Smartwatches, fitness apps and equipment are enabling us to monitor our physical fitness in real time and are providing us with personalized plans, suggesting recommendations in terms of diet, exercise and sleep by putting a personal trainer in our pocket.

With the horde of tools made available today, we’ve never been so engaged with physical fitness. But what about financial fitness? Are there any tools available out there that allow us to monitor our financial health? What exactly is financial fitness anyway?

For GOKONG, a Zurich-based fintech startup, financial fitness is the company’s core focus as it strives to offer each and everyone in Switzerland with a complete financial fitness coach right in their pocket.

“We at GOKONG believe that financial fitness is about informing you, inspiring you, and sharpening your financial fitness skills across the three pillars of money management, consumerism and financial planning,” GOKONG’s CEO Rahul Kaushik said during his presentation at the Finance 2.0 conference in Zurich on May 28.

“What we do at GOKONG is essentially that, we bring all these things into one app, and we want to make financial fitness available to everybody. This is the model we stand by and this is the vision we have for everybody here in Switzerland.”

Founded in 2017 and backed by Bank Vontobel, GOKONG is a Swiss fintech startup offering a personal finance management platform that helps users better track their finances with 360° view.

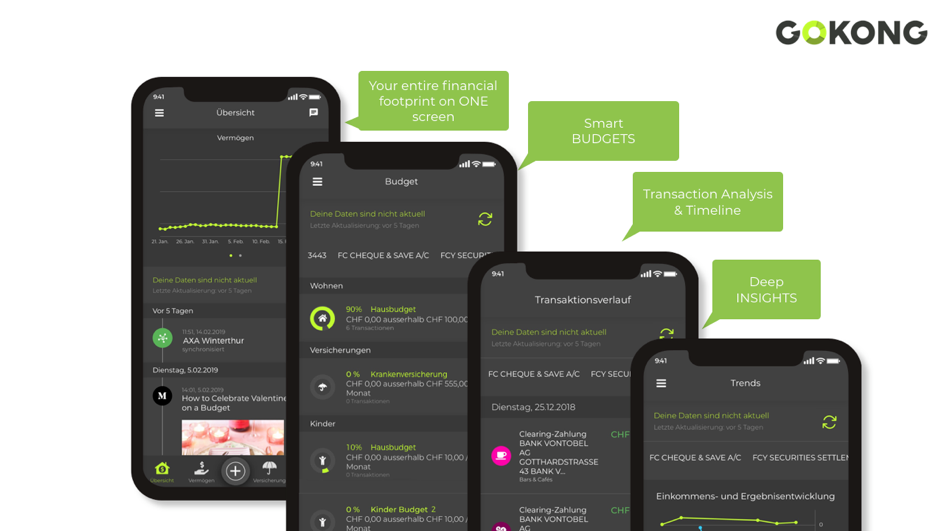

GOKONG platform

The read-only smartphone application aggregates all bank, insurance, credit cards and physical assets data, and stores them in an encrypted vault on a user’s phone. GOKONG not only allows users to monitor their finances on a day-to-day basis, the platform also delivers insights and tailored recommendations based on a user’s financial footprint, income, spending habits, and more.

“We aggregate your financial institutions: Credit Suisse, UBS, Postfinance … What’s interesting and important is that we are institution-agnostic,” Kaushik said. “You can put insurance data, credit card data, non-banking assets: if you have a fancy car, you can take a picture and put it in there.”

Budget Overview: Do you spend more than the average Swiss household?

One particular feature Kaushik highlighted is the budget, which offers recommendations based on spending patterns of households in Switzerland and allows users to compare themselves to others in their community.

“At the press of a button, it tells us a category of transactions or budgets across 50 different categories and that’s based on actual data from Swiss households. There is a lot of machine learning going on there,” he said.

Another interesting feature is the activity feed, a scrollable feed located on the main page of the app which currently displays financial fitness relevant blog posts and notifications.

“In the near future, we will be delivering more customized content, as well as customized suggestions to help you achieve your goals and make you more financially fit,” Jeremy Callner, chief product officer at GOKONG, said in a blog post.

All your data in one secure place

“We’re not here to replace the banks… We’re simply here to put all your data in one place so you can actually get a sense of what’s going on” Kaushik said.

GOKONG is already speaking with a few partners and moving forward, Kaushik said, the startup will be looking to partner up with additional banks, insurances and other financial institutions “in a way that’s very organic.”

Featured image: GOKONG’s CEO Rahul Kaushik speaks at the Finance 2.0 conference in Zurich on May 28, 2019.

The post It is Time to get Your Swiss Personal Financial Fitness Coach appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments