At a time when China is trialing its own central bank digital currency (CBDC), European leaders must urgently come together and work collectively on the development of a digital, programmable euro, the Fintech Council of the German Federal Ministry of Finance has said.

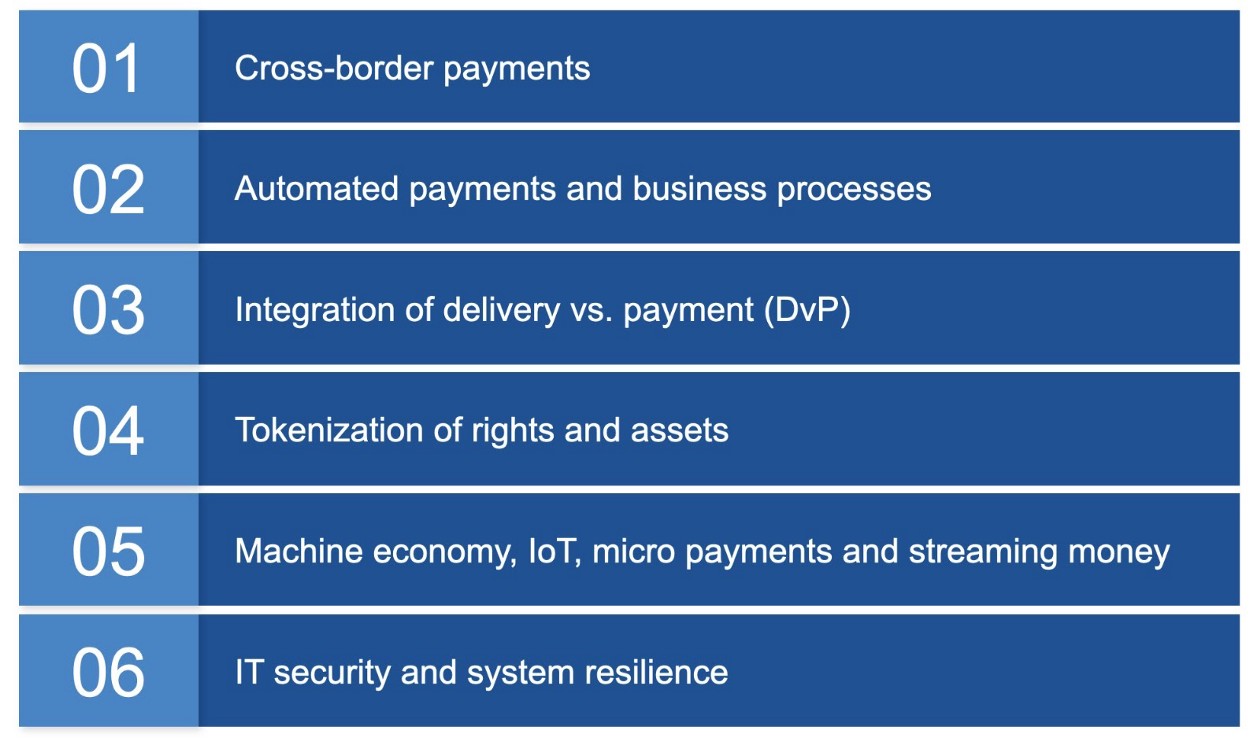

In a paper released on July 23, the Fintech Council explains why a digital, programmable euro would be beneficial for the German and European economy as a whole, citing advantages and improvements in areas such as increased efficiency in cross-border payments, the enabling of payment automation, micropayments and tokenization, IT security and system resilience, as well as the possibility for integration of delivery versus payment (DvP) in one platform.

The paper, titled Der digital, programmierbase Euro (The digital, programmable euro), notes that while China has been leading the way in the development of its own digital currency, in Germany and Europe, progress has been slow.

The Fintech Council calls for efforts to intensify and is advising industrial companies, retailers, associations, commercial banks, the Deutsche Bundesbank (German Federal Bank) and the European Central Bank (ECB) to come together and discuss the development of a digital euro.

“The implementation and introduction of a digital, programmable euro have to be approached with similar ambitions in terms of scope and speed of implementation as the Libra project initiated by Facebook to give the programmable euro the appropriate significance,” the paper reads. “In this respect, efforts around the programmable euro and its application in Germany and Europe must be intensified considerably.”

This digital euro must be built on blockchain, the Fintech Council said, adding that only a blockchain-based system would allow it effectively be programmable and reach its full potential.

Reasons for a programmable euro, Source: Der digital, programmierbase Euro, Fintech Council, German Federal Ministry of Finance, June 2020

Among the numerous reasons why the European Union must introduce a blockchain-based digital, programmable euro, the Fintech Council cited more efficient cross-border payments, which would be done in just seconds, as well as instant settlements.

Blockchain would also allow for greater automation of all kinds of complex financial processes, including factoring, leasing, sales financing, loans as well as interest payments.

Another argument in favor of using blockchain technology in the context of a digital euro is that DvP can be organized on integrated platforms.

Other potential benefits include efficient micro-payments – since blockchain enables the transfer of even smaller amounts of money –, and a system that’s more resistant to hacker attacks, since it would be distributed, the report says.

Experts call for digital programmable euro

The paper released by the Fintech Council last month echoes statements formulated by the Association of German Private Banks back in October 2019. In a position paper, the organization, which represents more than 200 private commercial banks and eleven member associations, advocated the establishment of a European digital currency, calling for lawmakers and financial regulators to lay the foundations.

In July, academics of the Frankfurt School of Finance and Management and the University of Bayreuth, released findings of a research on the potential of a digital, programmable euro.

Out of the 51 experts surveyed, 76% demanded a digital, programmable euro, which they saw as an adequate solution that would address the inefficiencies of the current financial system and which would bring in greater automation due the programmable nature of this means of payments.

The majority of the respondents (62%) believed that distributed ledger technology (DLT) was the appropriate technology to implement a digital programmable euro.

Germany isn’t the only country in Europe that has shown interest in adopting a digital currency. In June, the Italian Banking Association, made up of over 700 Italian banking institutions, said its banks were willing to pilot a digital euro.

Earlier this year, the central bank of the Netherlands, De Nederlandsche Bank, released a statement outlining its position on the matter, noting that it was supportive of a CBDC. In France, the central bank sent out in March a call for proposals for CBDC experiments.

Featured image credit: Unsplash

The post German Ministry of Finance Calls for Blockchain-Based, Digital, Programmable Euro appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments