Though institutional adoption of digital assets remains low, demand from traditional trading firms is growing rapidly, showcasing that the sector is poised for prime time, according to a research by management intelligence platform Acuiti.

In a special report titled Institutional Adoption of Digital Asset Trading, Acuiti shares the results of a survey of traditional trading firms and institutions, specialist crypto trading firms and sellside service providers, which sought to assess the current state of digital asset adoption across the sector and gauge industry participants’ willingness to embrace the emerging asset class.

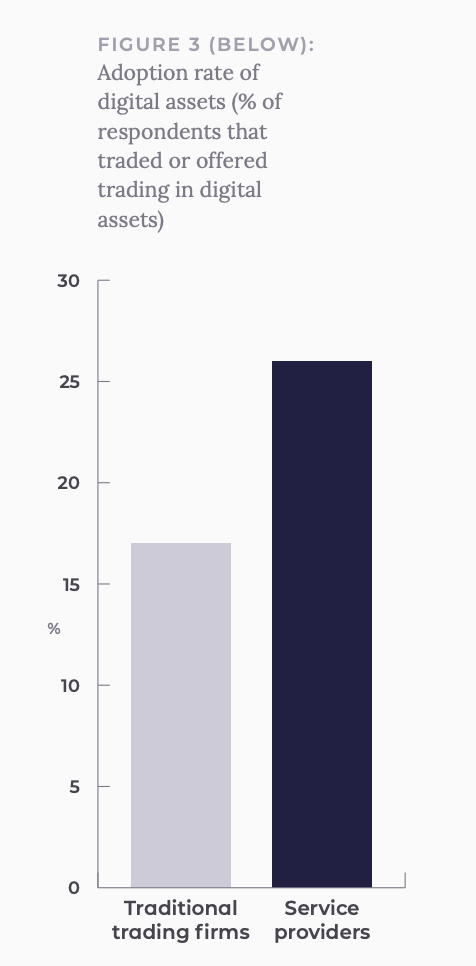

The research found that the current adoption rates were still relatively low with less than a fifth of traditional trading firms (17%) trading digital asset such as bitcoin and ether.

Adoption rate of digital assets, Source: Institutional Adoption of Digital Asset Trading, Acuiti, March 2020

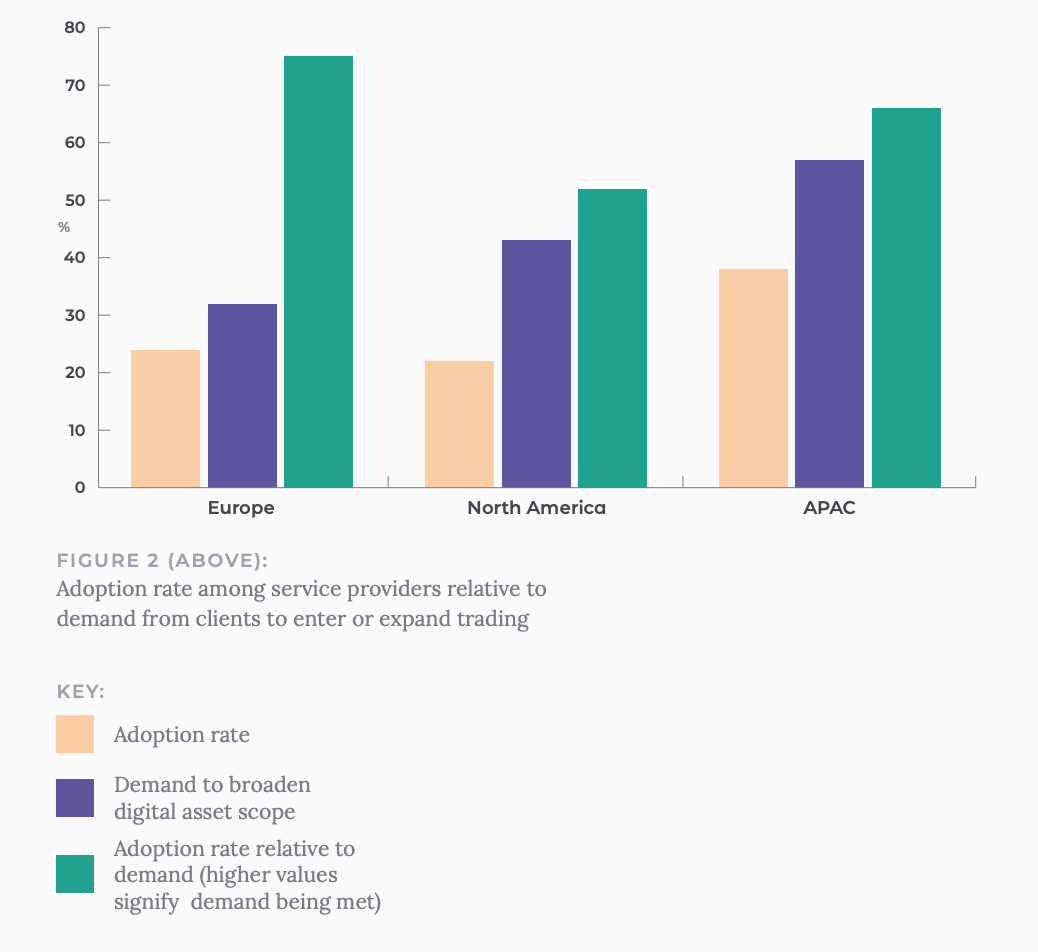

APAC had the highest adoption rates with 57% of APAC service providers surveyed providing execution or clearing services for digital assets, compared with about 40% in North America and 30% in Europe.

Adoption rate among service providers relative to demand from clients to enter or expand trading, Source: Institutional Adoption of Digital Asset Trading, Acuiti, March 2020

When asked about the main roadblocks preventing them from adopting digital assets, traditional trading firms cited the security of exchange/fear of hacking, concerns over custody, as well as the high margin requirements/pre-margining requirements.

For service providers, limited client demand, concerns over anti-money laundering (AML) and know-your-customer (KYC) of exchanges, and fear of reputational damage, were cited as the three main concerns holding them back in adopting digital assets.

Despite the current low adoption rates, the research identified growing demand from traditional institutions, with many looking to either enter the market or expand their coverage to trade more cryptocurrencies in the next future.

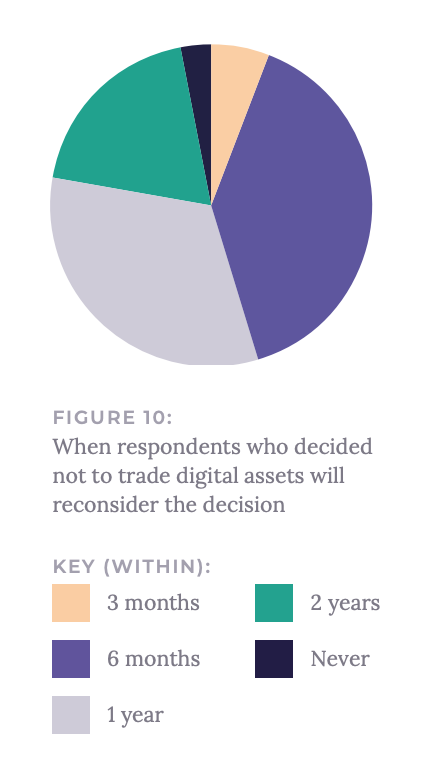

Out of the traditional trading firms that had made a decision not to trade digital assets, 97% said it will consider the opportunity again in the next two years or less. 45% said they were planning to revisit the idea within the next six months or less.

When respondents who decided not to trade digital assets will reconsider the decision, Source: Institutional Adoption of Digital Asset Trading, Acuiti, March 2020

A rapidly growing ecosystem

Over the past couple of years, the institutional digital assets capital markets industry has grown rapidly on the back of rising awareness of cryptocurrencies and favorable regulations.

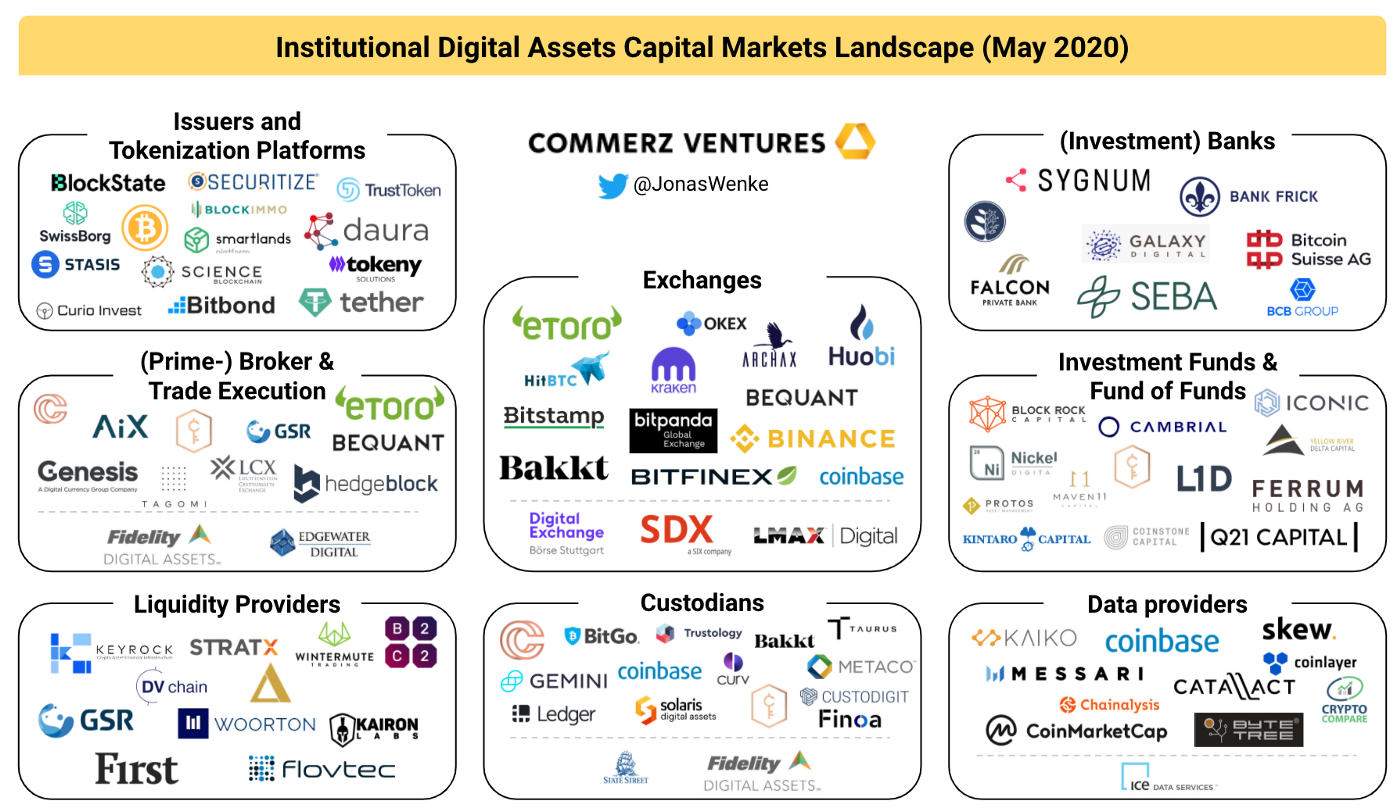

According to a May 2020 map produced by Jonas M. Wenke, a senior associate at CommerzVentures, the ecosystem now includes a number of companies that cover the entire value chain. These include issuers and tokenization platforms, brokers and trade execution companies, liquidity providers, exchanges, custodians, investment funds and fund of funds, and data providers.

Several incumbents including Fidelity, State Street and Börse Stuttgart have also entered the institutional digital assets capital markets landscape, the map shows.

Institutional Digital Assets Capital Markets Landscape, Jonas M. Wenke, May 2020

According to Wenke, “2020 will be a defining year” in the development of the industry as startups continue to build the enterprise-grade infrastructure needed, as asset managers become more accustomed to cryptocurrencies, and as new digital assets continue to emerge with the rise of tokenization.

But institutional adoption will also greatly depend on the pace at which regulators will create legal certainty around digital assets, Wenke says, including establishing a clear definition of what constitutes digital assets and which regulations they are subject to.

Nevertheless, several progresses have been made in this regard, he notes. The Liechtenstein Blockchain Act came into effect on January 1, 2020, providing a legal framework for asset tokenization. In Germany, the Federal Financial Supervisory Authority (BaFi) has incorporated crypto custody business into the German Banking Act with a new law that came into effect on January 1, 2020 as well as. And Japan has had one of the most progressive regulatory climates for cryptocurrencies, passing a law in mid-2017 that recognizes cryptocurrencies as legal properties.

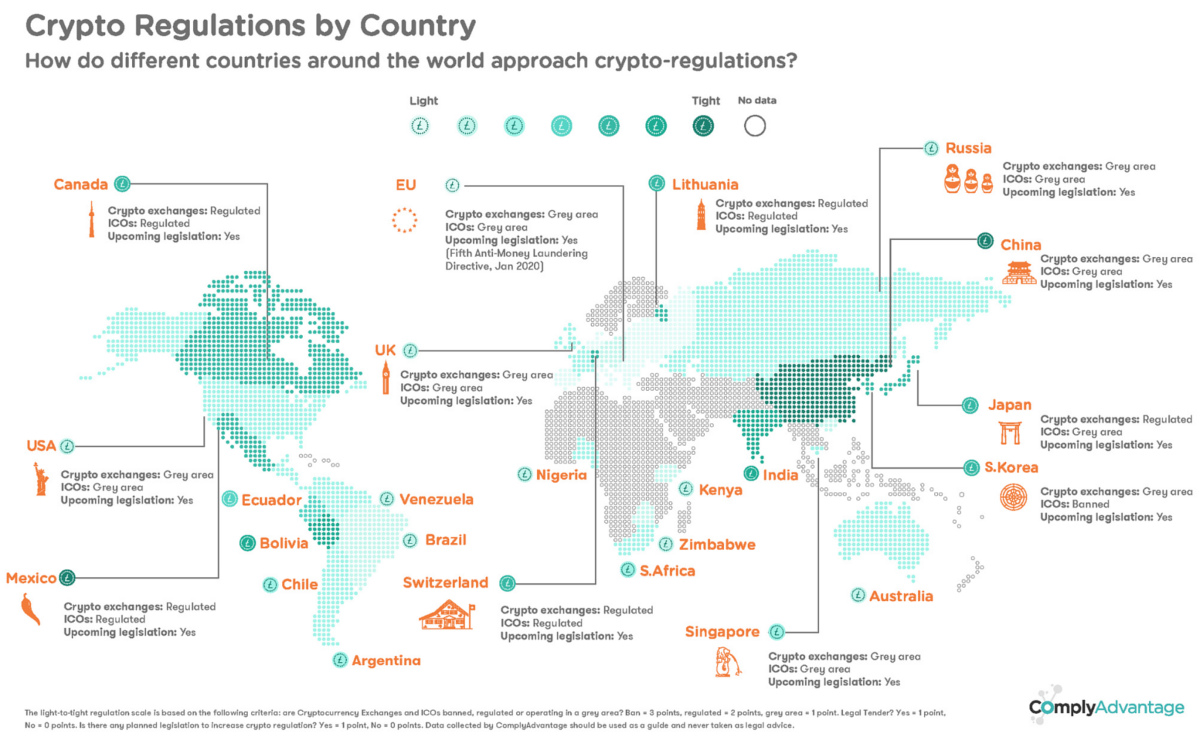

Crypto regulations by country map by VisualCapitalist, October 2019, Source: ComplyAdvantage

“From the developments I have seen in various startups throughout 2019, I am very optimistic that this momentum will continue and gather pace in 2020 that we will see the steady emergence of large and valuable companies in the digital assets space over time,” Wenke wrote in his blog post.

The post Institutional Adoption of Digital Assets Poised for Prime Time appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments