Around the world, central banks are accelerating their work on digital currencies (CBDCs) and exploring the opportunities these could bring to cross-border fund transfers.

CBDCs are now a widely researched new form of digital central bank money that are starting to be issued and piloted in some jurisdictions. Central banks are particularly interested in CBDCs’ potential to contribute to financial inclusion, increase transaction efficiencies, but also improve cross-border payments.

In a paper titled Multi-CBDC arrangements and the future of cross-border payments, the Bank for International Settlements (BIS) looks at three models for so-called multi-CBDC (mCBDC) arrangements for cross-border payments and systems interoperability, highlighting the work the organization has undertaken on the topic.

For the years 2021 and 2022, mCBDC will be one of the main areas of focus for the BIS Innovation Hub, the organization’s innovation arm.

The so-called mCBDC Bridge initiative seeks to explore proofs-of-concept (PoCs) to link wholesale CBDC in different currencies to allow international transfers. It will use distributed ledger technology (DLT) to facilitate real-time cross-border transactions and intends to build a corridor network prototype that would support CBDCs of other central banks.

Built on the experience of Inthanon-LionRock, a project of the Hong Kong Monetary Authority and the Bank of Thailand, it’s currently being undertaken by the team at the BIS Innovation Hub’s Hong Kong center.

With central banks around the world ramping up CBDC efforts, the BIS says the question of interoperability and linkage of national systems is critical.

“Any central bank issuing a CBDC will do so in pursuit of its domestic mandate and public policy objectives,” the paper reads. “Yet as the globalization of economic activity continues, a broader horizon will be needed.”

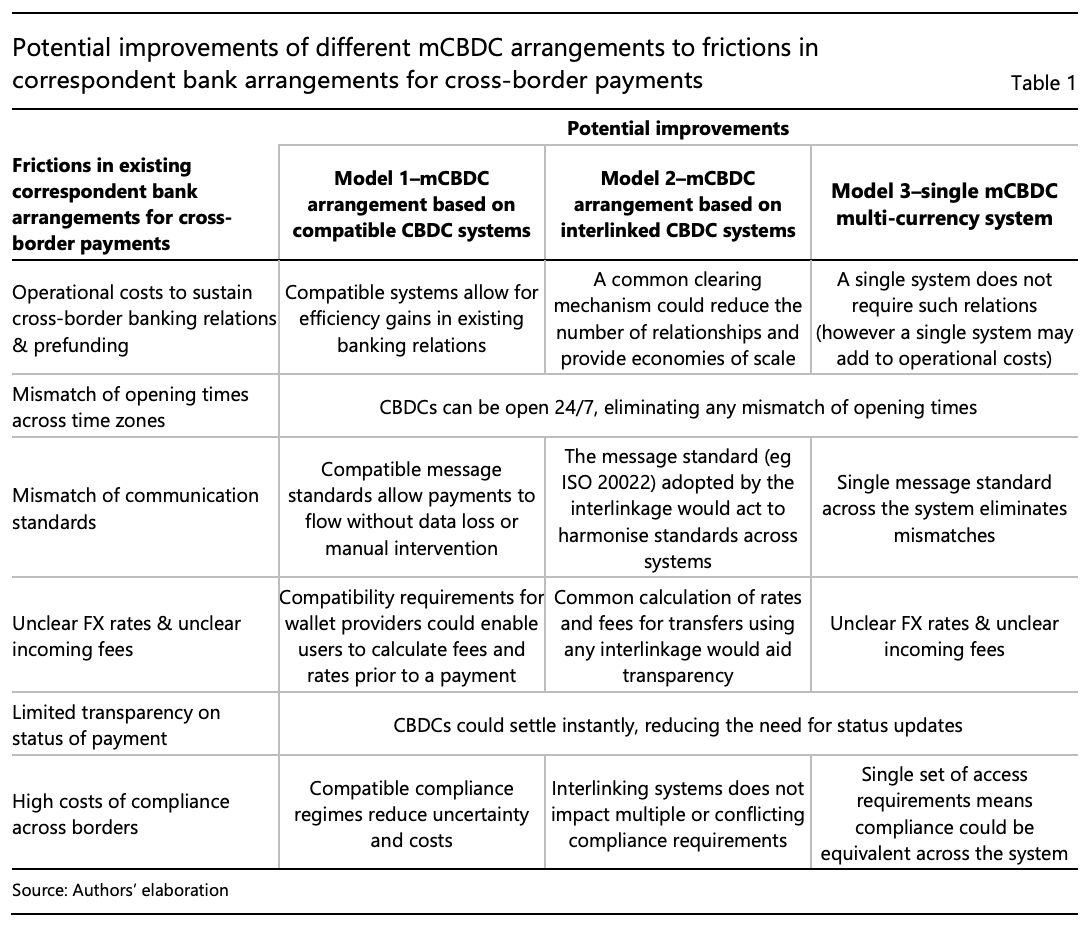

In its latest paper, the organization outlines three main approaches to cross-border CBDCs.

The first model involves making CBDC systems compatible from the get-go. However, setting common technical standards, aligning legal frameworks, and coordinating participants to move to these standards, could take years.

The second model involves linking CBDC systems. This would require the introduction of either a shared technical interface between domestic systems, or a common clearing mechanism.

Finally, the third model involves creating a system for multiple CBDCs. Such system would offer the same improvements as interlinking systems but with additional integration.

Potential improvements of different mCBDC arrangements, Source: Multi-CBDC arrangements and the future of cross-border payments, BIS, Mar 2021

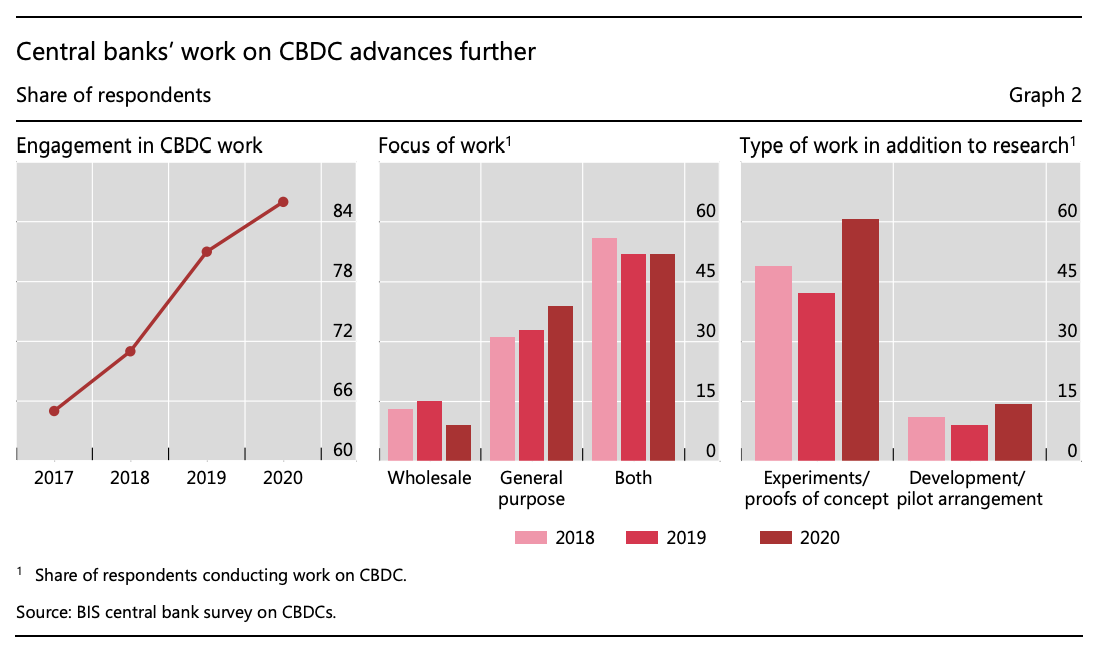

Over the past four years, the share of central banks actively engaging in some form of CBDC work grew by about one third and now stands at 86%, according to BIS’ latest survey of central banks. In particular, work related to retail CBDCs is gaining in relative popularity with central banks either looking at both wholesale and retail CBDCs, or retail CBDC only.

CBDC initiatives are now rapidly moving into more advanced stages of development. About 60% of central banks are conducting experiments or PoCs, while 14% are moving forward to development and pilot arrangements.

To date, the Central Bank of the Bahamas is the only central bank in the world to have issued a CBDC.

Central banks’ work on CBDC advances further, Source: BIS central bank survey on CBDCs, Jan 2021

Last week, China proposed a set of global rules for CBDCs. The new proposals were laid out at a BIS seminar and include rules on how CBDCs should be used around the world, privacy issues such as monitoring and information sharing, and more.

During the seminar, Mu Changchun, the director-general of the People’s Bank of China (PBOC)’s digital currency institute, said that “interoperability should be enabled between CBDC systems of different jurisdictions and exchange,” and that “information flow and fund flows should be synchronized so as to facilitate regulators to monitor the transactions for compliance.”

PBOC is aiming to become the first major central bank to issue a CBDC. In Europe, the European Central Bank (ECB) is also exploring the introduction of a digital euro within the next five years. Concerned about privacy issues, the ECB is looking into the possibility to introduce so-called “anonymity vouchers,” which would allow users to privately transfer a limited amount of digital currency over a defined period of time.

The post Making Central Bank Digital Currency Systems Interoperable for Cross-Border Fund Transfers appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments