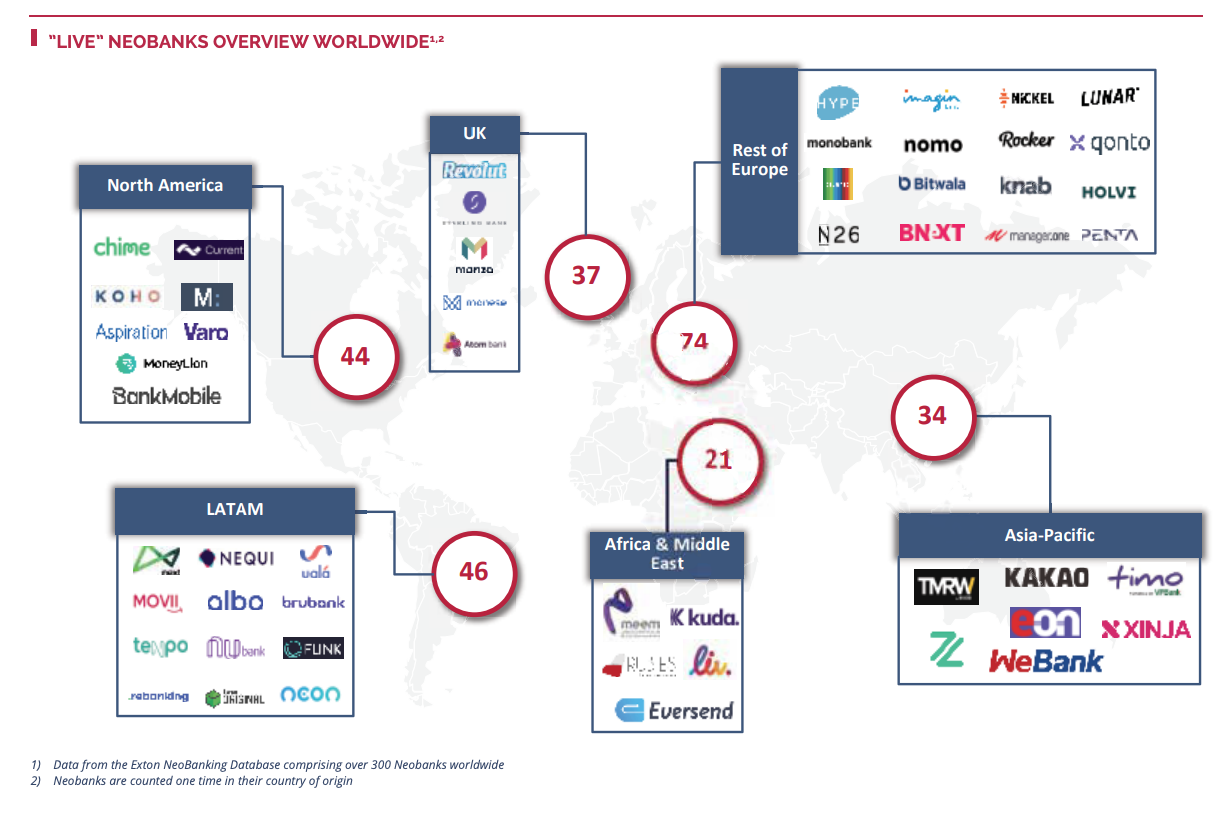

Since 2010, more than 310 neobanks have launched around the world, attracting an estimated 39 million users globally. Out of the 300+ ventures to have ever launched, 256 were live as of late-2020 with nearly half (111) located in Europe, data from European management consulting firm Exton Consulting show.

Inside Financial Services: Neobanks 2021, Exton Consulting, 2020

Neobanks, also known as online banks, virtual banks or digital banks, are a type of direct banks that operate exclusively online without traditional physical branch networks. These fintech-based financial providers are challenging traditional banks by offering services digitally either through their own banking license, or through banking partners.

Europe leads neobanking

In Europe, the UK is home to 37 neobanks, or more than the whole Asia-Pacific (APAC) region (34) or Africa and the Middle East (21), making it a neobanking powerhouse.

Revolut is perhaps the most well-known neobank from the UK. Launched in 2015, Revolut provides bank accounts, money management tools, stock trading and more via a mobile app. Since its inception, the startup has attracted more than 15 million retail customers and has expanded to over 35 countries with India now next in line.

This year, Revolut applied for a UK banking license and has been working on getting a US banking license as well as.

The startup is currently looking to raise a new round of funding that would value the company at between US$10 billion and US$15 billion, Sky News reported last week. The new valuation would make it one of the UK’s top 2 most valuable venture capital (VC)-backed companies, according to data from CB Insights.

In the rest of Europe, 74 neobanks were live in late-2020, making the region the most developed when it comes to digital banking.

N26 is a notable players serving more than seven million customers in 25 markets. N26, which is from Germany, is a mobile bank with its own full European banking license from the Federal Financial Supervisory Authority (BaFin). It provides a free basic current account and a debit card, with available overdraft and investment products and premium accounts for a monthly fee.

N26 operates in various member states of the Single Euro Payments Area (SEPA) and in the US where it provides banking services in partnership with Axos Bank. This year, N26 will be launching N26 Insurance as part of a new API-driven strategy which will seek to allow partners to integrate their products on their own, and facilitate data transfers and transactions between N26 and its partners.

In Finland, Holvi has created one of Europe’s most successful digital banks for freelancers, sole traders and small businesses. Founded in 2011, Holvi provides an online platform for sales, invoicing and cash flow tracking services, as well as traditional banking. Holvi was acquired by Spanish banking giant BBVA in 2016 before being sold to Keru Fintech Investments, an investment firm set up by one of the Finnish fintech’s founders in February 2021. Holvi serves some 200,000 customers.

Bunq, a challenger bank from the Netherlands, was named by the Financial Times as one of the fastest-growing fintechs in Europe with 2019 revenue reaching EUR 8.8 million, rising as a compound annual growth rate of 280%. It’s reportedly nearing unicorn status.

This year, Bunq became the first challenger bank to join the TARGET Instant Payment Settlement (TIPS) network developed by the European Central Bank, giving its users access to instant payments with banks both in its native country but also across Europe.

In France, Qonto is a popular neobank for entrepreneurs and small and medium-sized enterprises (SMEs) serving some 120,000 companies in four markets, namely France, Spain, Germany and Italy.

Neobanks around the world

Europe stands ahead of the other regions when it comes to neobanking innovation but other locations are rapidly catching up.

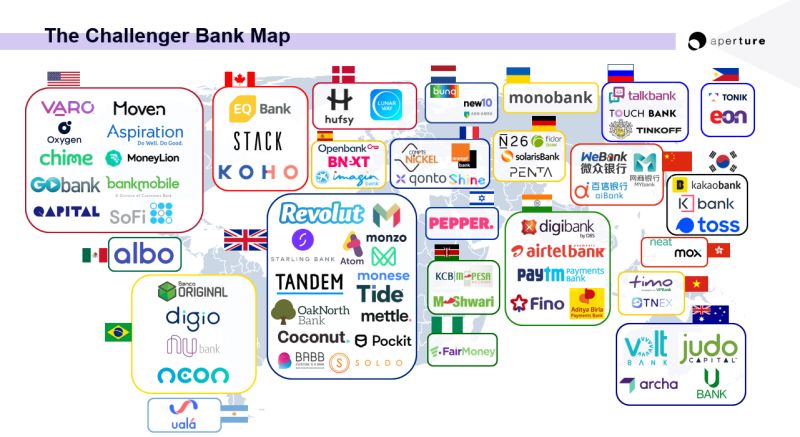

The Challenger Bank Map by Swiss strategy consultancy Aperture, updated last earlier this month, showcases a booming digital banking landscape that has taken over the world.

In Asia Pacific, rule changes are opening up the market to new entrants in jurisdictions like Singapore, Hong Kong, the Philippines and Indonesia.

Singapore and Hong Kong, two leading financial centers in the region, already granted their digital banking licenses. All of Hong Kong’s eight virtual banks are live, while in Singapore, the central bank expects the four digital banks to commence operations by early 2022.

The Philippines approved a new license category for digital banks in November 2020, and, as of February 2021, has received two applications. In Indonesia, guidelines for digital banks are expected to be released by mid-2021.

South America is another region that has witnessed a booming neobanking landscape. Data from Dutch fintech consultancy firm Fincog show that as of January 2021, the region was home to more than 30 live neobanks and digital banks that served over 50 million customers.

Brazil’s neobank Nubank is the largest fintech company and the most valuable venture capital (VC)-backed company in the broader Latin American region, valued at US$25 billion, according to data from CB Insights.

Aperture’s Challenger Bank Map, April 2021:

The post Neobank, Challenger Bank Maps Showcase Boom in Digital Banking appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments