Although commercial use of blockchain technology remains limited, global executives are poised to make some major moves over the next year, according to a research by Deloitte.

A survey commissioned by Deloitte and conducted online between March and April 2018, polled more than 1,000 blockchain-savvy executives at companies with US$500 million or more in annual revenue across seven countries: Canada, China, France, Germany, Mexico, UK, and the US.

Overall, respondents are still extremely bullish on blockchain’s potential, namely its ability to broadly scale and reach mainstream adoption. A majority also agreed that blockchain technology will disrupt their industry, whether that’s financial services, automotive, energy, or healthcare.

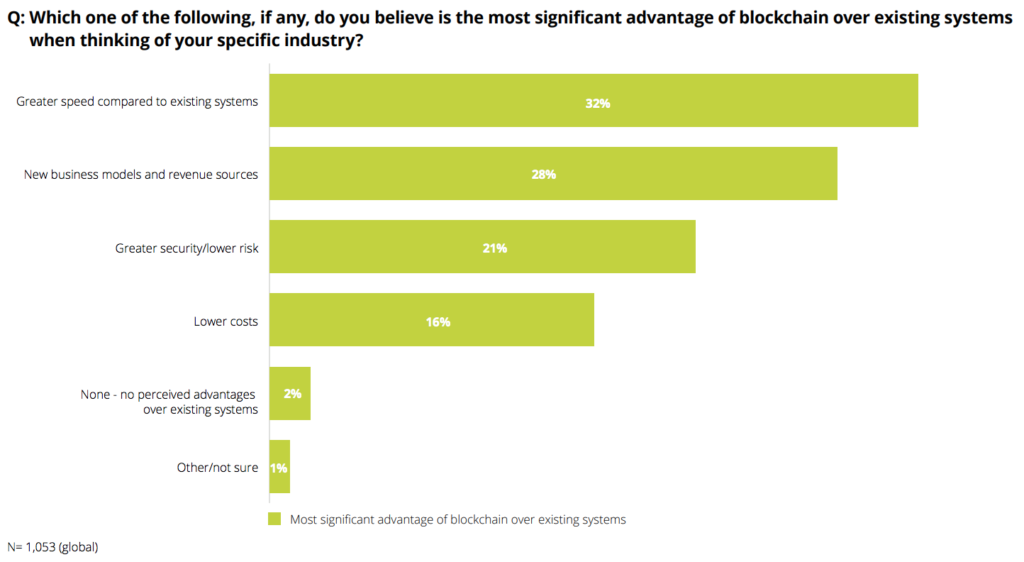

Respondents cited greater speed, new business models and revenue sources, and greater security, as the most significant advantages of blockchain-enabled systems over existing systems.

Deloitte’s 2018 global blockchain survey

74% said that their organizations see a “compelling business case” for the use of blockchain; many of these companies are moving forward with the technology. 34% said their company already has some blockchain system in production, while another 41% of respondents say they expect their organizations to deploy a blockchain application within the next year.

“We are at an inflection point — momentum is shifting from a focus on ‘blockchain tourism’ and exploring the technology’s potential to building practical business applications,” said Linda Pawczuk, a principal with Deloitte Consulting LLP and the head of Deloitte’s US financial services blockchain group.

“As more organizations put their resources behind this emerging technology, we expect blockchain to gain significant traction as its potential for greater efficiency, support for new business models and revenue sources, and enhanced security are demonstrated in real-world situations.”

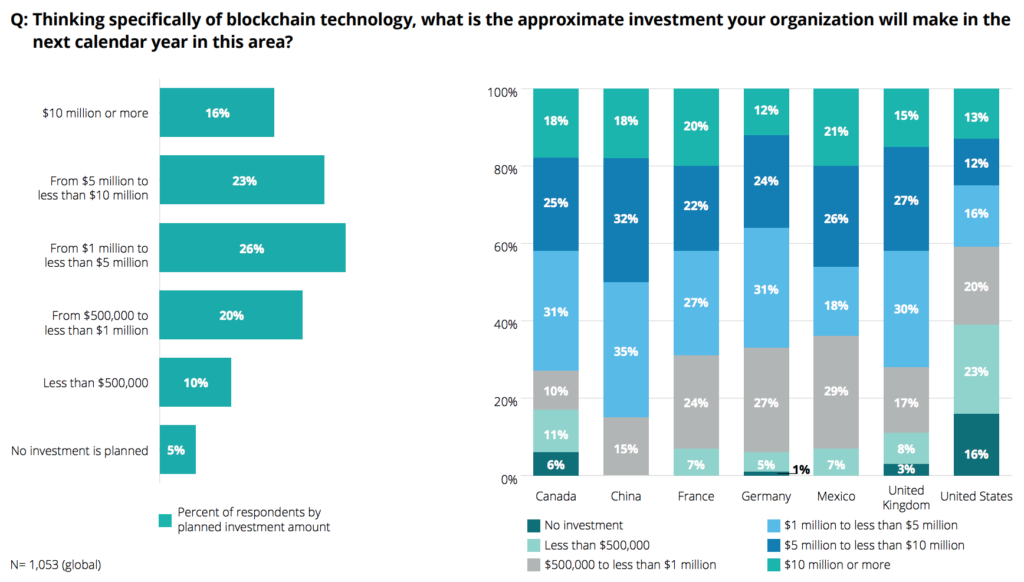

One proof that 2019 will likely see significant commercial blockchain activity is the investment amount that these large firms are willing to pour into developing blockchain solutions.

39% of respondents reported that their organization will invest US$5 million or more in blockchain technology in the coming year, and nearly 50% identified blockchain as one of their “top five strategic priorities.”

Deloitte’s 2018 global blockchain survey

While the financial services industry has been leading the way in using blockchain, there have been a growing number of emerging disruptors across each sector, challenging traditional business models with the use of blockchain, the report notes.

In particular, it cites the examples of Stori Labs, a distributed cloud storage provider, Rivertz Corp., which provides a store of value for devices to pay for, and control, cybersecurity services, and Filecoin, a decentralized file storage network and native token powered by blockchain technology.

Blockchain in Germany

In Germany, blockchain technology has been a primary digital focus area and was even included in the coalition agreement of the new government.

In the German corporate world, several firms from a variety of industries have gone public with their blockchain use cases, and two large global financial institutions, namely Munich Re and Allianz, are founding members of the Blockchain Insurance Industry Initiative (B3i) consortium, which aims to explore the potential of distributed ledger technologies to better serve clients through faster, more convenient and secure services.

In the German corporate world, several firms from a variety of industries have gone public with their blockchain use cases, and two large global financial institutions, namely Munich Re and Allianz, are founding members of the Blockchain Insurance Industry Initiative (B3i) consortium, which aims to explore the potential of distributed ledger technologies to better serve clients through faster, more convenient and secure services.

Additionally, several key players behind Ethereum and IOTA are located in Germany.

In the European Union, the European Commission has supported the signing of a 27-country pact on blockchain, the European Blockchain Partnership, that will see EU-wide collaboration on regulatory and technical matters.

The EU will allocate EUR 300 million in blockchain investment over the next three years. It has also established the European Blockchain Observatory to undertake research on how blockchain can be applied.

The post Global Executives Still Very Bullish on Blockchain appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments