In 2022, online marketplace lending continued to rise in Switzerland, driven by mortgage loans and corporate and public sector debt instruments.

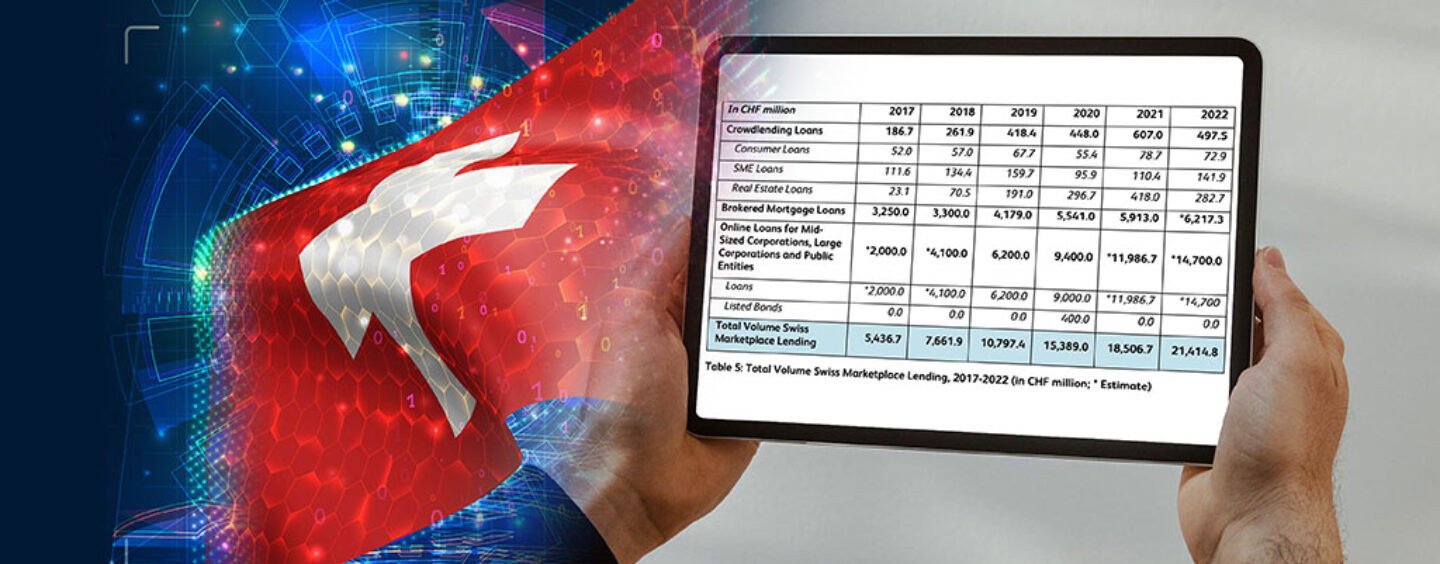

A study by the Lucerne School of Business and the Swiss Marketplace Lending Association (SMLA) reveals that in 2022, the total volume of debt capital issued on online platforms reached a new record of CHF 21.4 billion, up 15.7% year-over-year (YoY). Much of this growth was fueled by an increase of online mortgage loans and corporate and public debt financing volumes, which rose by 5% and 22.6% YoY, respectively.

The data, shared in the latest iteration of the Marketplace Lending Report Switzerland, shows that digital lending continued to see increased economic significance in the Swiss market in 2022, with loan volumes for corporates and public entities debt, and mortgage loans carrying on the upward trend they’d witnessed since 2017. Online loans to mid- and large-sized corporations and public entities surged from an estimated CHF 2 billion in 2017 to a considerable CHF 14.7 billion in 2022, while brokered mortgage loans rose from CHF 3.3 billion to CHF 6.2 billion.

Overall, the total volume of volume of debt capital issued on online platforms grew by nearly fourfold between 2017 and 2022, increasing at an annual average growth rate of about 32%.

Total volume of Swiss marketplace lending, 2017-2022, Source: Marketplace Lending Report Switzerland 2023, Lucerne School of Business and the Swiss Marketplace Lending Association, Oct 2023

While online mortgages and corporate and public sector debts continued their ascending trajectory in 2022, online crowdlending pulled back by 18% YoY in 2022. This decline was largely driven by a reduced number of real estate loan transactions (-32.4%), and more moderately, a decline in consumer loans (-7%).

Switzerland’s marketplace lending ecosystem

By the end of 2022, there were 29 homegrown marketplace lending platforms in Switzerland with crowdlending being the most crowded segment, comprising 14 platforms. These platforms connect private and/or institutional investors with consumers and/or businesses to provide them with debt. A third loan segment is real estate crowdlending, which provides mortgage-backed loans to individuals and small and medium-sized enterprises (SMEs).

A number of banks and insurance companies are involved in the Swiss crowdlending ecosystem, including PostFinance (Lendico), Vaudoise Group (Neocredit) and Luzerner Kantonalbank (Funders). Basellandschaftliche Kantonalbank is also a strategic stakeholder in Swisspeers.

Not included in the list of crowdlending platforms is Systemcredit, a marketplace that went online in 2018. Systemcredit provides SMEs with several credit offers from banks, institutional investors and crowd lenders, making its business mode comparable to that of a broker.

Swiss crowdlending platforms, Source: Marketplace Lending Report Switzerland 2023, Lucerne School of Business and the Swiss Marketplace Lending Association, Oct 2023

Online mortgage loans were the second largest marketplace lending segment in late 2022, comprising 12 different platforms. These platforms have an exclusively professional investor base, such as banks, insurance companies and pension funds as lenders, target private borrowers, and allow the mortgage application process to be done partially or entirely online.

The category includes Atrium, a platform launched by UBS in 2017 which eventually evolved into UBS Key4 Mortgages, and Valuu, launched by PostFinance in 2019. HypoPlus, Hypotheke and MoneyPark are independent mortgage loan platforms that are nevertheless attached to bigger institutions. Fully independent mortgage brokerage firms in Switzerland include RealAdvisor, Resolve, topHypo, Hypohaus, PropertyCaptain and Hypo Advisors.

Though the market for online mortgages remains a niche, the report notes that volumes have grown substantially, reaching an approximate 3.5% share in late 2022.

In the online corporate and public sector debt segment, two homegrown platforms were active in Switzerland at the end of 2022. Loanboox, which has been operational since 2016, has grown rapidly in the loan market for public entities, and is now active in twelve European countries. Cosmofunding is the other platform operating in the sector. The platform, which targets public and corporate borrowers, is owned by Bank Vontobel and was launched in 2018.

Finally, in the money market segment, online one platform was active in late 2022. This platform is Instimatch Global and provides digital price discovery, negotiation, counterparty diversification and automated execution of money market products across various sectors and countries.

Marketplace lending trends in Switzerland

The Marketplace Lending Report Switzerland 2023 highlights key trends observed in 2022 in the Swiss marketplace lending ecosystem, which are anticipated to continue shaping the industry’s trajectory.

One significant trend is the increasing emphasis on sustainability, with platforms beginning to integrate environmental considerations into their lending practices. Initiatives like “green mortgages” by UBS Key4 Mortgages, green scoring systems, and sustainability-integrated decision-making processes are emerging, indicating a shift towards more environmentally conscious lending products. Marketplace lending platforms are also addressing climate change concerns by facilitating emission-reducing projects for Swiss municipalities.

Another trend outlined in the report is the evolution of the mortgage brokerage business. With growth rates starting to decline, it expects the business-to-consumer sector to see some stagnation or even a decrease in volume in 2023 and 2024, prompting a shift towards the business-to-business sector.

Finally, another key trend is the role of marketplace lending in financial innovation. These platforms, which are leveraging technologies such as artificial intelligence to enhance efficiency and streamline loan evaluations, are contributing to the ongoing evolution of modern finance, the report says.

Featured image credit: Edited from freepik

Comments