Non-cash payments are increasing in France, driven by the rise in e-money usage and the decline in the use of national payment instruments such as cheques and trade bills, according to the Banque de France.

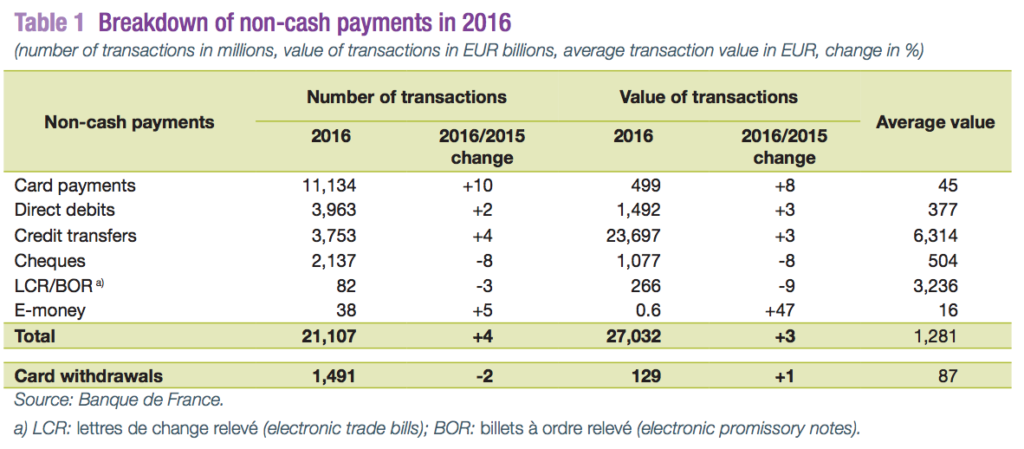

In 2016, the total value of non-cash payments rose by 3% to EUR 27 billion with the most important increase coming from the use of e-money, which increased by 47% between 2015 and 2016, according to statistics from the institution. In particular, it is the rise in peer-to-peer payment service, including mobile payment apps, that’s fuelled the sharp increase in e-money transactions.

Mobile payment services in France

There are currently a number of different cashless payment instruments available in France, used for a wide variety of purposes but the past decade has seen the emergence of new means of payment, spurred by the rapid expansion of Internet and advances in digital technology.

These new services offer a range of innovative functions. They include contactless payment systems, or devices that allow users to make small payments rapidly simply by waving a card or smartphone over a payment terminal, and digital wallets, which work through digital platforms and mobile apps.

Lydia mobile app

Lydia is one of the leading mobile payment services providers in France. Launched in 2013, Lydia’s iPhone and Android apps allow users to pay anyone very easily and make online purchases. Lydia crossed the milestone of one million users at the end of 2017, and claims that more than 2,000 Lydia accounts are created daily. Lydia raised EUR 13 million in a funding round led by CNP Assurances in February, bringing the total amount raised by the startup to more than EUR 23 million.

Lemon Way is another key player in the French digital payments space. The startup provides a white-label B2B platform that offers payment processing, wallet management and third-party payment solutions for businesses involved in crowdfunding, e-commerce, mobile, and more. It claims to be serving about 1,400 marketplaces, including 200 crowdfunding platforms and processed EUR 1.4 billion worth of transactions in 2017.

Lemon Way is working with companies like CNP Assurances, the French National Football League, Yellow Pages (SoLocal Group), and many more. It has partnered with multiple banks including BNP Paribas, Barclays, Crédit Mutuel, and Banco Sabadell. Lemon Way raised EUR 10 million from Breega Capital and SpeedInvest in July to expand across Europe.

Lemon Way merchant dashboard

French startup Leetchi, which operates a crowdfunding platform and the Mangopay payment processing solution, was acquired by French bank Crédit Mutuel Arkéa in 2015. Les Échos reported that Crédit Mutuel Arkéa spent more than EUR 50 million to acquire 86% of the company.

Crédit Mutuel was also involved in several other projects including the Lyf Pay digital wallet. Lyf Pay was launched in May 2017 from the merger of the BNP Paribas-backed Wa! And Crédit Mutuel’s Fivory. The all-in-one mobile payment solution centralizes customers’ paymentscards, coupons and loyalty cards and allows for in-store, online, and peer-to-peer payments.

French multinational telecommunications corporation Orange entered the mobile payments market in 2015 with the launch of Orange Cash, a mobile wallet app. The app allows users with NFC-enabled smartphones to pay at any contactless Visa terminal across the country with just a tap.

Carrefour, a French multinational retailer and one of the largest hypermarket chains in the world, introduced its mobile payment app Carrefour Pay earlier this year. The mobile app will be linked to all bank cards by the end of 2018 and will allow for easy in-store payments at NFC-enabled terminals.

With the launch of its very own payment app, Carrefour is putting into practice its five-year transformation plan, launched in January and which plans to invest EUR 2.8 billion in developing the retail chain’s digital and omnichannel operations.

Meanwhile, the city of Dijon, France, and public transport operator Keolis, launched a new contactless payment system on the city’s trams network in March.

Contactless Payment, Dijon Tram, @WorldlineGlobal, Twitter

The technology has been supplied by Visa, Worldline and Natixis Payment Solutions, with the support of regional development bank Caisse d’Epargne de Bourgogne Franche-Comté. The technology is to be rolled out to the city’s buses later this year or next year.

Featured image: Paris, Pixabay

The post Mobile Payments on the Rise in France appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments