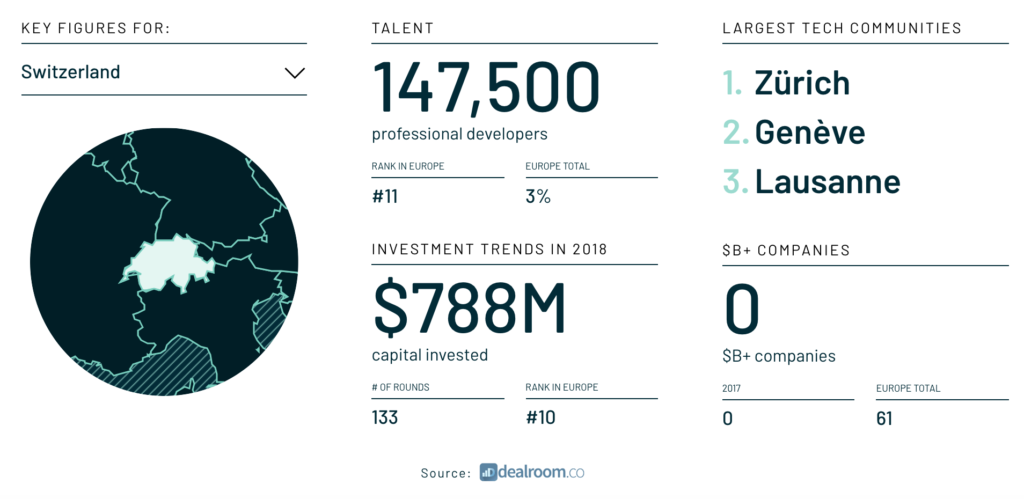

Switzerland figures, The State of European Tech 2018

The fourth edition of the State of European tech report, by Atomico in partnership with Slush and Orrich, draws on data from partners and a survey of 5,000 members of the tech ecosystem, from founders to students, investors to researchers, to provide a comprehensive data-driven overview of European technology today.

According to the research, Europe is home to a thrive tech ecosystem with at least 30 different hubs with 50,000 or more professional developers. Its three largest hubs for developers are London, Paris and Amsterdam which together are home to about 15% of the region’s total developers.

With nearly 100,000 professional developers in 2018, Zurich is the tenth largest tech hub in Europe.

Top European cities by # professional developers in 2018, The State of European Tech 2018

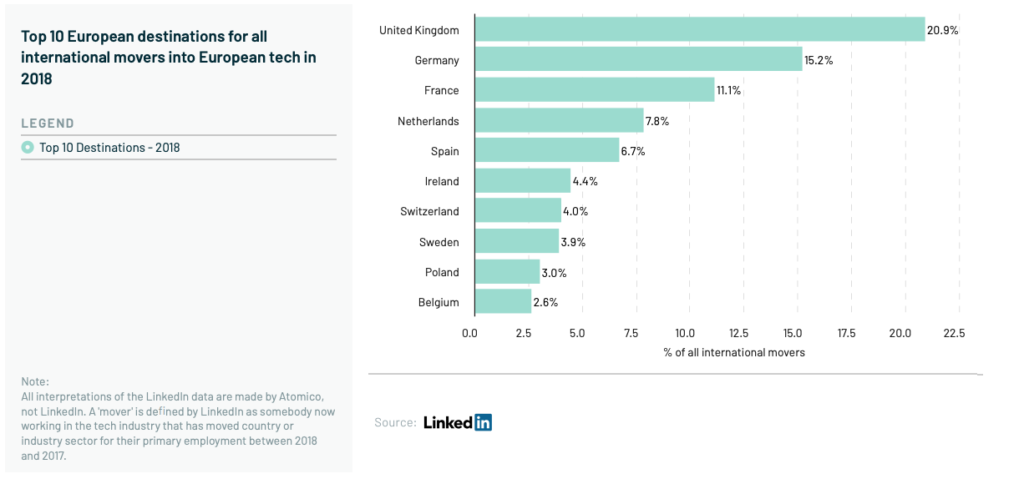

The UK is the number one destination for all international movers into the European tech ecosystem with 20.9%. Switzerland ranks seventh at 4%.

Top European destinations for all international movers into European tech in 2018, The State of European Tech 2018

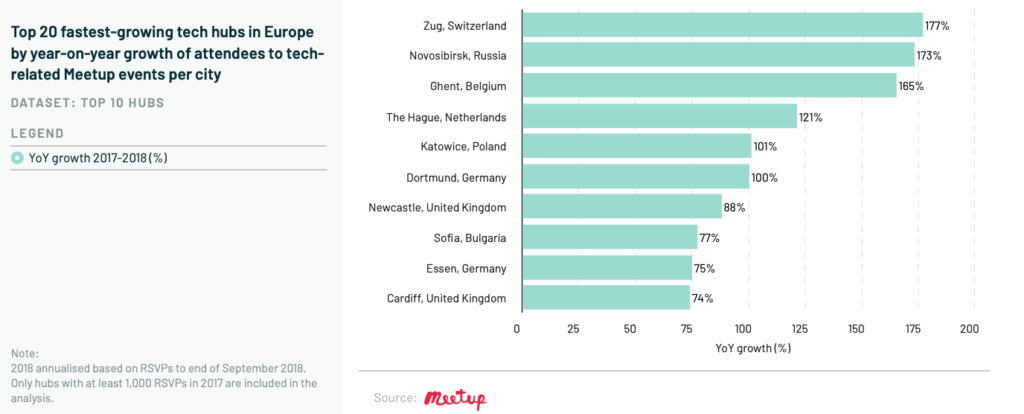

The report notes huge geographic diversity amongst the top 20 fastest-growing tech hubs in Europe, as measured by the annual growth in attendees to tech-related Meetup events in those cities.

Zug in Switzerland, home to a growing crypto community, ranks number one as the fastest-growing community overall at 177%.

Top 20 fastest-growing tech hubs in Europe by year-on-year growth of attendees to tech-related Meetup events per city, The State of European Tech 2018

In recent years, Switzerland has emerged as a fintech powerhouse with Zug its blockchain hub. The city has been nicknamed Crypto Valley for the high concentration of blockchain and cryptocurrency startups which include the Ethereum Foundation, Tezos, Xapo, ShapeShift, and Proxeus.

A research paper by Speedinvest X and Frontline released in September 2018 ranked Zug the third city in the world in terms of startup funding volume in H1 2018, driven primarily by its rapidly expanding crypto-community.

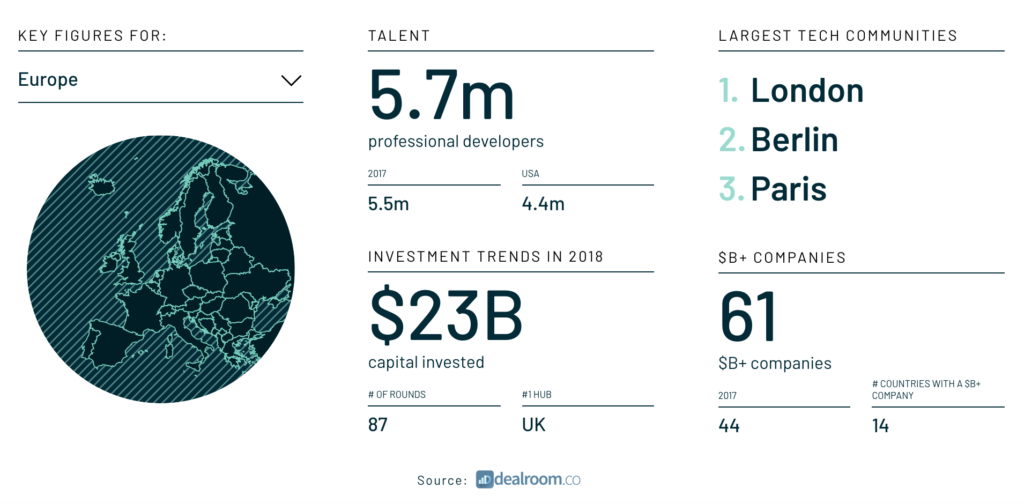

A record year for European tech

In 2018, European tech companies raised a record of US$23 billion, up from just US$5 billion in 2013 and four tech IPOs or direct listings of European tech companies reached valuations of more than US$5 billion on opening day, including Europe’s largest ever venture-backed publicly-listed tech company Spotify, fintech firm Adyen, luxury online marketplace Farfetch, and software company Elastic. In total, Europe contributed three of the top 10 largest tech IPOs globally of 2018.

The State of European Tech 2018

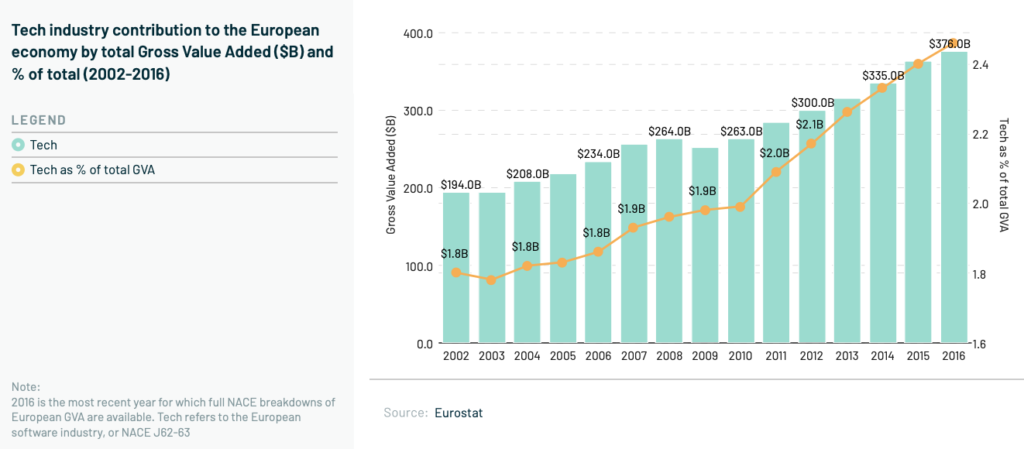

According to the report, Europe’s tech industry is growing 5x faster than the rest of the European economy in terms of gross value added, a pace that has accelerated in recent years. The European tech industry contributes around US$400 billion to the European economy today.

Tech industry contribution to the European economy by total GVA and % of total, The State of European Tech 2018

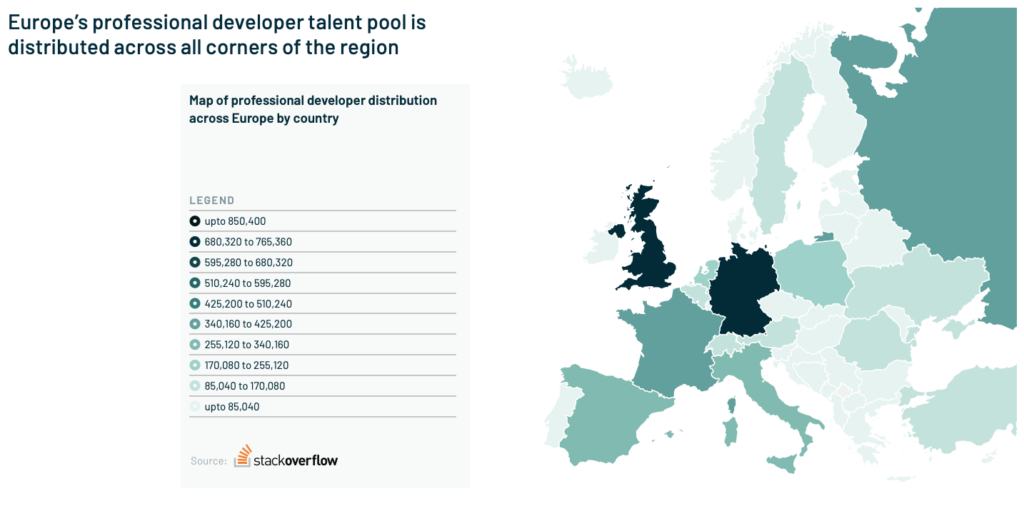

One of European tech’s greatest strengths is its deep talent pool, the report notes, which is more distributed and more interconnected than ever with some 5.7 million professional developers, up by 200,000 on 2017. This compared to the 4.4 million in the US, a number that stayed flat year-on-year.

Europe’s professional developer talent pool, The State of European Tech 2018

Germany is home to the region’s largest single market for professional developer talent, followed closely by the UK with 830,500 professional developers, and then France with 491,800 professional developers.

Moving forward, the report predicts that more European tech hubs will emerge with cities such as Cologne, Warsaw and Vienna poised to make a name for themselves. These have larger developer populations than Stockholm and active local tech communities, but have yet to attract as much investment. The report notes that there are 15 European cities with professional developer populations of 50,000+ that have seen less than US$1 billion in total capital investment since 2013.

The post How Switzerland Ranks in the State of European Tech Hub Study appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments