Initial coin offerings (ICOs) have raised more than US$1.6 billion so far this year, surpassing traditional venture capital money. As the novel fundraising method gains popularity, the practice and processes of marketing ICO campaigns, too, have been on high demand.

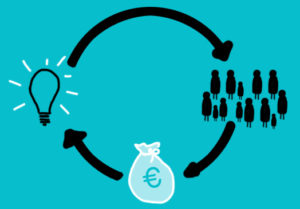

Image credit: Crowdfunding concept by Rocio Lara via Flickr

ICO marketing consists in designing and developing ICO campaign assets to give a project a professional look and build trust. It blends practices of both public relations and investor relations, and involves creating a white paper, building social media presence, and establishing credibility, among many other things.

But as jurisdictions around the world are looking to regulate the controversial fundraising practice, the days of marketers easily entering and operating within the ICO space are over.

In fact, the US Securities and Exchange Commission’s statements about ICOs issued in July imply that from now on, there will be greater regulatory and legal issues for those promoting the sector. One particular concern for marketers is to properly determine whether a given ICO is considered or not as a securities offering.

Like the US, Hong Kong‘s chief securities regulators issued a warning on ICOs earlier this week, remarking that some tokens may constitute securities, echoing similar statements from authorities in Singapore and Canada.

“The Monetary Authority of Singapore (MAS) has observed that that function of digital tokens has evolved beyond just being a virtual currency. For example, digital tokens may represent ownership or a security interest over an issuer’s assets or property,” reads an official MAS release.

“Such tokens may therefore be considered an offer of shares or units in a collective investment scheme under the Securities and Futures Act (SFA). Digital tokens may also represent a debt owed by an issuer and be considered a debenture under the SFA.”

The new ICO ruling in China, which strictly forbids the practice, has just made the country a forbidden space for ICO promotion and marketing.

Similarly, South Korea, which is looking to regulate digital currencies, stated earlier this month that it will punish ICO fundraising platforms for violating the capital market act by raising funds through stock issuance using cryptocurrencies.

Meanwhile, other countries have taken the opposite stand and quickly emerging as favored ICO destinations for blockchain startups. The Isle of Man, for instance, has created a regulatory framework it believes will allow for token sales that are compliant with anti-money laundering and know-your-customer regulations.

“Our understanding and analysis of the ICO market is that it represents a massive vertical market for us,” Brian Donegan, head of operations for fintech and digital development at the Isle of Man’s Department of Economic Development, told CoinDesk.

In Canada, Quebec’s regulator for financial institutions, the Autorite des Marches Financiers (AMF), is looking to better understand ICOs. The authority recently determined that a token sale by Impak Finance, a platform for investing in socially responsible enterprises, was a security. The AMF also accepted the company into its regulatory sandbox.

But for most jurisdictions, ICOs are still in a legal grey area. In Russia, the central bank published a notice this week warning about the “high risks” of exchanging cryptocurrencies, as well as participating in ICOs. The authority said that at this stage, it will neither authorize any cryptocurrency trading on any official exchanges, nor approve the use of the tech for infrastructure purposes.

In Israel, a committee established by the Israeli Securities Authority (ISA) is to assess the need for ICO regulations, and determine whether or not the practice fall under the purview of securities legislation. The ISA committee is expected to submit its assessments by December 31, 2017.

For Switzerland we haven’t yet seen any regulation comment yet. Watching the ICO records, Switzerland seems still one of the top countries for Initial Coin offerings and marketing.

Nevertheless, as jurisdictions around the world are working out regulations for ICOs, ICO marketers should familiarize themselves with the legalities of securities marketing worldwide as laws of this nature can be intense.

It is crucial for these professionals to research and study the information that exist on investor relations legislation because an ICO may be subject to them all. An ICO that’s marketed incorrectly can result in both civil and criminal charges.

Featured image via Pixabay.

The post How New ICO Rules Affect ICO Marketing appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments