Central banks around the world are exploring the potential of digital currencies to improve monetary transactions. While so-called central bank digital currencies (CBDCs) appear to be upon us, promising many benefits including faster and cheaper transfers, they also present multiple challenges to consumers and financial institutions, according to a new report by Deutsche Bank.

In the latest Deutsche Bank Wealth Management CIO report, titled Central bank digital currencies: Money reinvented, the bank delves into the state of CBDC developments around the world, pointing out the opportunities and challenges that these may bring.

According to the paper, CBDCs could change the world we live in significantly, improving the speed and ease of monetary transactions between individuals, but also between governments and individuals.

More effective monetary policy and increased traceability

For central banks, the launch of a whole new digital currency system would change monetary policy and traditional financial system, opening up a large range of new possibilities.

Central banks could use CBDCs to ameliorate specific problems around low or negative interest rates, as well as stimulate growth. A CBDC would give policy-makers more options to combat undesirably high savings rates, by, for example, allowing them to set individual allowance limits.

In the case of an account-based CBDC where individual accounts are held at the central bank, money could be transferred directly from the central bank to individuals instead of relying on the transmission via banks.

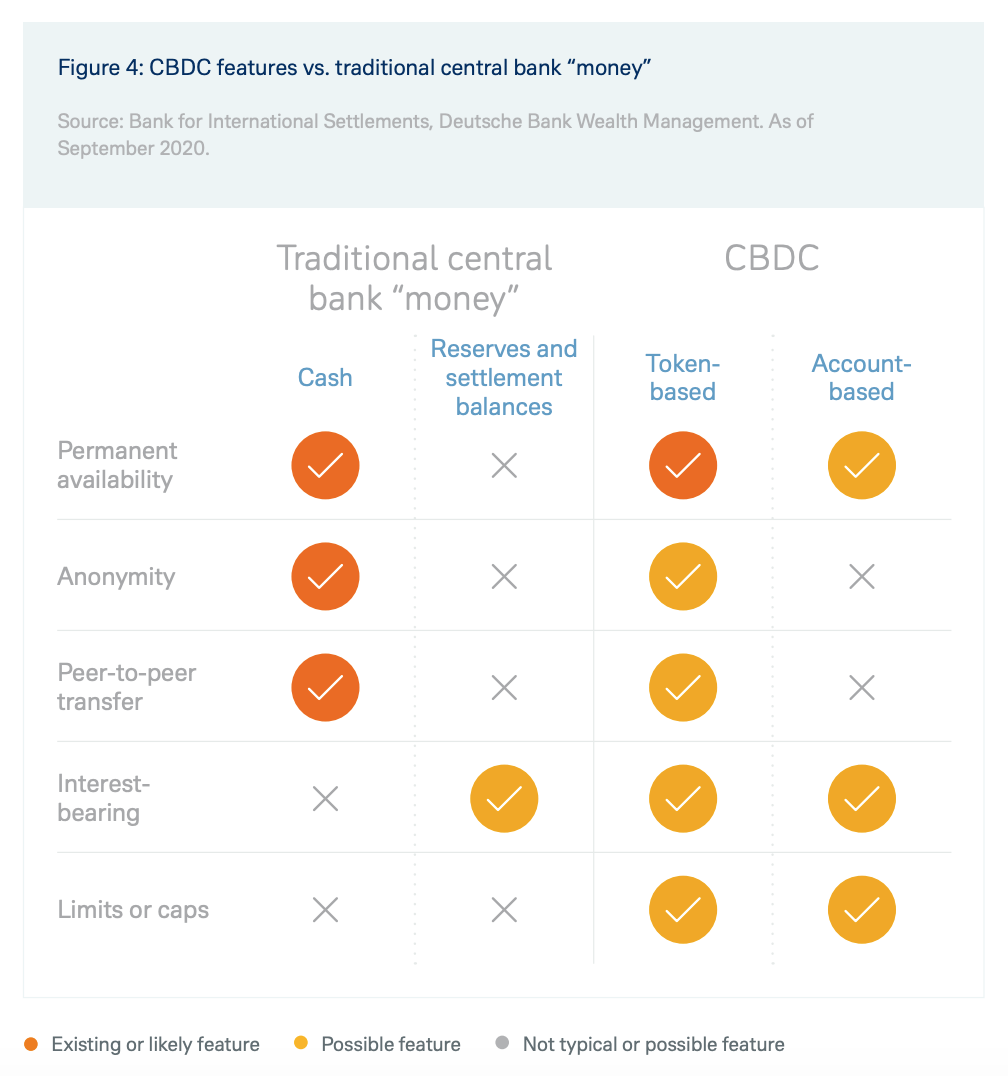

Image: CBDC features vs. traditional central bank “money”, Source: Bank for International Settlements, Deutsche Bank Wealth Management, as of September 2020

Ultimately, this would mean that the role of banks as a gatherer of private savings would change dramatically, and they would need to offer higher interest rates than the central bank in order to attract savings, the paper says.

For governments, one major advantage of CBDCs is that they could make it much easier to enhance capital movement controls. In particular, centrally-organized digital currencies would make it possible for regulatory authorities and commercial institutions to see and trace every transaction, making it thus easier to crackdown on money laundering and tax evasion. CBDCs could also allow governments to better manage social benefit transfers.

CBDCs for individuals and privacy concerns

For individuals, CBDCs could bring many changes and benefits including lower cost and real-time transactions. Counterparty-party risk could also be eliminated.

But because CBDCs would make possible for governments to trace every money flow, they also come with serious privacy implications that could make consumers refractory to adopt them. Therefore, implementation of CBDCs could very well encounter political unrest and, possibly, encourage social unrest, the paper warns.

Other challenges posed by CBDCs include scalability, regulation, as well as their possible implications for the global economy and international relations.

CBDCs development around the world

Over the past 5 years, central bankers’ views on CBDC have evolved to become more accepting of collaborative innovation. Now, several countries around the world are exploring the possibility of launching their own CBDC, with many of them having already completed or in the process of initiating advanced stage pilots.

China’s Digital Currency Electronic Payment (DC/EP) is arguably the most developed experiment of a CBDC in an advanced economy. The People’s Bank of China (PBOC) started testing DC/EP in December 2019, and though there is still no official launch date, the PBOC’s governor has said that DC/EP may be piloted at the 2022 Beijing Winter Olympics.

Other early pioneers around the world include Sweden (e-Krona), Uruguay (e-Peso) and Ukraine (e-Hyrvnia). The e-Krona project was initiated in Q1 2017 and is currently being tested for payment, deposit, and transfer capabilities. Uruguay’s e-Peso pilot ran from September 2017 to April 2018 and tested the issuance and distribution of digital banknotes for use in peer-to-peer (P2P), business-to-business (B2B), and business-to-customer (B2C) payment use cases. And in Ukraine, the central bank successfully tested an electronic form of its hryvnia currency, the e-Hryvnia, in 2018.

Meanwhile, other jurisdictions have pursued the potential of wholesale CBDCs. Unlike retail CBDCs which are available for the general public, wholesale CBDCs are restricted to serve a limited circle, mostly financial institutions.

Such projects include for example Project Stella, a joint research project conducted by the European Central Bank (EBC) and Bank of Japan to explore the opportunity for distributed ledger technology (DLT) to improve financial market infrastructure, Project Ubin, a collaborative project across the Monetary Authority of Singapore (MAS), the Association of Banks in Singapore (ABS), and several international financial institutions to explore the use of DLT for clearing and settlement use cases, and Project Inthanon/LionRock, a joint initiative launched by the Hong Kong Monetary Authority and the Bank of Thailand to explore wholesale CBDC use for cross-border payments.

The post New Deutsche Bank Paper Outlines Opportunities and Challenges of CBDCs appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments