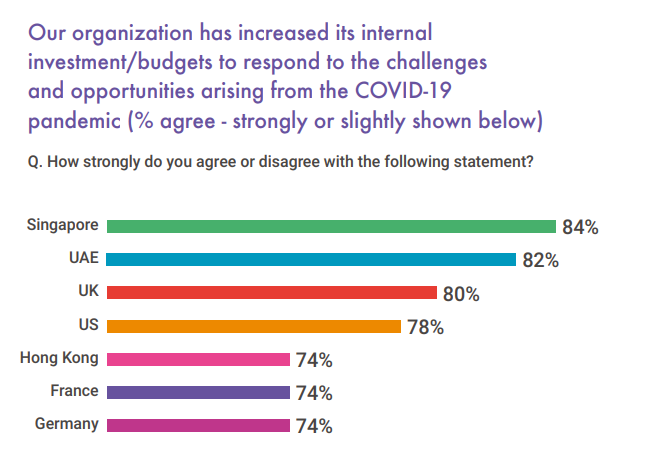

- According to 8 out of 10 global companies, COVID-19 acts as an accelerator for adaptation and investment in new technologies and innovations. Singapore (87 percent), Great Britain (82 percent) and the UAE (82 percent) had the greatest influence here.

- The financial industry is increasingly concerned with its corporate purpose. 86 percent of respondents believe that financial services and banking are about more than just finance and that financial service providers have a duty to support society.

Eli Rosner

“The results of our study show how financial institutions are already benefiting from open banking and – new this year – a growing role from BaaS.

We believe these initiatives have already paved the way to true open finance and help financial service providers continue to develop and improve the services they offer their clients,”

said Eli Rosner, Chief Product and Technology Officer at Finastra.

The post Finastra Study: Banking-as-a-Service to Gain Massive Traction in the Next Year appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments