Zurich-based fintech venture GOKONG is looking to put a personal financial fitness coach in everyone’s pocket.

GOKONG believes financial fitness should be available to everyone. At GOKONG they can monitor and control the financial health just like your physical health. The Swiss personal finance startup, a company owned by Bank Vontobel, has developed a mobile platform designed from the ground up to consolidate users’ financial footprint into a 360° view, aggregating all of their finances data in one place.

We at GOKONG believe financial fitness should be available to everyone. We can know, monitor, and control our financial health just like our physical health. So shouldn’t we?

The company intends to address the data fragmentation issue in personal finance by bringing all of a user’s assets under one umbrella. This includes both bankable assets from as many different accounts as they have, and non-bankable assets, such as jewelry and other valuable items.

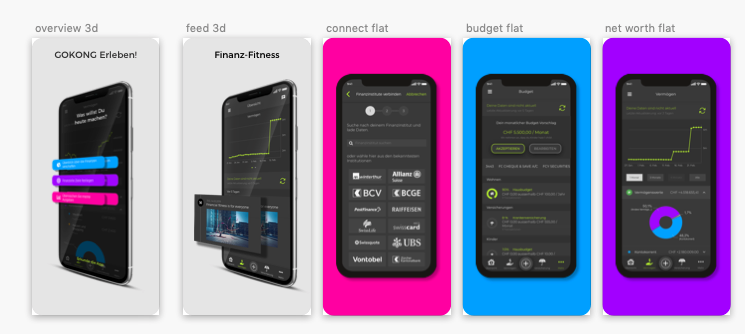

The mobile app aims to be engaging, straightforward and easy to use, not only to allow users to keep track of all their finances on a day-to-day basis, but also to derive insights that allow them to make wise financial decisions on the spot.

Explaining how he got the idea to develop GOKONG, Rahul Kaushik, CEO of the company, wrote in a blog post:

“In this day and age, when companies put together so many datasets about me to provide me with meaningful material, why wasn’t it possible to put all my financial data in one place so that I could extract meaningful insights on how to manage my spending and saving?

“So, I started wondering if there was a way of importing all my data from all my accounts into my banking app, so that I would get a 360˚view of all my finances in one app and a daily update on the current state of my finances.

“That was how I was inspired to develop GOKONG, an app that brings all your finances together under one roof.”

The GOKONG app downloads, cleans and aligns all financial data from all sources in just a few seconds. Through the platform, users can easily keep track of not only their transactions and progress towards their financial goals in real time, but also insurance coverages and get an accurate overview of the general state of their finances on an hourly, daily, weekly or monthly basis.

In addition to the data pulled from personal accounts at financial institutions, users can also add assets manually such as real estate, cars, art objects and jewelry.

Revolut support coming soon

GOKONG currently supports eight banks, Credit Suisse, UBS, Postfinance, Raiffeisen, Vontobel, BCV, ZKB and BCGE, insurers AXA, mobiliar, Swiss Life and Allianz Suisse, as well as independent credit card provider Swisscard, investment platform Swissquote, financial information provider Finanzen.ch – with support for Revolut coming soon. More banks are also planned to onboard by end of year.

The platform features a recommender engine which helps users save money by pushing relevant reminders and recommendations based on their preferences and spending patterns. Using GOKONG on a regular basis will allow the engine to gradually be able to generate better suggestions and recommendations based on their transaction and other data.

GOKONG’s budget recommendations are based on spending patterns of households in Switzerland. Users can compare themselves to other households in their community.

In terms of security and data privacy, GOKONG is read only and users’ personal details never leave their smartphone. The company claims in its FAQ it does not share any of users’ information with other financial institutions.

The company offers a basic, free version which allows users to get insights based on data from one institution. The pro version gives customers access to unlimited institutions and automatic stock updates, in addition to basic features including Smart Budgets, Spending Analysis, Goals and Savings recommendations and Asset Liability view. The pro version costs CHF 10/month or CHF 108/Year. Goking is running a promotion until the end of April 2019, where they offer a discounted annual fee and have sweetened the pot by making the first four institutions free.

The company aims to reach 500,000 users by 2021. In particular, the company is targeting 40+ years old professionals who are unable to do financial planning due to time and knowledge constraints. In 2019, GOKONG will focus on user acquisition and growth, the company says.

GOKONG is one of the numerous personal finance platforms and startups in Switzerland. Competitors include Numbrs, a fintech company offering an app that aggregates bank account and credit card information and facilitates mobile banking and personal financial planning and Qontis, an online personal finance management platform.

“Compared to competitors, user credentials never leave the device”, claims GOKONG.

The post GOKONG Mobile App Gives Users A 360˚View Of All Their Finances appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments