Wealth management has now reached a point where a mind shift has become essential, as the gap between profitability and market share has widened to unsustainable levels, said Deloitte.

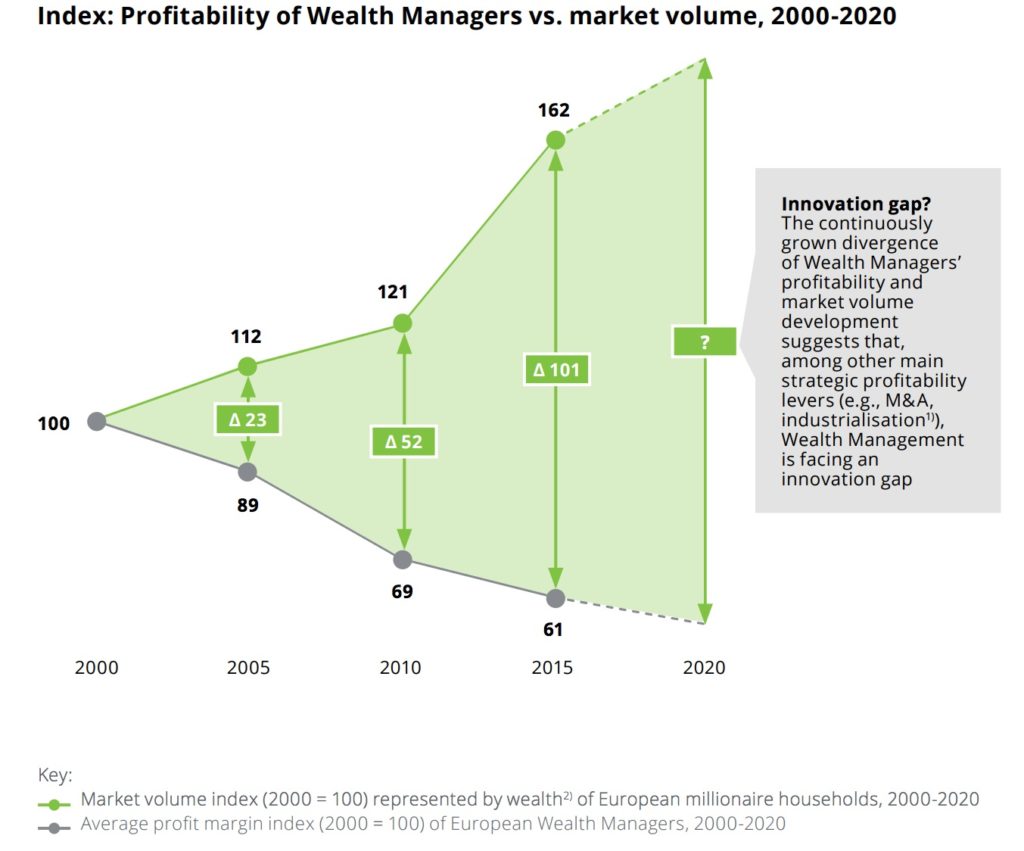

In its report Innovation in Private Banking and Wealth Management: Embracing the Business Model Change, it noted that he profitability of European Wealth Managers has been in constant decline in recent years, with profit margins falling by 40 percent between 2000 and 2015.

It pointed out that in 2015, the indices for market volume and wealth managers’ profitability have diverged by more than 100 percentage points from their individual levels of 2000 indicating that a low point for wealth management had been reached.

This calls for a dramatic shift in business strategy for the wealth management and private banking businesses. “Wealth managers are failing more and more to serve clients successfully with their existing business models of an integration value chain,” said the report.

During the same period, the market size for private banking measured by the bankable assets of European millionaire households has grown by more than 60 percent, noted Deloitte.

This increasing gap between profitability and market size shows that wealth managers are failing more and more to serve clients successfully with their existing business models of an integrated value chain. This suggests that the industry is facing an innovation gap, since industrialisation and M&A – the other two main strategic growth levers – have already been employed for years.

More adoption of innovation needed.

More adoption of innovation needed.

Innovations can be found today in the wealth management industry. Deloitte found that an increasing number of FinTechs active in wealth management, at a 300 percent increase in in the past three years is disrupting traditional industry structures. It also found that millennials will form 50 percent of the global workforce by 2020, creating demographic change.

Deloitte noted that most innovations are a response to existing business challenges, and far fewer exploit opportunities to create value in a new way. Wealth managers are mainly digitising their traditional business model to reduce their cost base; and FinTechs are either offering digital solutions to support wealth managers or are providing digital offerings to compete for digitally-aware private clients.

Deloitte concluded that the innovation efforts of wealth managers are therefore concerned mainly with industrialisation efforts. Fintechs, on the other hand, are focusing on disruption.

“Neither are focusing on innovation to embrace a change of the wealth management business model,”

it said.

What kind of innovation will change wealth management for good?

Currently, innovation efforts in wealth management concentrate mainly on digitising processes and structures in the existing business model.

Instead, wealth managers could exploit innovation opportunities in a more transformational way by re-designing instead of reorganising their infrastructure (e.g., through Cloud Computing, Open APIs, Orchestrating), deepening their understanding of client needs (e.g., through Social Listening, Instant Client Feedback), identifying new sources of revenue (e.g., supplementary Client Care Services, Digital Security Services) and refreshing their brand (e.g., through Sub-branding, Ingredient Branding).

Deloitte urges wealth managers to be open to the new realities of today’s world and the future, by monitoring trends and their implications, and recognising the urgency and importance of innovation.

This requires leadership to be onboard. It further noted that innovations should be managed as a portfolio, supported by and rewarding the appropriate talent according to their contributions.

The post Private Banking and Wealth Management are still stuck in the past appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments