Well, it’s already happening. In the past week, I have heard of 4 Swiss private companies approached by US-listed SPACs interested to acquire them. There may be more such cases in Switzerland by now, but there will definitely be more in the near future. SPACS are publicly traded companies with no commercial operations that have been formed strictly to raise capital through an IPO with the purpose of acquiring a private operating company. The SPAC concept has been around for many years. It is the extent of the phenomenon that is new.

Irrespective of whether the SPAC listing trend continues, or will be more subdued, one thing is certain. On the one side Switzerland has many interesting private companies. On the other side, for at least a few years from now, there will quite a few listed SPACs, with considerable amounts of cash in the bank, that will be looking for a target, against a strict timeframe.

How many SPACs are “on the hunt” at the moment?

Many, and the number is (still) growing.

In the US, NASDAQ and NYSE saw 249 SPACs list in 2020. Out of these, by my calculations and research, between 65-70% are currently looking for targets. In 2021, the two exchanges saw an additional 189 SPACs list in January and February.

In Europe, SPACs are also becoming trendy. Whether or not this lasts – it needs to be seen. Recent IPOs include the Frankfurt-listed EUR 275m Lakestar SPAC I SE, backed by the Lakestar founder Klaus Hommels, ESG Core Investments, a EUR 250m SPAC listed in Amsterdam. There are many other SPACs in the making. For example, Bernard Arnault, Europe’s richest man, is planning to back a financial services SPAC. Rumour goes that there might be some Swiss SPACs in preparation as well. Worth noting that European stock exchanges are also starting to adapt rules to accommodate the US-style of SPACs. As of early February 2021 Nasdaq Stockholm has new rules with regards to SPACs. In the UK Lord Hill’s Listing Review Report, released this week, is also making recommendations in that respect.

Which SPACs could be looking to acquire Swiss companies?

US-listed SPACs with European management or current and future European-listed SPACs are likely to exhibit a degree of European bias.

In addition, many US-listed SPACs look to acquire companies in sectors that are global by nature, where the origin of the target is relatively unimportant. For example, out of the 90 SPACS listed on Nasdaq in 2020 that are still looking for a target, from what I can see about 2/3 have a global, geography-agnostic mandate. In terms of sector, if we look at the same set of SPACs, from what I could see roughly 65% of them were in technology and healthcare, with other global themes such as ESG, travel and leisure following suit.

Worth also mentioning that the Hong Kong and Singapore bourses have recently announced they were considering allowing SPAC listings as well. If that happens, they may also list SPACs that look to acquire European companies in the future.

What is the typical target profile SPACs are looking for?

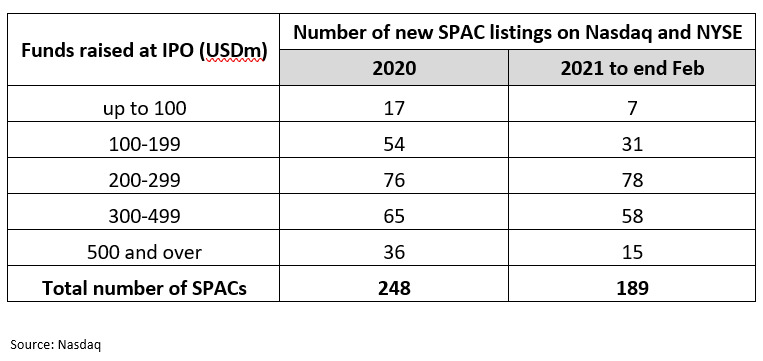

A certain size is what I would like to highlight. From the start, in the US for example, there is a minimum threshold imposed under the NASDAQ and NYSE rules, which specify that “the De-SPAC transaction must be with one or more target businesses or assets that together have an aggregate fair market value of at least 80% of the assets held in the trust account at the time of signing the definitive agreement”. If one looks at the table below, one could do some back-of-the-envelope math.

In the case of SPACs with a “one acquisition” strategy, a rule of thumb seems to currently be to assume that funds raised by a SPAC at IPO represent roughly 25-30% of the target enterprise value (EV), although I have seen quite a few deals where the target was significantly larger than that.

In the case of SPACs with a “buy and build” or multiple acquisition strategy from the start, there is obviously more flexibility in term of size per individual target.

To give you an idea of the level of funds raised (which you would then have to multiply by 3 or 4 for an indicative EV of the target), I have gathered some data from the SPAC listings of 2020 and 2021 on NASDAQ and NYSE:

Europe being Europe – I can only presume it will not have the same number of very large SPAC IPOs. Therefore, the target size European SPACS will be looking for is likely to be generally smaller. It is difficult to be more precise on size, because we do not have any visibility of what SPACs will be listed in the future. As a reference point, the smallest SPACs listed in the US recently, as per the above table, have raised USD 40m at IPO. Multiplied by 3, that’s an indicative target EV of USD 120m.

To this end, I personally doubt that a CHF 10-20m EV Swiss company would be a target any time soon, but starting from an EV of CHF 100-150m, it is not implausible to see a SPAC approaching such a company in the future.

Prior to 2020, it used to be more or less the norm that SPACs would look for EBITDA-positive companies. Since 2020, things seem to have become more flexible.

In terms of performance and prospects, it only makes sense for SPACs to target companies they believe to have meaningful upside potential. Some SPACs are looking for companies that are already doing well, some are looking for “fallen angels”, for restructuring and turnaround situations. To this end, a Swiss Software-as-a-Service company with high and sustainable growth, a later-stage biotech, a fast-growing company in the renewable space and a family business that has a solid market position but needs a re-vamp, could all be targeted by different types of SPACs.

At the opposite end, anything that is generally too early stage for an IPO, or developed but ex-growth in a stale or shrinking industry, with no chance of revival, would generally not make a good SPAC acquisition target.

The 4 Swiss companies I have heard of that have been approached by SPACs are one in the tech space and three biotechs. All of them were at different stages of preparing for an IPO anyway, as far as I know.

How can Swiss private companies become more “SPACs-y”?

There are two key things one could do, to trigger attention from SPACs: be visible to the relevant parties and have “the house in order”. In my view, the categories of Swiss companies that are naturally in pole-position here are:

- Industry leaders and industry disruptors, which are generally known in the relevant sector circles and are likely to be very well organised internally; and

- IPO candidates, because IPO preparation ticks both boxes. IPO candidates are known to bankers, and bankers are often idea or lead generators for the SPAC founders. At the same time, the in-house part of IPO preparation naturally makes the company far easier to due diligence and more agile to respond to an M&A approach.

For all those companies that are none of the above, but have now become interested in the phenomenon, there is no impediment in them taking a more proactive role and contacting the SPAC management teams directly. The SPAC information (profile, key management) is in the public domain, on the website of the stock exchanges, in the media etc.

For US SPACs, you can see the full list of IPOs and new filings (imminent IPOs) here. They generally are the ones with an initial price per share of USD 10 and a ticker symbol that ends in U (for “unit”). In Europe, some exchanges do not publicly share their IPO lists. One needs to keep an eye on the media in this case. The London Stock Exchange publishes its IPOs here and Nasdaq Nordic publishes here. SIX (if and when SPACs happen) publishes completed IPOs here.

However, worth remembering that – particularly for Swiss companies that have shown no interest whatsoever in going public to date and have all of a sudden become excited about SPACs – an acquisition by a SPAC may come as a shock to the system. That is because, from a target’s perspective, a transaction with a SPAC is basically a hybrid “IPO/M&A” done within a condensed timeframe. In contrast, companies would generally take one to several years to prepare internally for an IPO. In addition, the end of this hybrid “IPO/M&A” process is nothing but the beginning of another process: that of life as a public company, with all its benefits, but also obligations.

In my view, there is no universal answer to the question “is it better for companies to go public via an IPO or a SPAC”, the same way one could have pros and cons for an IPO versus a direct listing. The answer depends very much on every target, and the respective SPAC and its sponsors, and the terms and conditions of the deal etc. One thing is for sure though: for the target, going public through SPACs is faster, there is the certainty of price, one does not need to do the beauty parades with the banks or the initial investor roadshow and targets can talk about their future and forecasts more freely.

For me and for now, the listing via SPAC is just another type of listing, alongside IPOs and direct listings. For Swiss private companies in general though, the carrot of “SPAC = money looking for companies” may just be the right incentive to make them give public markets a more serious consideration.

This article first appeared on Next-Generation Wealth

Featured image credit: edited from Unsplash and Freepik

The post Is a SPAC Approach Plausible for Swiss Companies? appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments