Earlier this month, Sam Bankman-Fried, the founder of defunct cryptocurrency exchange FTX, was found guilty for his role in the collapse of the company. The disgraced founder, who once ran one of the world’s biggest crypto exchanges, is now facing a maximum sentence of 115 years in prison.

A New York jury found Bankman-Fried guilty on all seven charges against him, convicting Bankman-Fried of wire fraud and conspiracy to commit wire fraud against FTX customers and against lenders of its sister hedge fund Alameda Research.

The verdict, delivered on November 02, concludes a stunning fall from grace for the former billionaire, once known as the “crypto king”.

Bankman-Fried was arrested in December 2022 after his crypto exchange FTX went belly up. The spectacular collapse was caused by a spike in customer withdrawals that exposed a US$8 billion hole in the crypto exchange’s accounts.

Prior to its collapse, FTX was among the world’s biggest crypto exchanges by volume and had over one million users. The company, which was at one point valued at a breathtaking US$32 billion, was also incredibly successful in fundraising, having managed to secure about US$1.8 billion from blue-chip investors including Sequoia, Tiger Global, Softbank and Lightspeed Venture Partners.

Several analyses of FTX’s infamous 2021 pitch deck have been formulated and released. These analyses take a close look at the document that was presumably used to raise FTX’s staggering US$1 billion Series B of that same year, highlighting that despite the startup’s subsequent challenges, the company achieved what only a few had.

The reports all argue that the pitch deck’s unique elements, including its clear vision, numerical traction and distinctive approach to competition, contributed to FTX’s ability to attract funding from prestigious investors. The document offers up-and-coming entrepreneurs with valuable insights into successful fundraising strategies.

FTX’s 2021 pitch deck analysis

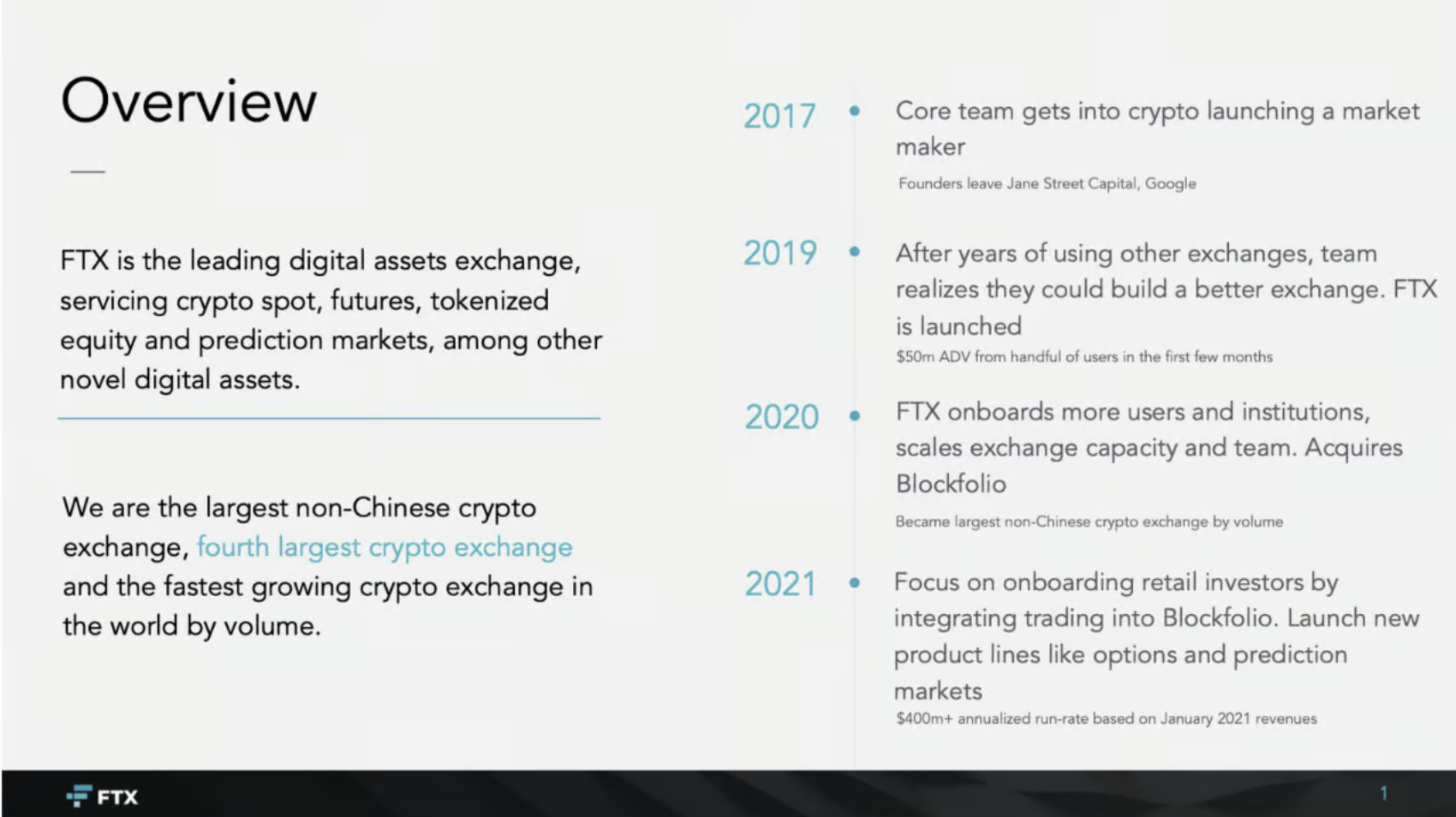

Looking at each key slide, the analyses note that the presentation starts with an “overview” slide which highlights FTX’s vision and notable accomplishments, including being the “fourth-largest crypto exchange” and the “fastest-growing crypto exchange in the world by volume”. It also provides a minimalist timeline showcasing the company’s impressive growth story.

Overview slide, Source: FTX Series B pitch deck

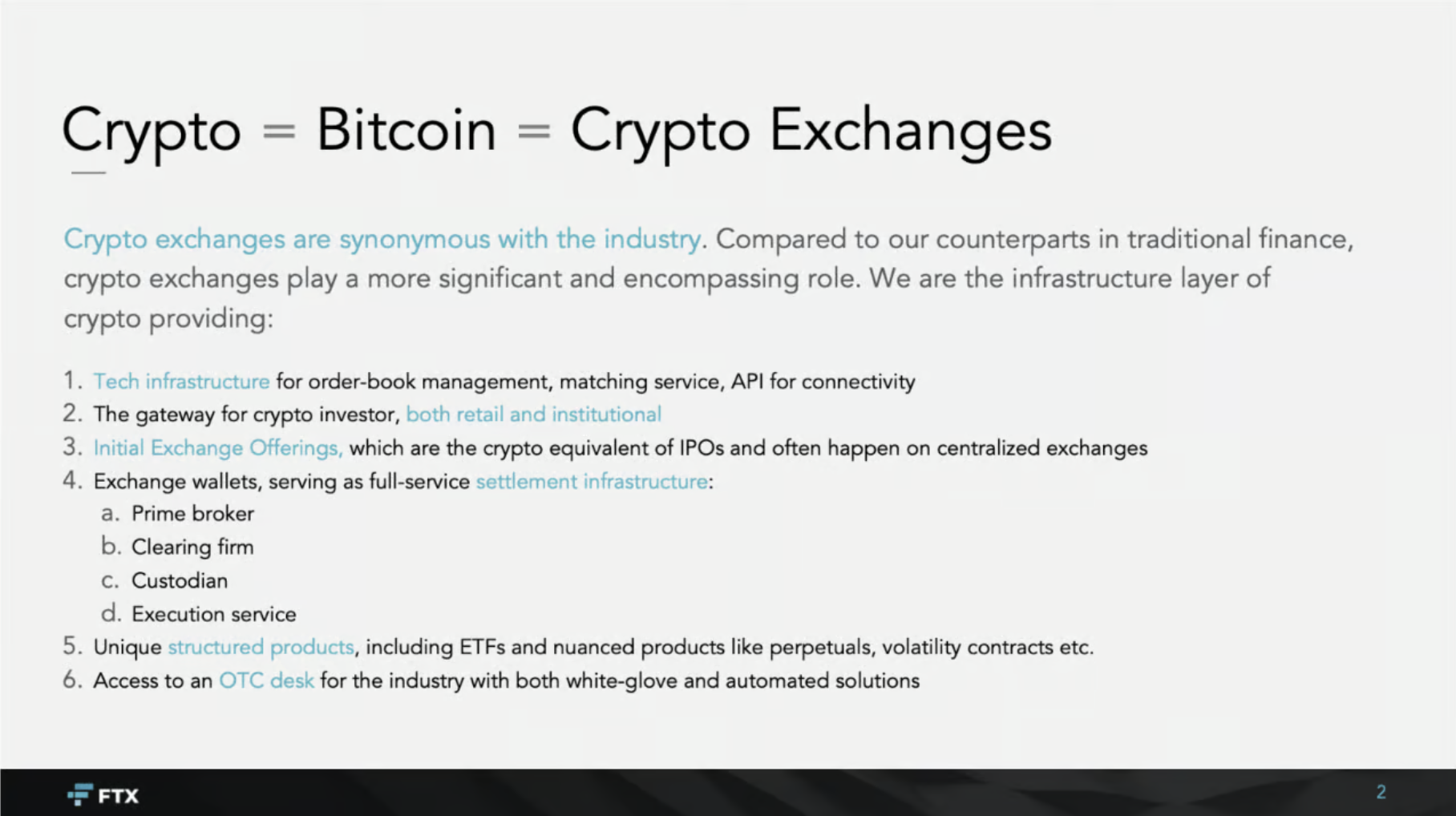

The “overview” slide is followed by a slide presenting FTX’s growth potential and which emphasizes how crypto exchanges can become bigger than their counterparts in traditional finance.

Potential slide, Source: FTX Series B pitch deck

The following slides showcase key numerical milestones and metrics that demonstrate FTX’s success to-date. They include multiple slides emphasizing the growth in trading volume, claiming a 72.5x increase between the start of 2020 and May 2021, as well as 2019’s numbers to offer further reference for the startup’s growth trajectory.

Traction slide, Source: FTX Series B pitch deck

Traction slide 2, Source: FTX Series B pitch deck

The slides also include a comparison with rivals, which, unlike traditional growth and competition slides, emphasize quantitative growth rather than qualitative comparisons. These slides focus solely on how FTX outpaces the growth of its competitors, demonstrating how it grew faster than virtually any other exchange, including Binance, Coinbase and Kraken. These slides maintain a clean and minimalist design to highlight the numerical data, the reports highlight.

FTX growth compared to competitors, Source: FTX Series B pitch deck

The growth and competition slides are followed by a presentation of FTX’s product offering, which, at the time, included futures, spot, leveraged tokens, over the counter (OTC) trading, spot margin trading and peer-to-peer lending, and tokenized stocks.

FTX’s product offering, Source: FTX Series B pitch deck

The following slides then present FTX’s growth strategy, sharing the new products in the pipeline. They also highlight how the startup is able to work with regulators to ensure compliance and present the members of the top management team.

FTX new products and growth strategy, Source: FTX Series B pitch deck

FTX team members, Source: FTX Series B pitch deck

Finally, the closing slide concludes the growth story by showing FTX’s end goal. This slide is unique as it takes an emotional angle, stating that FTX’s goal is to “leave the world a better place than we inherited it,” and noting that “1% of all net revenues are donated to the world’s effective charities.”

Closing slide, Source: FTX Series B pitch deck

The crypto industry has had a tough two-year period, with market capitalization plummeting from an all-time high of US$3 trillion in November 2021 to as low as US$800 billion in December 2022.

2022 was a particularly challenging year that was marked by a series of industry meltdowns that sent bitcoin crashing to its lowest price since 2020. Besides FTX, crypto companies that failed last year include Terraform Labs, Celsius Network, Voyager Digital and Three Arrows Capital.

But over the past couple of weeks, the market has started to bounce back, with bitcoin rising by about 37% over the past month, growing from US$27K in mid-October to now US$37K. The ongoing rally is being spurred by the prospect of new spot crypto exchange-traded funds.

Comments