Startups have been amongst the hardest hit companies as the COVID-19 pandemic shuts down economies.

In Switzerland, four of five blockchain companies located in the so-called Crypto Valley are looking at bankruptcy within the next six months, and 88% believe they won’t survive without state aid, according to a survey conducted between March 31 and April 3 by industry group the Swiss Blockchain Federation.

To do our part in supporting the fintech startup community, the Fintech News Network will be covering each week a promising Swiss Fintech Startups that deserve the spotlight.

This week, we look at Gentwo Digital, a Zug-based startup that aims to build a bridge between the traditional finance world and the crypto market.

Gentwo Digital: bridging traditional finance and the crypto world

Founded in 2018, Gentwo Digital is a business-to-business (B2B) service provider specialized in securitizing both bankable and unbankable assets.

With the mission to act as a bridge between the traditional financial market and the new emerging crypto market, Gentwo Digital claims it has created the world’s first issuing platform for financial products in the crypto space.

Through the platform, customers can make any ICO, token and crypto asset investable and bankable through a conventional Swiss-compliant tracker certificate complete with Swiss ISIN (International Securities Identification Number). ISIN is an international numbering system for specific securities, such as stocks (equity and preference shares), bonds, options and futures.

Gentwo Digital has worked with numerous companies and built securitization platforms for partners which include banks, brokers, asset managers, and family offices, enabling them to issue new kinds of assets. These include asset manager Clarus Capital, token issuer Finka, blockchain-powered exchange platform Lykke, and even Hollywood film producer Barry Films.

Gentwo Digital is a joint venture between Gentwo, which specializes in independent securitization of financial products, inacta, a blockchain service provider, and the Crypto Valley ecosystem.

Most recently, the startup expanded to Geneva, establishing a presence in French-speaking Switzerland. It also teamed up with integrated, regulated bank SEBA Bank in February to develop a sophisticated offering for institutional investors.

Crypto Valley

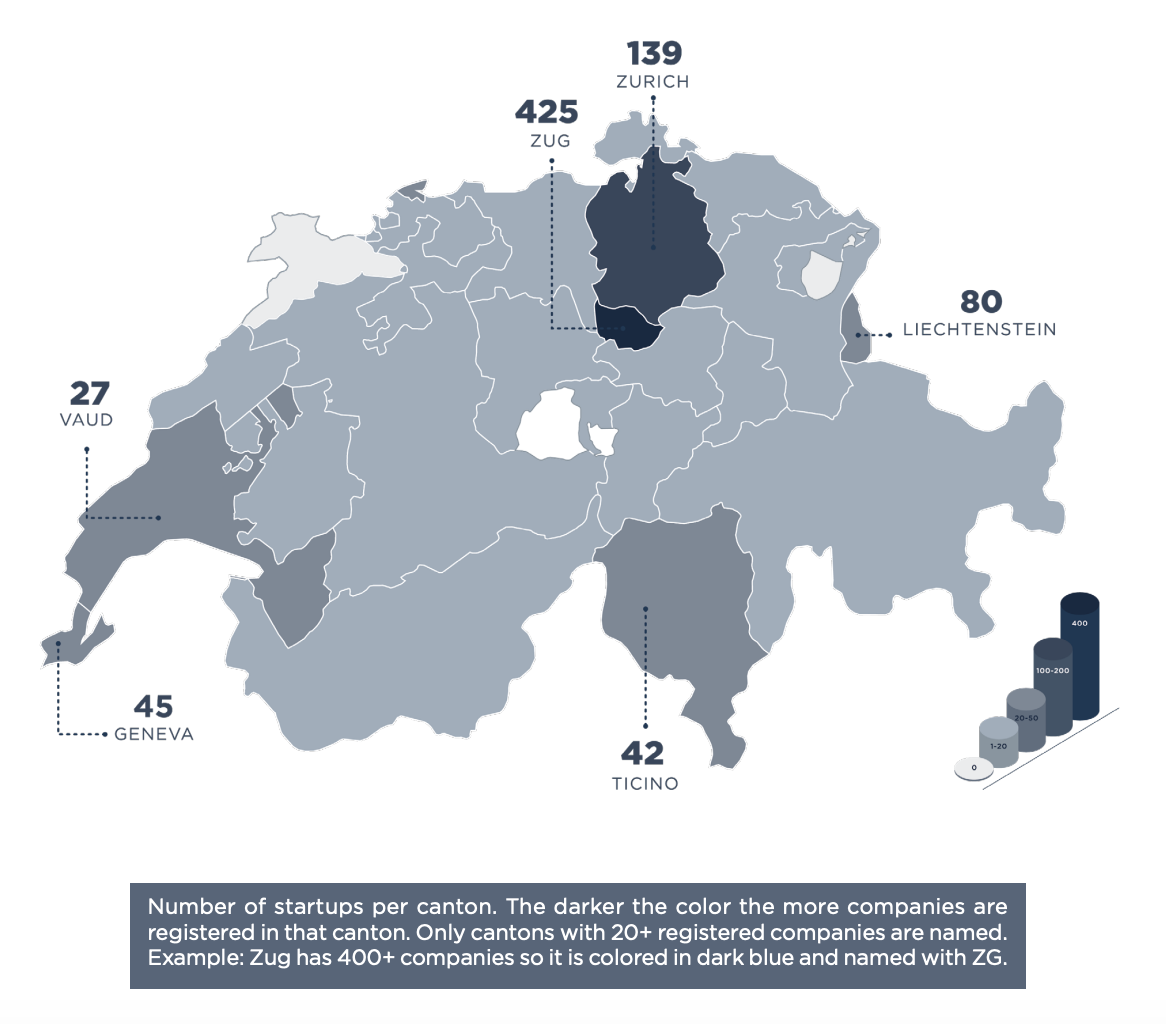

Gentwo Digital is part of Zug’s ever growing crypto and blockchain startup community. Nicknamed Crypto Valley due to the large number of companies engaged in the space, Zug is currently home to 425 registered crypto and blockchain companies, representing more than 50% of all crypto companies located in Switzerland and Liechtenstein, according to the CV VC Top 50 Report H2/2019.

Number of startups per canton, CV VC Top 50 Report H2 2019, CV VC, January 23 2020

Released in January, the report provides an overview of the crypto industry in the second half of 2019, highlighting growth and further maturation of the sector. In particularly, it notes strong development of the finance cluster with the introduction of crypto banks, and active involvement of Swiss private banks and traditional financial services companies in the field.

The report cites the example of SIX Group, the operator of the Swiss Stock Exchange, which launched a pilot version of SDX, its exchange and central securities depository (CSD) for digital assets, in September 2019.

Real estate security tokens were another noteworthy trend in H2 2019, which saw, for example, Emaar Properties, one of the world’s largest property developers, launch a reward token for its ecosystem through Emaar Suisse.

As of early 2020, Switzerland and Liechtenstein were home to five crypto unicorns: Ethereum ($14.4B), Dfinity (US$2 billion), Polkadot (US$1.2 billion), Bitmain (US$1 billion), Libra (US$1 billion). Unicorn contenders included Tezos (US$924 million), Cardano (US$869 million), and Cosmos (US$818 million).

The post Gentwo Digital, a Securitization Specialist for Bankable and Unbankable Assets appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments