Amid the COVID-19 pandemic, consumers are increasingly turning to non-traditional players including bigtechs and product manufacturers such as Tesla for innovative, personalized insurance offerings, and enhanced customer experience, according to the Capgemini and Efma’s newly released World Insurance Report 2020.

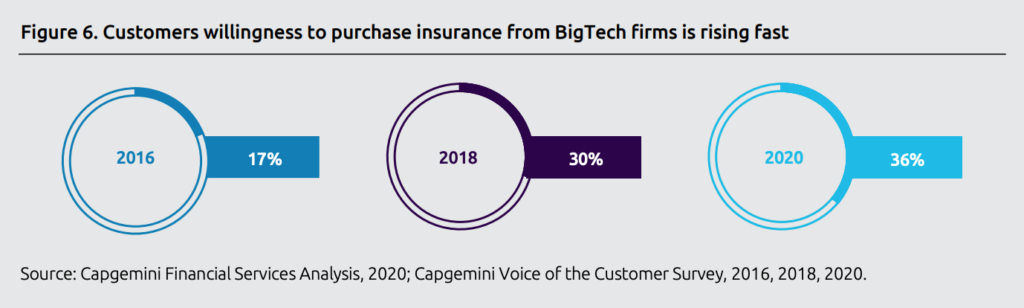

The appetite for bigtech insurance is accelerating fast, with consumers rapidly warming up to the idea of buying insurance products from agile, tech companies. While in 2016 only 17% of World Insurance Report survey respondents said they would consider purchasing insurance from a bigtech, the 2020 number has doubled to 36%.

Customers willingness to purchase insurance from bigtech firms is rising fast, Source: Capgemini Financial Services Analysis, 2020; Capgemini Voice of the Customer Survey, 2016, 2018, 2020

Behind these rapidly changing customer behaviors is the reality that digital adoption is no longer a function of age but is now mainstream across generations. The research found in 2020, the number of Gen X and older customers (born in 1980 or earlier) making daily online and mobile transactions such as shopping or bill payments has doubled, rising from 30% of Gen X and older respondents in 2018 to 64%.

Customers frequently doing transactions online or via mobile app (%), 2018-2020, Source: Capgemini Financial Services Analysis, 2020; Capgemini Voice of the Customer Survey, 2018, 2019, 2020

According to the report, the COVID-19 lockdown will further fuel this trend as consumers are forced to use digital channels for day-to-day transactions.

Demand for hyper-personalized products on the rise

Today’s customers want a hyper-personalized offering delivered through unique consumer experience. The 2020 survey found that demand for usage-based insurance has skyrocketed over the past year, with now more than 50% of customers requesting it, compared to only 35% in 2019.

The 2020 survey respondents across segments said they liked usage-based insurance because it is the best expression of a hyper-personalized approach and offers a sense of value for money.

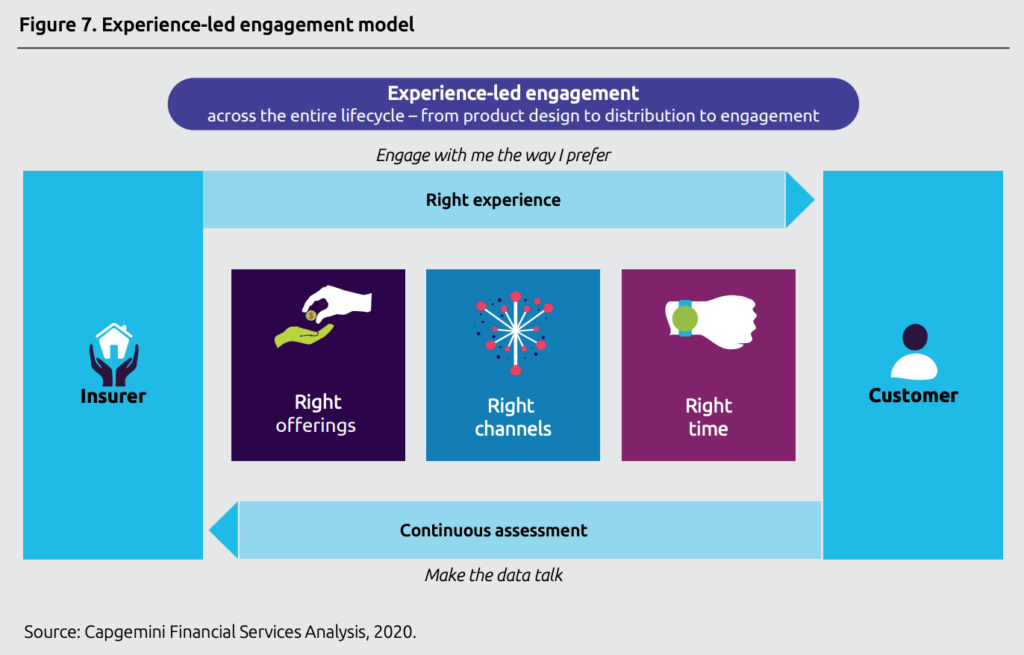

In this rapidly evolving landscape, the report cites three key pillars incumbents must focus on when developing an engagement strategy: offering products that suite evolving customer needs and preferences across the lifecycle; reaching out to customers during the time they are likely to perceive insurance coverage to be the most valuable; and interacting with customers via the channels that they prefer and access the most.

Experience-led engagement model, Source: Capgemini Financial Services Analysis, 2020

Additionally, since customer preferences are evolving more quickly than ever, insurers must remain alert and agile, with continuous assessment through substantial, real-time data management, so that their initiatives can be modified on the fly.

New entrants making waves

Over the past couple of years, bigtechs including Amazon, Apple, Google, Alibaba and Tencent have entered the insurance market and attracted a massive customer base.

In China, Tencent launched insurance platform WeSure in November 2017 and by the end of 2019 had insured more than 25 million customers. Xiang Hu Bao, an online mutual-aid platform owned by Alibaba affiliate Ant Financial, attracted 100 million users within its first year of operation.

In the US, Amazon started making significant strides in the insurance business back in 2018, partnering with Berkshire Hathaway and JP Morgan to create a healthcare company with the aim of cutting healthcare costs and improving services for their US employees. In 2019, Amazon received a corporate agent’s license from the Insurance Regulatory Development Authority of India to sell third-party products, and is now reportedly working with local insurtech startup Acko to offer a wider range of products.

But besides the bigtechs, a new group of market entrants are poised to make waves. Product manufacturers such as Tesla have begun dipping their toes into insurance, and with their sharp understanding of their own products and customers, they may very well make a critical juncture for the industry, the report says.

These companies have access to a plethora of real-time customers data they collect using Internet-of-Things (IoT) devices or mobile apps, allowing them to aggressively price insurance offerings.

Tesla, for example, leverages the advanced technology of its electric cars including camera recordings and sensor readings to develop highly personalized pricing and value-added services that traditional insurers cannot offer. In August 2019, the firm launched an insurance offering in California which promises Tesla owners up to 20% lower rates, and in some cases as much as 30%.

The post Insurance Report: Consumers Turn to Non-Traditional Players, Bigtechs Amid COVID-19 Crisis appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments