A new study by the International Monetary Fund (IMF) has established a link between the prominence of fintech and the level of risk financial institutions are willing to take, revealing that greater fintech presence is associated with heightened risk-taking by incumbents. This result indicates that high fintech penetration and competition are eroding the market power of traditional banks, their profit margins and their franchise value, subsequently encouraging incumbents to take greater risks in a bid to maintain their market position and profitability.

The study, released on January 26, 2024, used a curated database covering over 10,000 financial institutions and global fintech activities to investigate how fintech activities influence risk-taking by financial institutions.

Findings reveal that fintech companies are putting pressure on traditional financial institutions, a threat which incumbents are responding to by taking greater risks. These findings have notable policy implications, the report says, and highlight that the combination of robust institutions and well-defined policy frameworks is crucial for harnessing the benefits of expanding fintech activities while maintaining financial stability.

Impact varies across fintech and bank types

Delving deeper into the results, the study found that the impact of fintech varies between distinct fintech business models on different types of traditional financial institutions.

For example, commercial banks were found to be the most negatively impacted by fintech companies operating under a balance sheet lending model. Fintech companies operating under this model provide credit and manage the entire loan process, making them direct competitors to commercial banks.

In contrast, commercial banks were found to be positively impacted by fintech companies running peer-to-peer (P2P) lending activities, suggesting that larger banking players are benefitting from partnerships with P2P lenders.

On the other hand, the profitability of cooperative banks was found to be the most negatively impacted by P2P models. This may be because P2P lenders, which allow people to lend or borrow money from one another without going through a bank, are targeting underserved or less creditworthy borrowers, a key target of cooperative banks. These innovative players are more efficient in serving the needs of these demographics, leveraging alternative data and advanced technology to more quickly and efficiently evaluate creditworthiness. They are also better equipped to swiftly adapt to changing market conditions and are known for providing superior customer experiences.

In contrast, cooperative banks may find it difficult to afford the necessary IT investments to meet customer expectations, particularly among younger generations who are more inclined to use digital banking services and may not have strong attachments to community-oriented institutions.

For both commercial banks and cooperative banks, the report says that a key factor linked to increased risk-taking among banks may be the deterioration of their profitability. As fintech companies enter the financial landscape, they introduce new competitive pressures, forcing incumbents to take on more risks in an effort to maintain their financial performance, it says.

These results indicate a policy trade-off concerning fintech activities. While certain regulatory and supervisory measures can lead to reduced risk-taking as fintech companies expand, other measures, such as restrictions on bank activities, may prompt increased risk-taking. Hence, striking the right balance between regulatory stringency and supervisory intrusiveness is crucial to reap the benefits of fintech while maintaining financial stability, the report says, and in this context, employing multiple supervisory approaches may aid in managing this trade-off.

A threat to banking incumbents

Results of the IMF study are consistent with a prior research conducted by the organization last year. The “Is Fintech Eating the Bank’s Lunch?” study, released in December 2023, explored the impact of fintech on traditional financial institutions, uncovering that the rise of fintech is negatively affecting the profitability of incumbents.

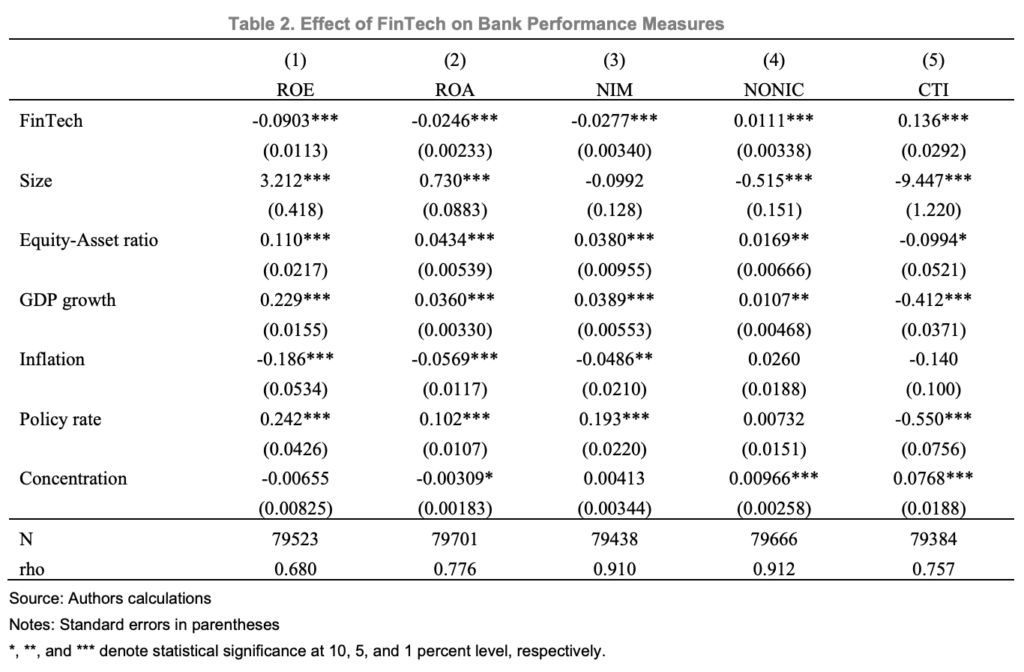

Effect of fintech on bank performance measures, Source: Is Fintech Eating the Bank’s Lunch?, International Monetary Fund, Nov 2023

Specifically, the study found that as fintech transaction volumes increase, there is a corresponding reduction in return on equity and return on assets for incumbent financial institutions. The heightened competition in the lending market and increased costs are identified as the primary drivers of this negative impact on profitability.

The research also delved into the impact of different fintech business models. Cooperative banks, compared to larger commercial banks, were found to experience greater profit deterioration from P2P lending and balance sheet lending. Commercial banks, on the other hand, were less affected by fintech, potentially due to their larger size and wider geographical reach.

Overall, incumbents with a lower risk profile tended to be more prone to a decline in profitability due to fintech competition.

Featured image credit: freepik

Comments