A new partnership between banking consortium Fnality International and software development firm Epam will seek to use blockchain technology to improve efficiency in cross-border trade transactions, enable faster trade settlement and reduce risk, Epam announced in a release on May 27, 2020.

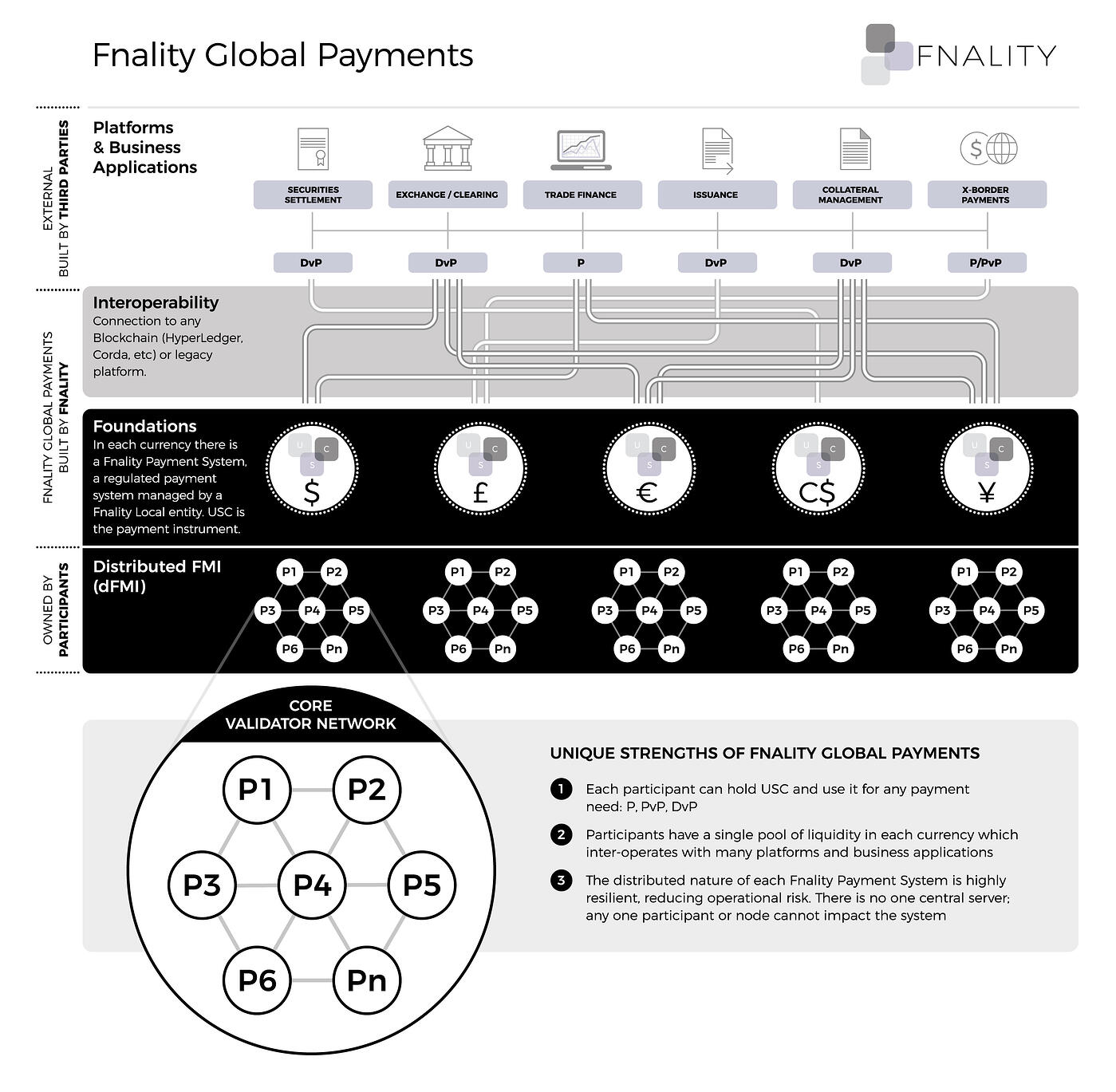

The project aims to leverage blockchain to deliver “payment-on-chain” for wholesale banking. It will focus on building several national peer-to-peer Fnality Payment Systems (FPS) and facilitating these systems’ integration and interoperability within blockchain networks and legacy systems. To this end, Epam will provide Fnality with software development services.

Epam said the goal here is to improve efficiency in trade transactions, especially in cross-border commerce, by using blockchain to make processes instantaneous, peer-to-peer (P2P), and reduce the risk of error.

The company says the FPS systems will settle tokenized value transactions, and the distributed nature of the systems will eliminate negative system impact from individual participants or nodes, resulting thus in faster settlements and reduced systemic, operational and credit risks.

Fnality and Epam hope to demonstrate the successful operation of the first use case of the FPS system in 2021, after which more currencies will be added, in addition to legal entities from shareholders, participants and business applications.

Fnality Global Payments

Fnality’s national FPS payment systems will each be regulated in their home jurisdiction. These systems will be key components within the consortium’s grander Fnality Global Payments (FGP), an upcoming P2P payment system to settle tokenized transactions.

In each FPS payment system, a Fnality settlement asset will act as the settlement/payment asset for any Payment (P), Delivery v, Payment (DvP) or payment vs. payment (PvP) need.

Initially, FGP will focus on supporting five key currencies, USD, EUR, CAD, GBP and JPY, with balances fully pre-funded with fiat currency transfers. The settlement asset will be 100% back by fiat collateral held with a central bank.

Fnality Global Payments infographic, Source: Fnality.org

Fnality, which boasts 15 major institutions as shareholders including Barclays, Commerzbank, Credit Suisse and UBS, has set out to build a regulated payment system for wholesale banking to support the growing industry adoption of tokenized assets and marketplaces.

Over the past year, the consortium has established several new partnerships, which, besides Epam, include Adhara, Broadridge, and assurance partner EY. The organization is also working with central banks to “ensure that the current toolsets and policies support and allow what is needed,” according to a blog update.

Fnality celebrated its first birthday in June. The founding members of the organization reportedly invested around US$50 million at the start of the project.

The post New Blockchain-Based Payment Systems Seek to Improve Cross-Border Trade Transactions appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments