With rate of new COVID-19 cases slowing, Switzerland is gradually easing restrictions in a bid to avoid further damage to the economy.

As of June 12, Switzerland recorded more than 31,000 COVID-19 cases including over 1,600 deaths, according to data from the Federal Office of Public Health (FOPH). Only 19 more cases were reported from the previous day.

In Switzerland, reports of new cases began declining nationally in early April after peaking in late-March, according to data compiled by Swissinfo.ch.

Given the positive metrics, several restrictions were lifted in June with more to come. The government plans to re-open its borders with Germany, Austria and France on June 15 but is holding off on opening borders to Italy, and on June 19, the “extraordinary situation” will be officially lifted.

The COVID-19 pandemic and restrictions put in place to contain contagion have put a toll on the economy with the Swiss State Secretariat for Economic Affairs (SECO) estimating that Switzerland’s GDP could decline by 7-10% in 2020 due to the crisis.

According to a survey conducted in mid-April by Deloitte, 18% of self-employed individuals in Switzerland have had to close their business and 21% are still trading but have seen business drop to zero. A further 38% report a decrease in business.

To support the fintech startup community, the Fintech News Network is covering each week a promising Swiss fintech startup that deserve the spotlight.

For this week, we look at Vlot, an insurtech startup specialized in life insurance.

Life risk analysis and hyper-personalized coverage with Vlot

Vlot is a Zurich-based insurtech startup that provides a fully-fledged digital value chain combining a holistic life risk assessment with a tailored risk coverage solution as well as ongoing life-cycle triggered adjustments.

Vlot’s technology aggregates social security benefits, employer benefits, as well as relevant personal data to capture users’ situation holistically.

Based on a user’s information, the system calculates the disability benefits this user is entitled to in the event of both an accident and illness. It then calculates the benefits that would be paid to the user’s survivors should the person die after an accident or illness.

Once all benefits have been calculated, the system determines in which scenario (death or disability) which cause (accident or illness) creates the greatest income gap.

These parameters are then sent through a machine learning algorithm that calculates if and how high an insurance coverage is recommended. For this calculation, factors including age, level of education, civil status, number of children, and cost of living adjustments, are taken into account.

Finally, the user get three proposals: “Vlot minimum,” “Vlot optimum,” and “Vlot maximum,” and the current monthly premiums for each cover are provided.

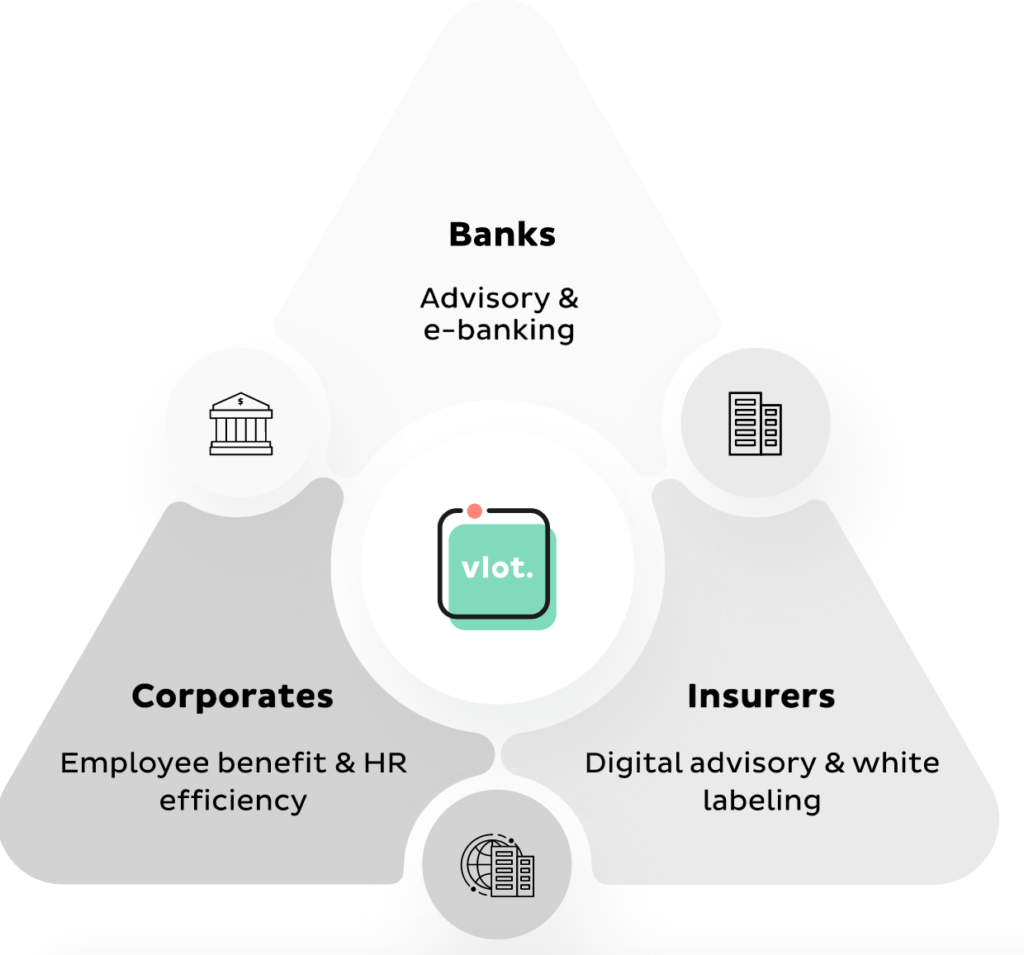

Vlot’s technology is being offered to both individual customers, as well as businesses.

For individuals, the platform allows them to access a holistic assessment of their available state and employer related social security benefits. It further enables end-customers to seamlessly close an identified income and savings gap through a tailored product solution (life insurance).

For insurers, Vlog’s end-to-end white labelled solutions allow them to automate their underwriting process, tap into additional distribution channels and decrease their cost while increasing customer satisfaction and loyalty.

For corporates, Vlot can be integrated in human resource offering as an employee fringe benefit. This would give employees access to a free life risk analysis as well as to flexible, competitive insurance coverage.

And for banks, Vlot can be integrated into any banking software environment: mortgage advisory processes, e-banking portals, or as a self-service offering, through APIs.

Vlot for businesses, Source: Vlot.ch

Established in 2017, Vlot went live in early 2019. The startup is an alumnus of the Plug and Play and Kickstart Accelerator programs and has received several awards and accolades over the years. Vlot was among the Digital Insurance Agenda (DIA) Top 100 Insurtechs 2019, and has been named one of Switzerland’s top insurtech startups by numerous outlets.

Insurtech in Switzerland

The insurance industry is going through a major transformation as new technologies, evolving customer behaviors and increasingly volatile, uncertain and complex business environments bring unprecedented challenges and opportunities.

In Switzerland, though insurtech has remained a rather small market, the country has nevertheless been the birthplace of some of Europe’s most recognizable insurtech startups including Wefox Group, which reached unicorn status in late-2019.

Most recently, ten companies from the digital insurance industry including TONI Digital, Dextra Versicherungen, ELVIA (an affiliate of Allianz Suisse), and ONE (an affiliate of the Wefox Group) teamed up to form a new industry trade group called the Swiss Association of Digital Insurers.

The organization aims to promote an exchange between members, as well as cultivate relationships with other associations with similar goals in Switzerland and abroad, it said in February.

The Swiss Association of Digital Insurers joins the House of Insurtech Switzerland, an insurtech hub established in 2019 and based in Zurich.

The post Holistic Life Risk Assessment and Tailored Coverage with Vlot appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments