New entrants to the banking market — including challenger banks, non-bank payments institutions and big tech companies — are amassing up to one-third of new revenue, which is challenging the competitiveness of traditional banks, according to new research from Accenture.

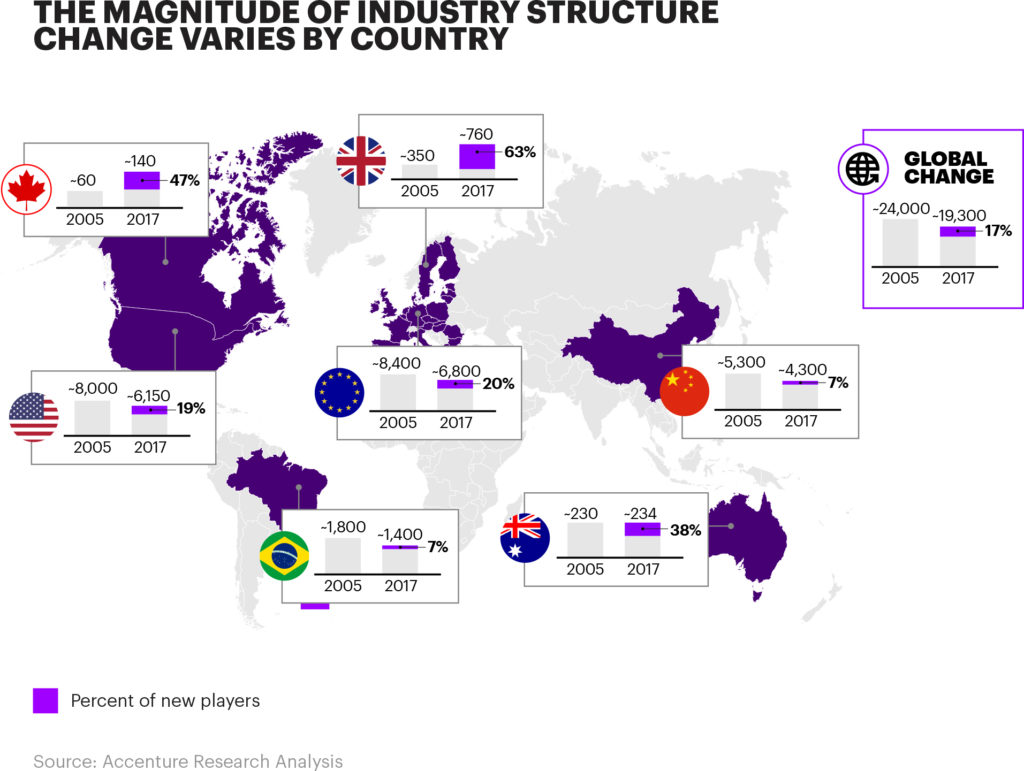

Accenture analyzed more than 20,000 banking and payments institutions across seven markets to quantify the level of change and disruption in the global banking industry. The study found that the number of banking and payments institutions decreased by nearly 20 percent over a 12-year period — from 24,000 in 2005 to less than 19,300 in 2017.

However, nearly one in six (17 percent) current institutions are what Accenture considers new entrants — i.e., companies entering the market after 2005. While few of these new players have raised alarm bells among traditional banks, the threat of reduced future revenue growth opportunities is real and growing.

However, nearly one in six (17 percent) current institutions are what Accenture considers new entrants — i.e., companies entering the market after 2005. While few of these new players have raised alarm bells among traditional banks, the threat of reduced future revenue growth opportunities is real and growing.

Two new reports from Accenture quantify the level of disruption in the banking industry: “Beyond North Star Gazing” discusses how industry change is shaping the strategic priorities for banks, and “Star Shifting: Rapid Evolution Required” outlines what banks can do to take advantage of these changes to maintain customer relevance and ensure future revenue growth.

Alan McIntyre

“Most banks are struggling to find the right mix of investments in traditional and digital capabilities as they balance meeting the needs of digital customers with maintaining legacy systems that protect customer data,”

said Alan McIntyre, a senior managing director at Accenture and head of its global Banking practice.

Industry disruption

Many incumbent banks continue to dismiss the threat of new entrants, claiming that fintech players are not innovative, and that they are not generating revenue nor profit.

However, the reports analyzed where revenue is shifting to new entrants and identifies examples of true innovation happening around the world that can no longer be dismissed. Accenture predicts that the shift in revenue to new entrants will continue and will start to have a material impact on incumbent banks’ profits.

Fintech Disruption: Breakdown By Region

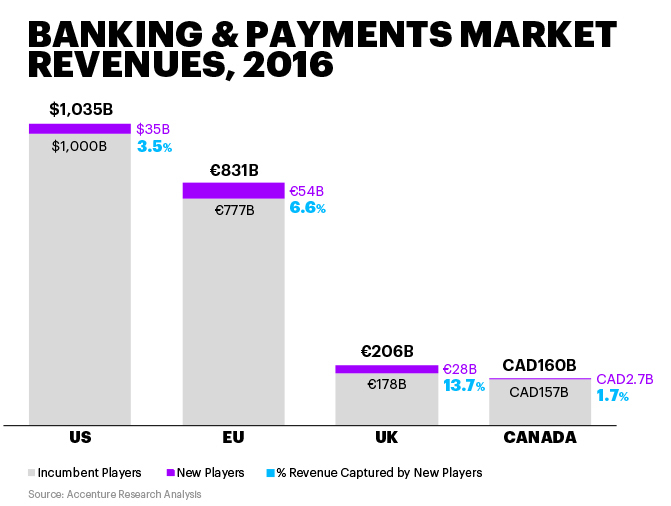

U.S.: Nineteen percent of financial institutions in the U.S. are new entrants and have captured 3.5 percent of total banking and payments revenues. Over the past dozen years, the number of financial institutions in the U.S. has decreased by nearly one-quarter, largely due to the financial crisis and subsequent regulatory hurdles imposed to obtain a banking license.

These factors have made the U.S. a difficult market for new entrants and a stable environment for incumbents. More than half of new current accounts opened in the U.S. have been captured by three large banks that are making material investments in digital, while regional banks focus on cost reduction and struggle to grow their balance sheets.

UK: With regulation increasing competition in the financial services industry and reducing the dominance of established banks, 63 percent of players in the UK are new entrants. This is eye-popping compared with other markets and the 17 percent global average. New entrants have captured 14 percent of total banking revenues, with the clear majority (12 percent) going to non-bank payments institutions.

While they have only taken around 14 percent of revenues, the reports suggest that they are taking over one third of new revenue indicating a higher level of disruption in the future. The reports also suggest that incumbent banks will therefore likely start to see a significant impact on revenues as leading challenger banks are surpassing the 1 million customer threshold and 15 fintechs have been granted full banking licenses.

Canada: Investors have backed new entrants in Canada with the intention of disrupting the banking industry. While nearly half (47 percent) of banking and payments institutions are new entrants, they have captured less than 2 percent of total banking and payments revenue, making Canada one of the least disrupted major banking markets.

Europe: In Europe (including the UK), 20 percent of the banking and payments institutions are new entrants and have captured nearly 7 percent of total banking revenue — and one-third (33 percent) of all new revenue since 2005.

The post Fintech Now Takes Up 33% of Revenue Share in Financial Services appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments