Industry trade group Swiss Fintech Innovations (SFTI) released on April 16 a new position paper, presenting its vision of “Open Pension”, a concept that’s intended to address longstanding concerns regarding pension provision in Switzerland by enhancing transparency and enabling data sharing.

The “Open Pension” concept would leverage modern technologies to upgrade the Swiss pension system, centering on empowering individuals to receive and share pension information with trusted third parties in a secure and standardized way, and improve efficiencies.

Drawing insights from European practices, particularly pension tracking systems (PTS), the paper advocates for digital access to pension data across all three pillars of the Swiss pension system. It notes that in many European countries, PTS are already actively used to enhance transparency, flexibility and control over pension investments.

A PTS is a system that provides an overview of individualized, objective and impartial information by accessing and aggregating pension data from all three pillars of pension provision. This encompasses accrued entitlements and projected retirement income from various sources, presented in a user-friendly manner through a front-end interface, commonly known as a pension dashboard.

In 2021, more than half of the countries in the European Economic Area (EEA) and the European Free Trade Association (EFTA) already provided a PTS to their citizens that covered all or at least some of the countries’ pension pillars, the report says. Data suggest that there is significant active usage of PTS, with rates in the 30 to 40% of the working population.

Top strategic implementation options

The paper emphasizes the importance of a comprehensive and open PTS in addressing the challenges faced by Swiss retirees, with a focus on the second pillar due to its critical role in pension provision.

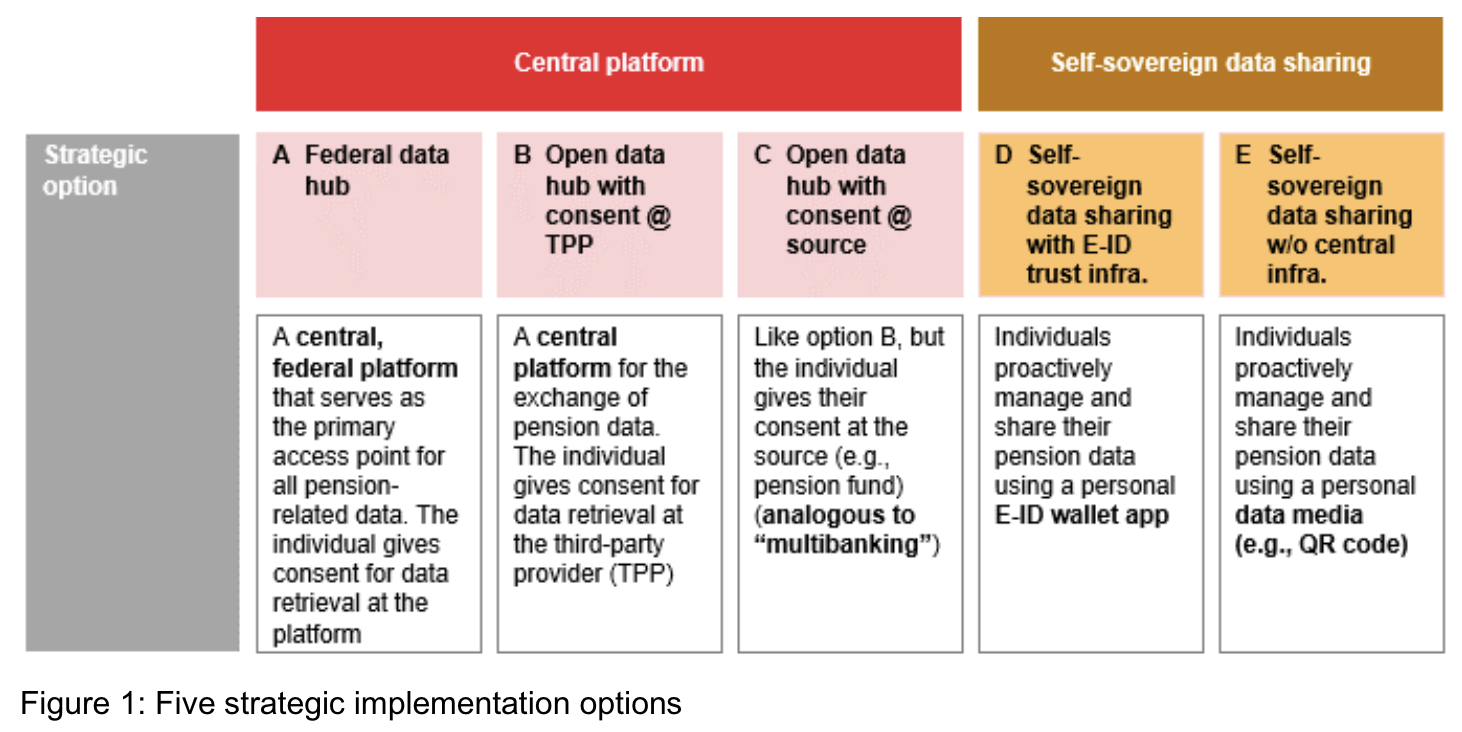

The report identifies five strategic implementation options for opening the second pillar which are categorized in two clusters: centralized platforms facilitating data exchange, and self-sovereign data sharing.

Five strategic implementation options, Source: Open Pension, Swiss Fintech Innovations, Apr 2024

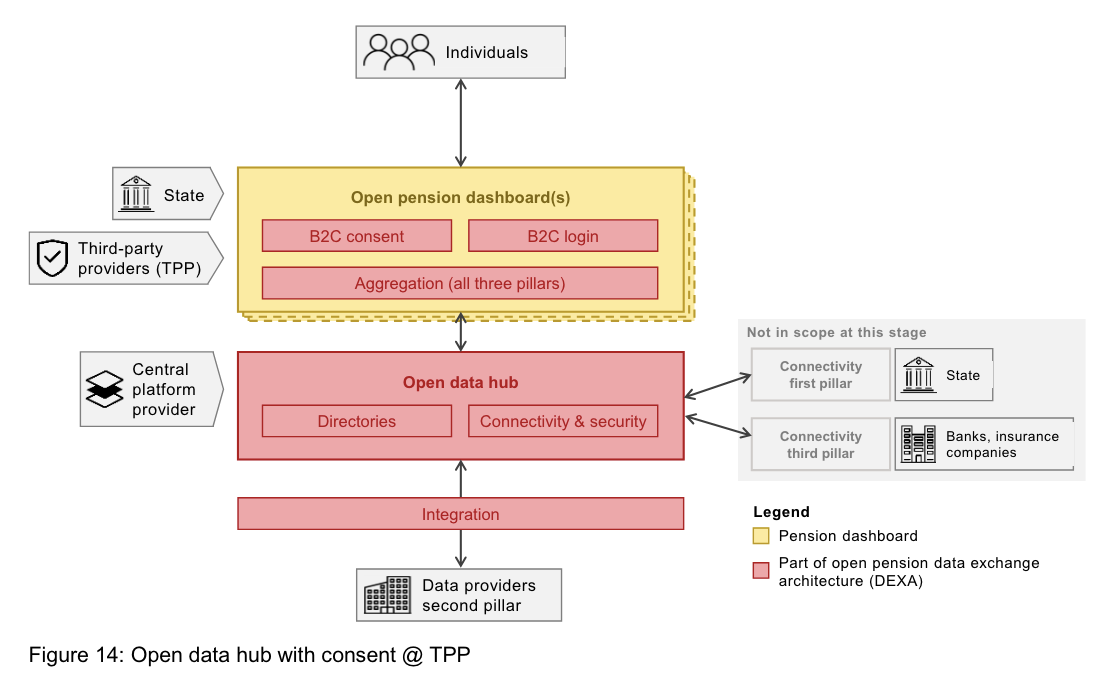

Two of these five options are highlighted as the SFTI’s favored options. Option B, the “open data hub with consent @ TPP”, presents a centralized open platform that facilitates the secure exchange of pension data among organizations. In this option, consent for data sharing is given at the level of trusted third parties (TPPs), where individuals authorize the sharing of their data directly with these TPPs.

According to the SFTI, Open B is a very balanced option and promises a high usability and adoption potential. However, there are relevant risks, particularly with regard to privacy protection and legal aspects. In addition, there is a need to find a legally and technically feasible way to match users across platform participants and sectors.

Option B: Open data hub with consent @ TPP, Source: Open Pension, Swiss Fintech Innovations, Apr 2024

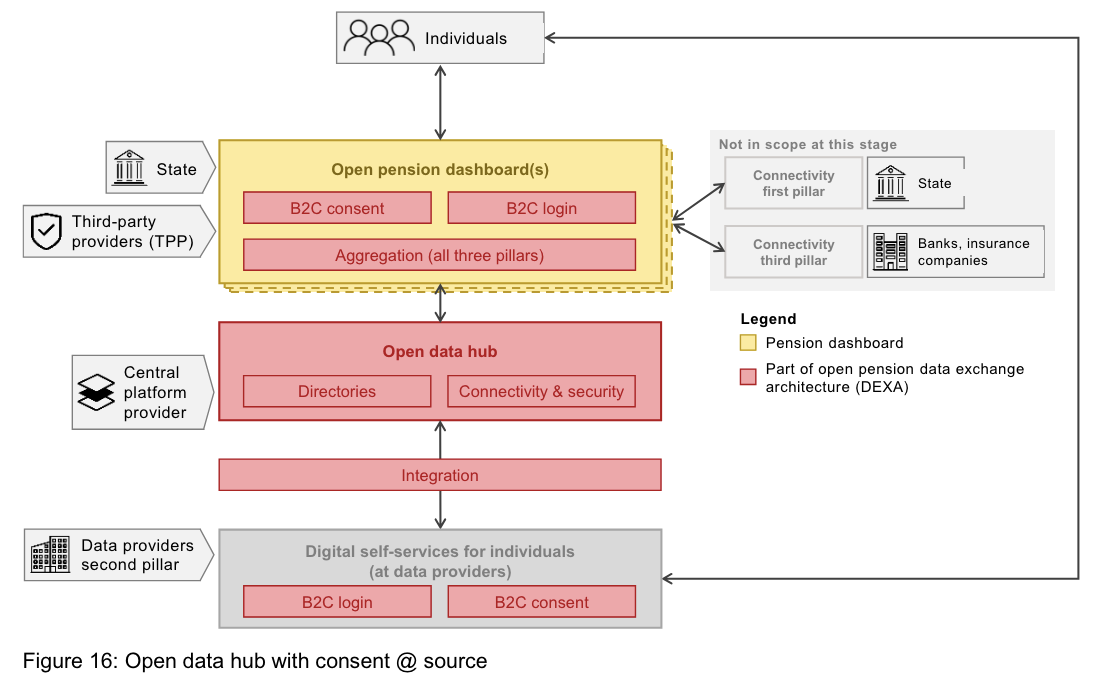

Like Option B, Option C, the “open data hub with consent @ source”, presents a centralized platform for the secure exchange of pension data among organizations. However, it stands out by implementing consent management at the level of data providers like pension funds. Individuals access a pension dashboard at a TPP and the TPP then directs them to the data provider’s client portal. There, individuals log in and authorize the sharing of their data with the specific TPP.

Option C builds on proven methods from open banking and multibanking. Compared to B, the strengths of option C lie in the direct control of data access by the individual. However, this model also imposes a fragmented stakeholder landscape and more complex implementation requirements, introducing considerable challenges and probably higher costs for the pension providers.

Option C: Open data hub with consent @ source, Source: Open Pension, Swiss Fintech Innovations, Apr 2024

A clear mandate needed

The SFTI argues that a clear federal mandate from federal authorities is essential for advancing the “Open Pension” vision and opening the second pillar’s interfaces. This assertion is backed by evidence from the SFTI’s Open Pension survey and insights from several SFTI working groups.

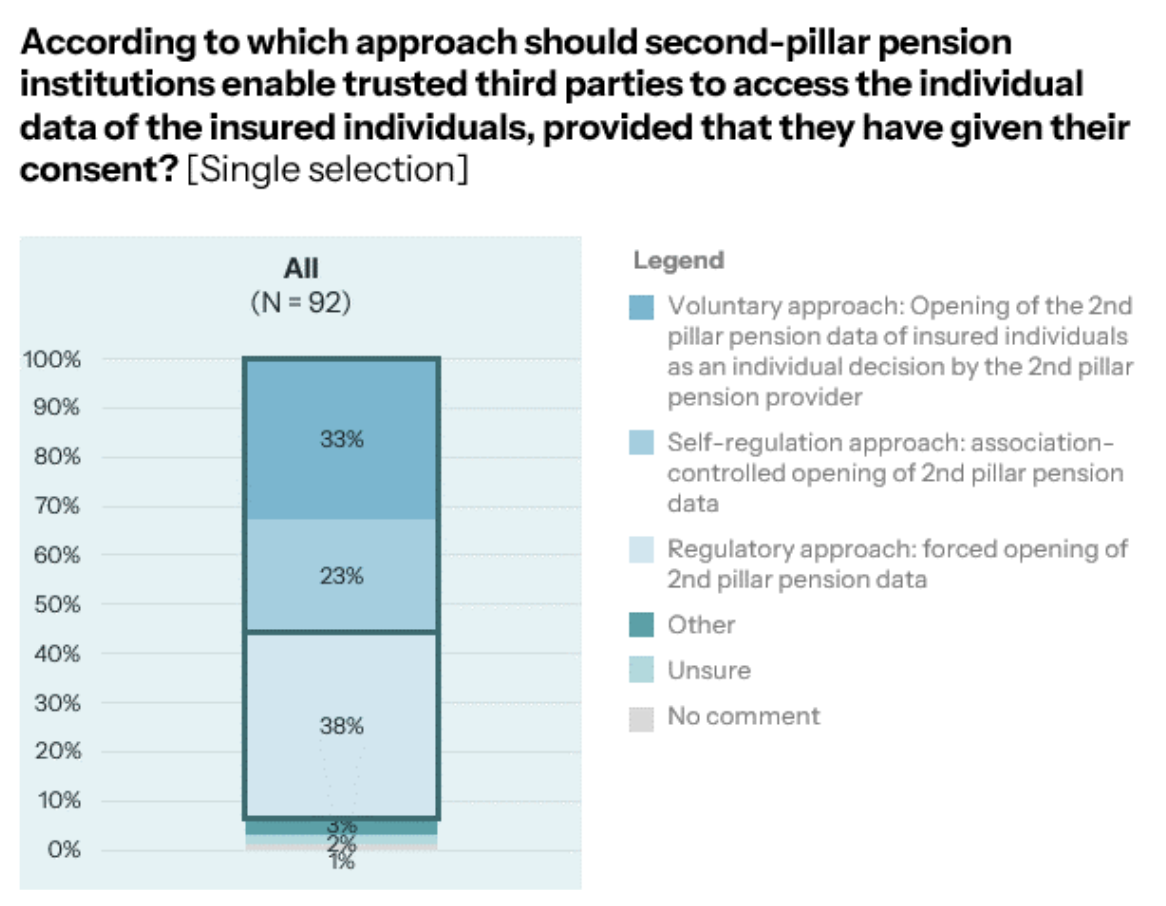

A public survey conducted in 2023, involving 92 participants from diverse stakeholder groups including data providers and users, revealed that while a slight majority favored a self-regulatory or voluntary approach to opening pension data, a notable 38% expressed a preference for regulatory intervention.

Preferred options for the opening of the 2nd pillar pension data, Source: Open Pension, Swiss Fintech Innovations, Apr 2024

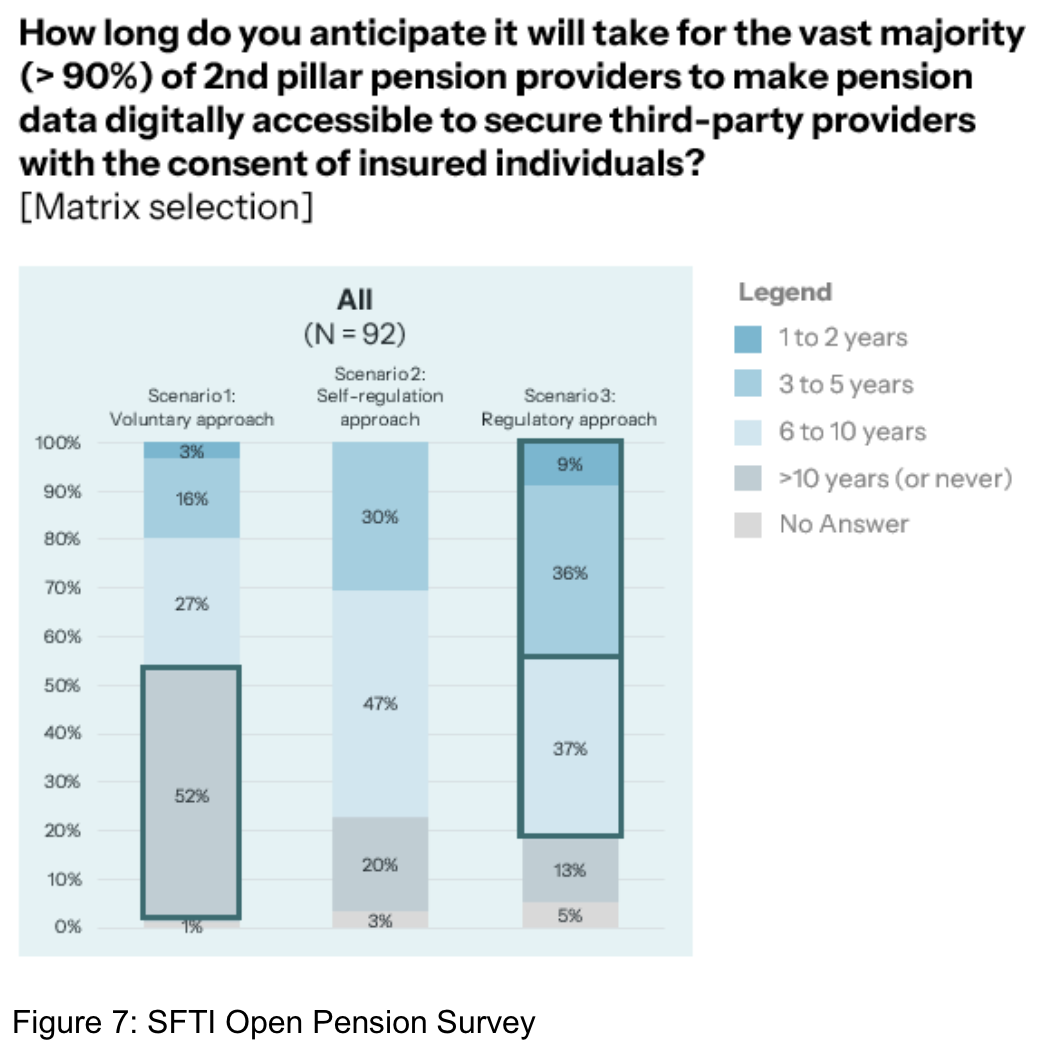

45% of the respondents believed a regulatory approach to be the swiftest path to implementing digital access to pension data for secure third-party providers, anticipating realization within three to five years.

How long will it take for the 2nd pillar pension data to be opened based on the different scenarios, Source: Open Pension, Swiss Fintech Innovations, Apr 2024

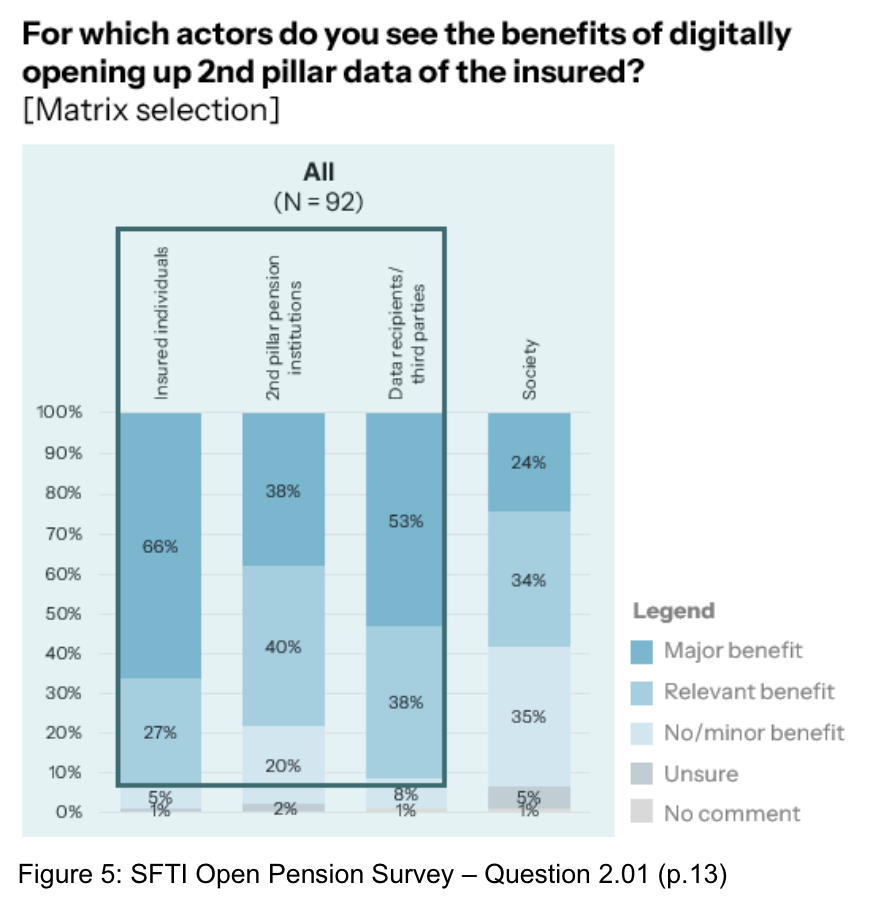

Overall, industry stakeholders expressed optimism regarding the potential of data sharing to enhance user experience and improve efficiencies in pension provision. More than 80% of the survey respondents foresee relevant benefits for data users, individuals and data providers resulting from digitally opening up second pillar data of the insured.

Industry stakeholders set to benefit the most from digitally opening up 2nd pillar data, Source: Open Pension, Swiss Fintech Innovations, Apr 2024

The Swiss pension system comprises three pillars: the state-run pension scheme, the pension funds run by investment foundations, and voluntary, private investments. The system is designed to ensure financial security for retirees, serving as the foundation of retirement planning.

However, the system faces challenges, with retirement concerns consistently ranking among Swiss citizens’ top worries. Factors such as an aging population and workforce shortage are raising doubts about the long-term viability of the system, prompting discussions on reforms.

Adding to these concerns is the lack of clarity among individuals regarding their expected monthly pension, owing to the complexity of calculations, fragmented data across pillars, and limited understanding of the pension system.

Featured image credit: edited from freepik

Comments