At its gala launch event at the Metropole Hotel in Geneva, Metaco, a Swiss leader in the field of distributed ledgers and digital currencies, announced the launch of its new solution, SILO, which allows banks to take safe custody of their clients’ cryptocurrency assets.

At its gala launch event at the Metropole Hotel in Geneva, Metaco, a Swiss leader in the field of distributed ledgers and digital currencies, announced the launch of its new solution, SILO, which allows banks to take safe custody of their clients’ cryptocurrency assets.

Even though cryptocurrencies, such as Bitcoin and Ethereum, have become much more popular over the last 12 months, they remain extremely difficult to store. Individual holders are required to keep safe a private key, which many forget, lose or have stolen, while many cryptocurrency exchanges have gone of business, committed fraud or been hacked. It is estimated that, just for Bitcoin, over 2 million coins have been stolen at least once, representing more than USD22bn at today’s prices.

Metaco, a Swiss company with clients such SIX Group and Postfinance that has been operating in the cryptocurrency market since 2014, aims to solve this issue, which remains one of the last major hurdles for more widespread adoption of cryptocurrencies.

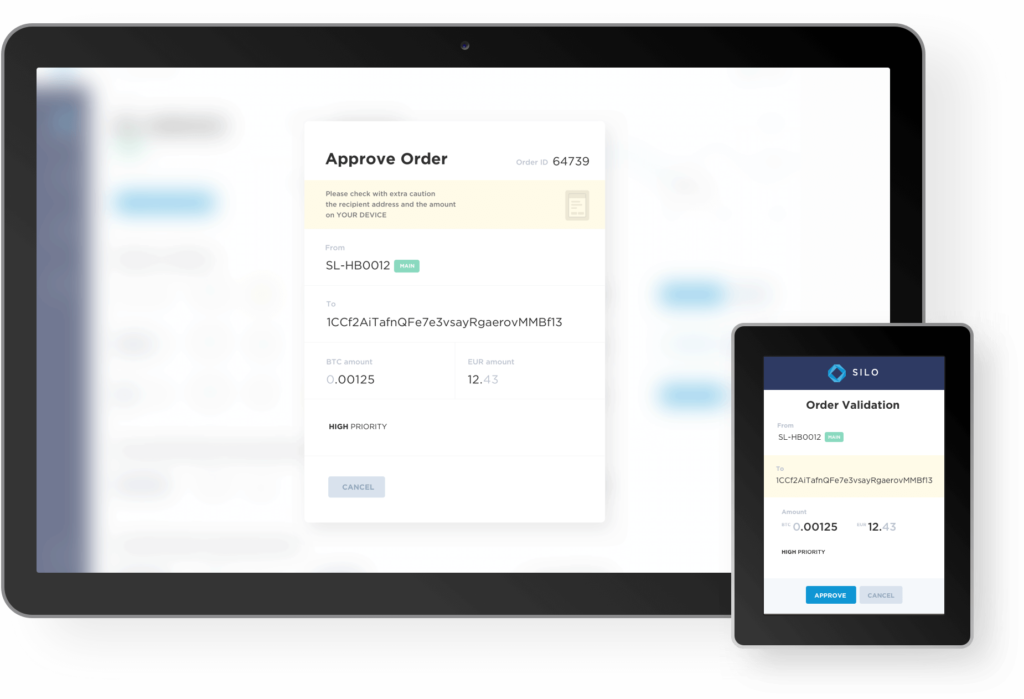

The SILO© solution, launched to an audience of over 80 senior bankers in Geneva last night, brings together cutting-edge software from Metaco with cutting edge hardware from Guardtime, a company which specializes in protecting firms and nation states from cyber attacks.

The patented multi-wallet solution deployed partly on-premise and partly in the cloud is designed to manage multiple accounts with different currencies and includes security protocols such as multi-signature and transaction flow limits. In short, it allows banks to provide clients with the highest-grade protection of their assets while still giving them liquidity to trade and make payments.

Adrien Treccani, CEO of Metaco, commented as follows on the launch,

Adrien Treccani

“There is no question that cryptocurrencies represent the future of money. However, there remains one major flaw, which is likely to get worse now that microprocessor issues have been uncovered: that cryptocurrencies are so difficult to store.

The world abounds with examples of bitcoin millionaires who lost their keys or had them stolen. SILO©, built exclusively for financial firms, solves this problem and allows individuals to trade cryptocurrencies with true peace of mind while extending the role of banks as custodians into the future.”

Ben Robinson, Chief Strategy Officer of Temenos which offers SILO© to its customers through MarketPlace, its app store, said:

Ben Robinson

“Already an important store of value and an important asset class for trading and investing, cryptocurrencies will increasingly act as a means of democratizing asset ownership through tokenization.

Metaco offers the best, most secure platform for banks wanting to provide cryptocurrency services. Our partnership is key to ensuring Temenos’ clients will play a meaningful role in the future of money.”

Mike Gault, CEO of Guardtime, commented:

“Cryptocurrencies are an important new asset class demanding highly specialist, secure technology. By combining our experience and expertise with that of Metaco, together we have developed the most secure cryptocurrency platform on the market.”

Featured image via Pexels

The post Metaco launches SILO – Allowing Banks to take Secure Custody of Crypto Assets appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments