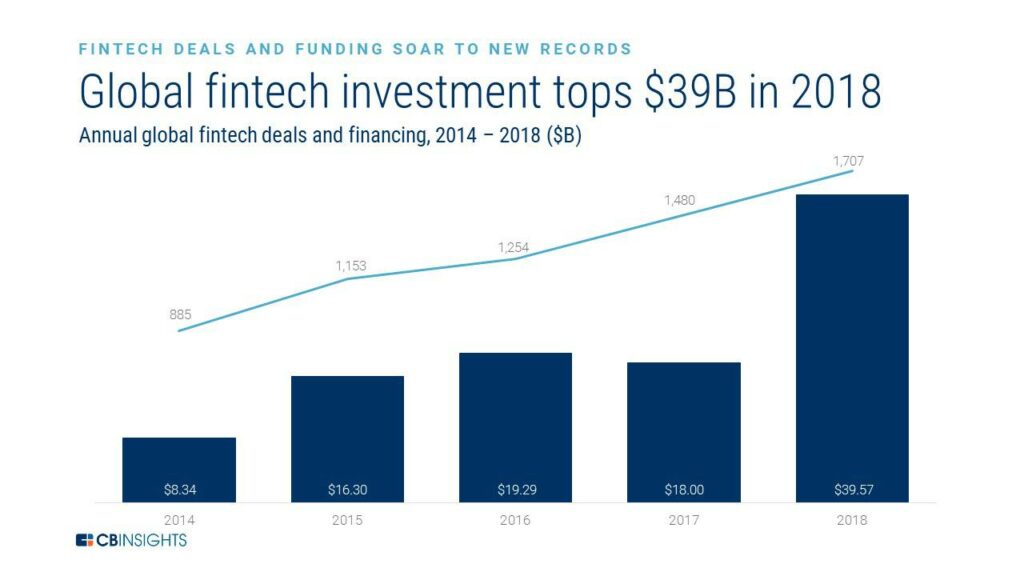

VC-backed fintech companies raised more than US$39 billion across 1,707 deals in 2018, according to a report by CB Insights.

The number of deals was up 15% compared to 2017, while the funding amount surged 120%. Driving these trends were 52 mega-rounds of more than US$100 million worth a combined total of almost US$25 billion.

Fintech Investment 2018, CB Insights

According to CB Insights, the most active fintech VCs in 2018 were:

500 Startups

Notable Investments: Grab, Flywire, Finaccel

500 Startups is a seed stage venture capital, since its inception in Silicon Valley, 500 Startups has invested in over 2,000 companies via 4 global funds.

Ribbit Capital

Notable Investments: Revolut, Coinbase, Revolut, Toss

Ribbit Capital is a global investment organization, the company states that they have one single, relentless mission: to change the world of finance.

Bain Capital Ventures

Notable Investments: Acorns, Flywire

Bain Capital Ventures is a venture who primarily focuses on growth and seed stage companies. It is an affiliate of Bain Capital.

a16z

Notable Investments: Stripe, Coinbase, Cryptokitties

Andreessen Horowitz is a private American venture capital firm, founded in 2009 by Marc Andreessen and Ben Horowitz.

Omidyar Network

Notable Investments: Chime, Tandem Bank

Omidyar Network describes itself as philanthropic investment firm. Within the world of finance Omidyar Network is active in verticals such as Financial Inclusion, Emerging Tech, and Digital Identity

The post Here’s The 5 Most Active Fintech Investors in 2018 appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments