Switzerland has become a hotbed for cryptocurrency and blockchain, and in many aspects, is now one of the world leaders in initial coin offerings (ICOs).

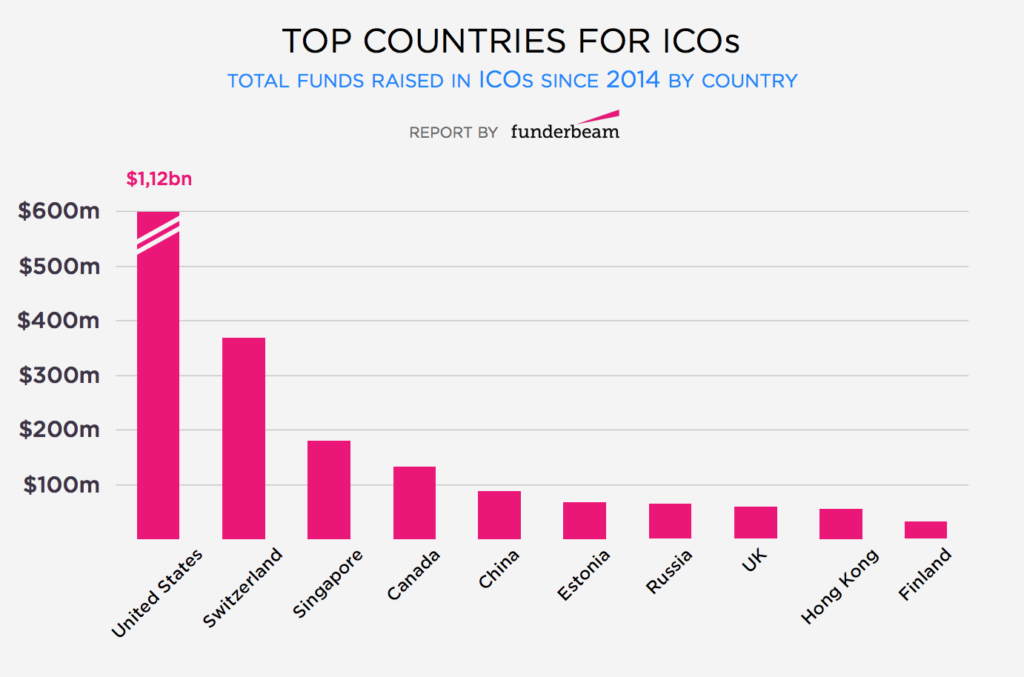

According to a report by Funderbeam, ICOs in Switzerland account for about 13% of the total amount raised since 2014 behind the US, the world leader, with a staggering 38%.

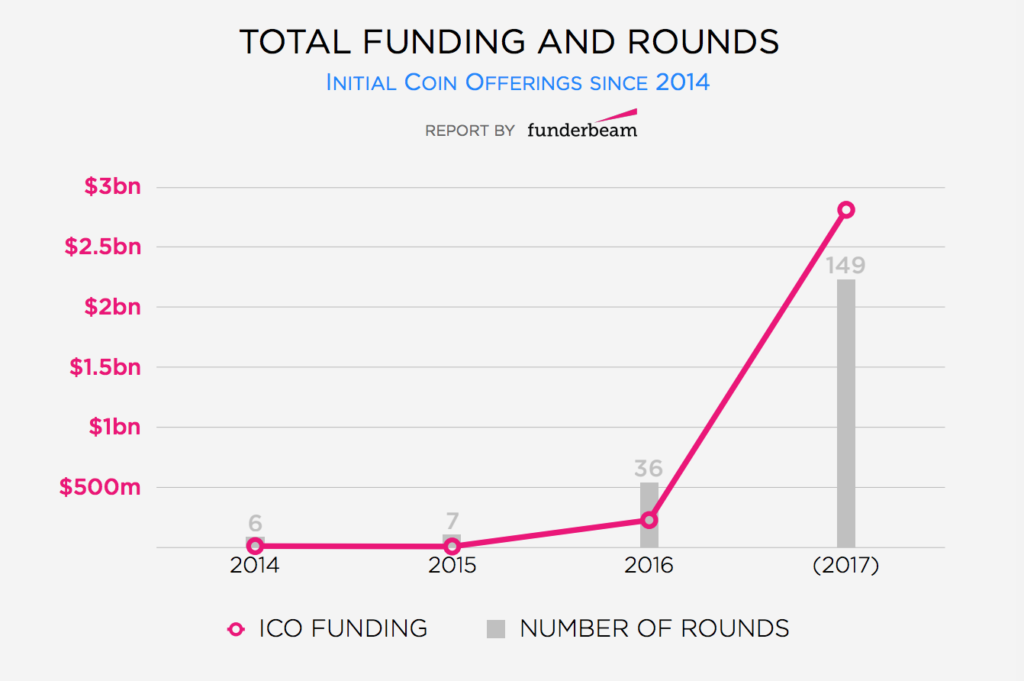

ICO funding started gaining traction in 2016 and exploded in 2017 where funding increased from US$228 million to US$2.8 billion in total amount raised since 2014, according to the Initial Coin Offerings Funding Report 2017. The number of rounds has quadrupled and nearly reached 150 in 2017.

North America has the most funding out of all regions raised by ICOs with US$1.2 billion, almost twice as much as in Europe with US$637 million.

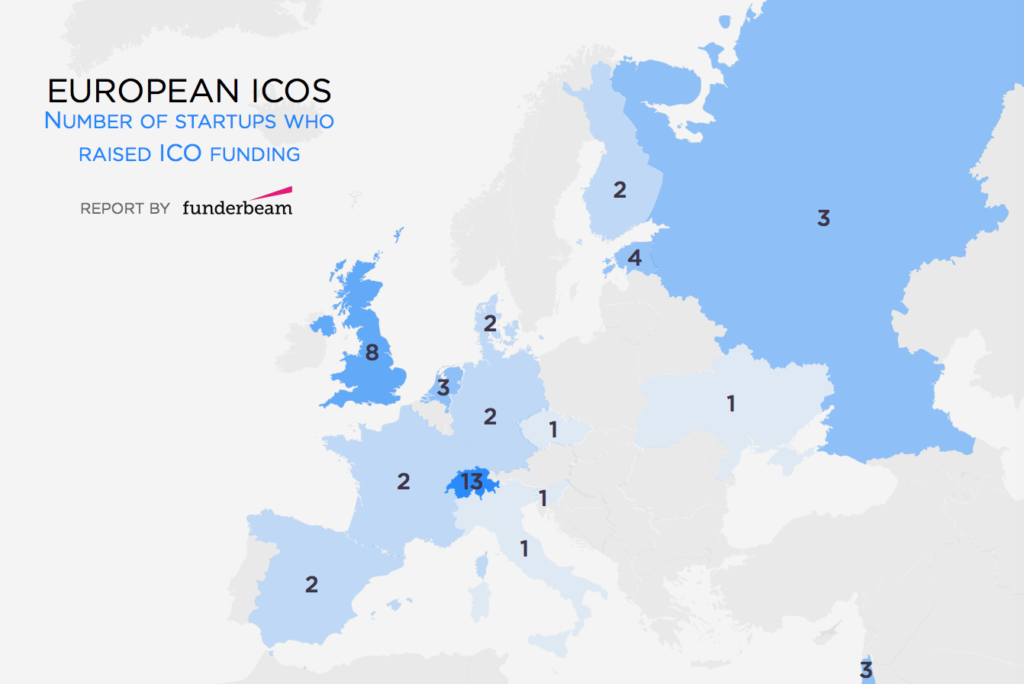

In Europe, Switzerland represents 58% of the region’s total funding raised with about US$370 million through 13 campaigns. The UK ranks second with eight ICOs and a total of US$71 million in ICO funding raised since 2014.

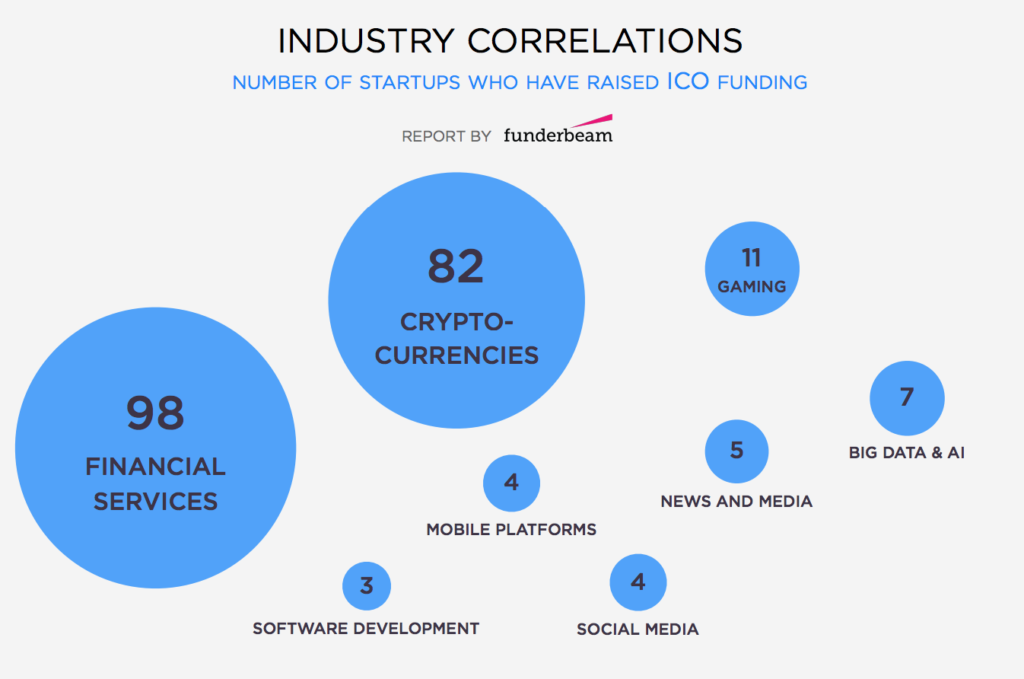

Looking at the industries that are raising funds through ICOs, it’s no surprise to see that the vast majority of the companies conducting ICOs are related to financial services and cryptocurrencies. Other industries present include gaming, Big Data and artificial intelligence, and news and media.

Switzerland, a hotbed for crypto and blockchain

According to a PwC report, Switzerland has hosted some of the world’s largest and most successful ICO campaigns. As of September 2017, four out of the six largest ICOs were in Switzerland: Tezos, which raised over US$238 million, Bancor, with US$156 million, The DAO, US$142 million, and Status, US$95 million.

In December 2017, Switzerland-based Singularity Net raised a record of US$36 million in its ICO in just over one minute, making it the fastest ICO campaign.

Earlier this year, Lausanne-based fintech startup SwissBorg raised CHF 50 million (US$54 million) in its ICO to fund the development of a computer dashboard, a cryptocurrency exchange and a robo-advisor platform for investment in cryptocurrencies. Over 20,000 subscribers took part in the token sale, according to the South China Morning Post.

Earlier this year, Lausanne-based fintech startup SwissBorg raised CHF 50 million (US$54 million) in its ICO to fund the development of a computer dashboard, a cryptocurrency exchange and a robo-advisor platform for investment in cryptocurrencies. Over 20,000 subscribers took part in the token sale, according to the South China Morning Post.

Swiss crypto real estate startup Crypto Real Estate will be launching its ICO on April 1. The startup is looking to take in between CHF 80 million (US$84.5 million) and CHF 100 million (US$105.7 million), co-founder and CEO Brigitte Luginbuehl told Finews.com.

The startup plans to plow the ICO funds into a portfolio of Swiss commercial property to be managed with the help of blockchain technology. The Swiss Real Coin (SRC) token’s value will be backed by the property portfolio as well as other collateral including the firm’s technology platform, the startup claims.

The growth of ICOs has been fueled by the surge in value and popularity of cryptocurrencies in the past years. In 2017, Switzerland witnessed the emergence of the Crypto Valley in the city of Zug and the formation of the government-supported Crypto Valley Association to represent the thriving industry. The initiative further demonstrated Switzerland’s ambition to become a leader in all things blockchain and preceded statements made by the CEO of the Swiss Financial Market Supervisory Authority (FINMA) Mark Branson who said in December 2017:

“Switzerland has positioned itself as a hub for blockchain related activities. This success will be maintained if Switzerland welcomes innovative and serious projects. […] Our work [at FINMA] consists in distinguishing the innovations that deserves to have a change for success from the ones that are fraudulent.”

Need for regulation

Image © Philipp Zinniker

Since Switzerland has risen to the preferred location for blockchain entrepreneurs to conduct their ICO, its financial regulator has been monitoring the sector very closely, cracking down on any activity it judges fraudulent.

In September 2017, it shut down the provider of an alleged fake cryptocurrency which had amassed funds of at least CHF 4 million (US$4.2 million) from several hundred users in exchange of so-called E-Coin. FINMA issued guidance on ICOs shortly after the event.

Most recently, a working group was established and tasked with investigating the possibility of regulating both ICOs and blockchain technology in the country. It will report back to the government by the end of 2018.

The newly-founded task force was established by the State Secretariat for International Financial Matters and includes FINMA and the Federal Office for Justice. The Swiss finance ministry stated in January:

“The aim of this work is to increase legal certainty, maintain the integrity of the financial center and ensure technology-neutral regulation. This clarification of the regulatory framework should help to ensure that Switzerland remains an attractive location in this area.”

While regulators around the world have taken an increasingly hostile stance toward cryptocurrencies with China and South Korea banning ICOs, the Swiss government believes they could offer an economic opportunity.

Johann Schneider-Ammann, economics minister said in January that Switzerland wanted “to be the crypto nation.”

Switzerland does not currently have any ICO-specific regulation, relevant case law or consistent legal doctrine. However, as set out in its previous September 2017 guidance, there are several areas in which ICOs are potentially impacted by financial market regulation. In particular, FINMA focuses on the function and transferability of tokens. The regulator categorizes these into three types: payment tokens, utility tokens and asset tokens.

Featured image: Crypto Virtual Money, Pixabay.

The post Fintech ICOs In Switzerland: All You Have To Know appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments