In a new report released on April 16, the World Economic Forum explores the potential of wholesale central bank digital currencies (wCBDCs) to address challenges in financial markets, improve settlement efficiency and tap into new market opportunities.

The report, titled Modernizing Financial Markets with Wholesale Central Bank Digital Currency (wCBDC) and produced in collaboration with Accenture, outlines key areas wCBDCs can provide unique value, highlighting their potential to establish a “global settlement window” to synchronize different settlement times. It also discusses how wCBDCs could improve data sharing to reduce operational risks and settlement failures, broaden payment-versus-payment (PvP) arrangements to address foreign exchange (FX) risk, and enable central bank money to settle transactions involving tokenized securities.

Boosting settlement efficiency

The first opportunity involves addressing the challenges stemming from disparate settlement cycles across regions and the lack of a global settlement window – challenges that are increasing settlement, counterparty and technology risks.

Real-time gross settlement (RTGS) system operating hours on working days for CPMI (Committee on Payments and Market Infrastructures) jurisdictions, Source: Modernizing Financial Markets with Wholesale Central Bank Digital Currency (wCBDC), World Economic Forum/Accenture, Apr 2024

Efforts to move towards shorter settlement cycles, such as transitioning from T+2 to T+1, are underway and aim to increase liquidity availability, reduce counterparty risk, and lower market and liquidity risk. There is also anticipation for T+0 settlement to become an industry standard in the future.

Implementing a global settlement window using wCBDCs could ensure settlement finality round the clock, the report says, providing advantages like mitigating liquidity and credit risk, optimizing settlement window accessibility, and streamlining multi-asset transactions across different regions.

Addressing operational risks

The second opportunity outlined relates to addressing operational risk and reducing settlement failures in securities markets that stem from data quality issues, limited interoperability, and manual processes.

Settlement failures and delays are increasingly common due to factors such as market volatility, liquidity constraints, and legacy systems. Data from the Swift network covering cross-border settlement and reconciliation flows, show that about one out of every ten securities transactions requires correcting or ends up failing. These incidents are increasing, with a 9% growth in cancelled instruction rate and a 16% increase in late settlements between 2020 and 2022.

To address these issues, the report proposes mutualizing data sharing using wCBDCs. In this application, wCBDCs could address information asymmetry issues by providing a trusted platform for data sharing among market participants, potentially accelerating the settlement cycle and reducing manual reconciliation efforts. Distributed ledger technology (DLT) is highlighted as a promising tool for enhancing trade and post-trade activities and improving transparency.

Reducing FX settlement risks

The third opportunity relates to addressing foreign exchange (FX) settlement risk stemming from limited accessibility and affordability of PvP arrangements globally.

Expanding PvP arrangements using wCBDCs could optimize FX markets by facilitating affordable and accessible multilateral PvP arrangement mechanisms, supporting flexible currency conversion arrangements for emerging market currencies, and expanding access to non-domestic and non-bank institutions to trade currencies.

Projects like mBridge demonstrate how wCBDCs can increase accessibility to PvP arrangements by facilitating direct bilateral connectivity between banks, supporting local currencies, and reducing settlement risk.

Tapping into the tokenized asset opportunity

Finally, the fourth opportunity outlined in the report relates to the increasing tokenization of assets and the need for corresponding tokenized cash to support settlement processes.

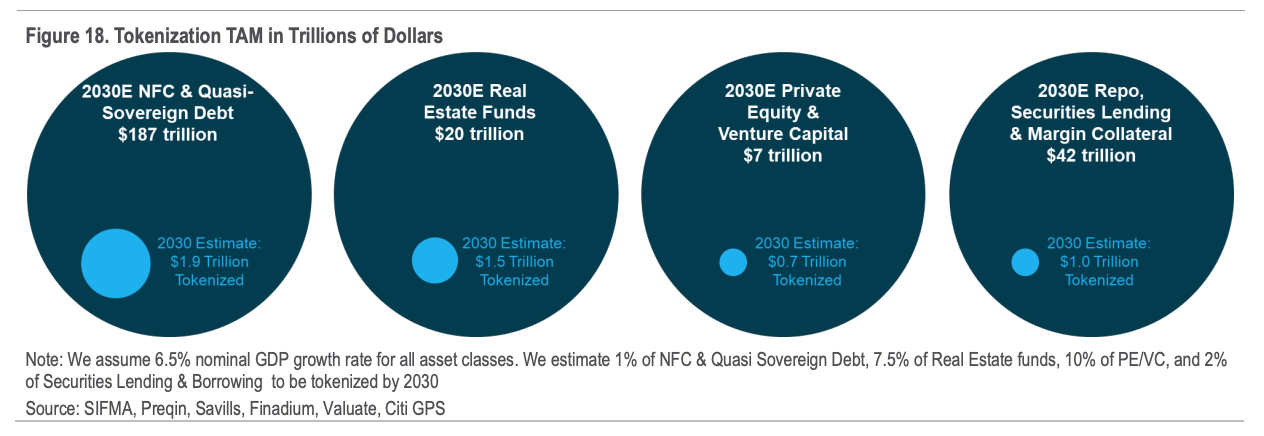

Tokenization of assets involves creating digital tokens representing various assets like real estate, equities, and cash. This process is seen as a key use case for blockchain, promising improved accessibility to financial services through fractionalization. Citi estimates point towards US$4-5 trillion in tokenized securities on DLT by 2030.

Tokenization total addressable market in trillions of US dollars, Source: Citi, March 2023

The report highlights examples of rising tokenized asset adoption, particularly in the bond market, with projects like Project Genesis and Project Evergreen in Hong Kong demonstrating the feasibility of using blockchain and smart contracts for tracking and settling securities tokens. Money market funds are also seeing growth in tokenization, with Franklin Templeton’s tokenized MMF surpassing US$270 million in assets under management in April 2023.

The report says that in the case of asset tokenization, wCBDCs could allow for the settlement of financial transactions using base money, eliminating counterparty risk, improving financial stability and reducing costs for market players who rely on privately issued monies.

Challenges remain

Central banks around the world are actively exploring the potential benefits of CBDCs, investigating their merits to improve process efficiencies, reduce risks and facilitate trade. Data from the Atlantic Council show that a staggering 130 countries were exploring a CBDC in November 2023, representing 98% of the world’s gross domestic product.

But despite their potential advantages, industry stakeholders are also warning of the pitfalls of CBDCs. A 2023 paper by Patrick Schueffel, adjunct professor at the Institute of Finance of Fribourg’s School of Management, outlines several drawbacks of CBDCs, including concerns about privacy infringement due to increased government surveillance of financial transactions, potential restrictions on spending and transactions imposed by authorities, and the risk of freezing or blocking accounts of individuals or organizations engaged in suspicious activities.

The report also stresses that CBDCs are vulnerable to cybersecurity attacks, account and data breaches, and theft. A successful hack could result in electronic counterfeiting of money, the theft of funds, or even to a disruption of the financial system, the report says.

Featured image credit: Edited from freepik

Comments