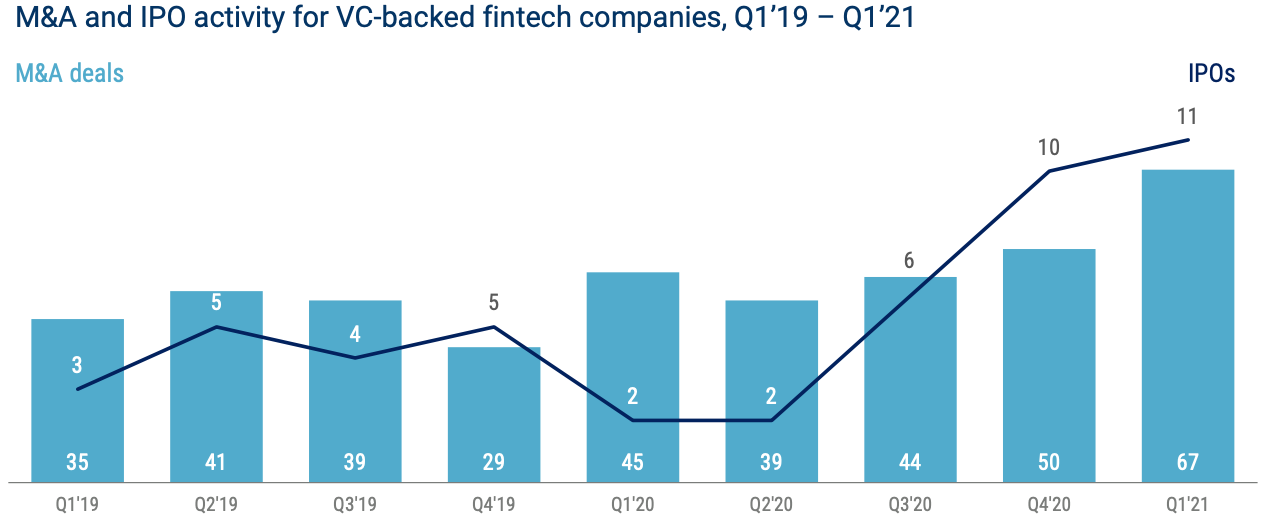

In Q1 2021, fintech exit activity hit a new high driven by blank check transactions. 11 initial public offerings (IPOs) and 67 merger and acquisition (M&A) deals were announced and/or completed this past quarter – many of which through special purpose acquisition company (SPAC) transactions, according to CB Insights’ latest quarterly State of Fintech report.

M&A and IPO activity for VC-backed fintech companies, Q1’19 – Q1’21, Source: State of Fintech Q1 2021 Report, CB Insights

Over the past year, SPACs have emerged as a popular way for private companies to go public. According to Refinitiv, the value of listings by SPACs grew seven-fold in the US last year to more than US$70 billion. This year, that full-year figure was surpassed by the end of March.

In Q1’21, fintech SPAC transactions were particularly prolific in the challenger banks segment, according to the CB Insights report, with startups including Social Finance (SoFi) and MoneyLion announcing multi-billion-dollar merger deals.

Retail investing platform eToro also unveiled plans to merge with Fintech Acquisition V in a US$10.4 billion deal, and digital asset marketplace Bakkt said in January that it will be going public with VPC Impact Acquisition in a deal valued at US$2.1 billion.

Real estate technology continued to be a major investment target for SPACs with several dedicated blank check companies being launched in Q1’21, as well as numerous proptech companies unveiling plans to go public via the SPAC route. These include spatial data firm Matterport, real estate marketplace Offerpad, building management software provider Latch, and real estate transaction platform Doma (formerly States Title).

Fintech funding rebounds to new high

Q1’21 saw a significant increase in fintech funding with US$22.8 billion raised through 614 deals. The figures make Q1’21 the largest quarter on record for fintech funding, surpassing Q2’18’s previous all-time-high that included a massive US$14 billion funding round closed by Ant Group.

Global VC-backed fintech funding trends, Q1’18 – Q1’21, Source: State of Fintech Q1 2021 Report, CB Insights

Fintech funding growth was global with nearly every continent recording an increase, except for Australia. Europe witnessed the biggest jump with fintech investment surging 180% quarter-over-quarter (QoQ) to US$5 billion, surpassing Asia at US$3.6 billion. North America continued to lead, ranking first with US$12.8 billion.

Quarterly funding ($M) by continent, Q1’21 – Q1’21, Source: State of Fintech Q1 2021 Report, CB Insights

Stock trading apps close large funding rounds

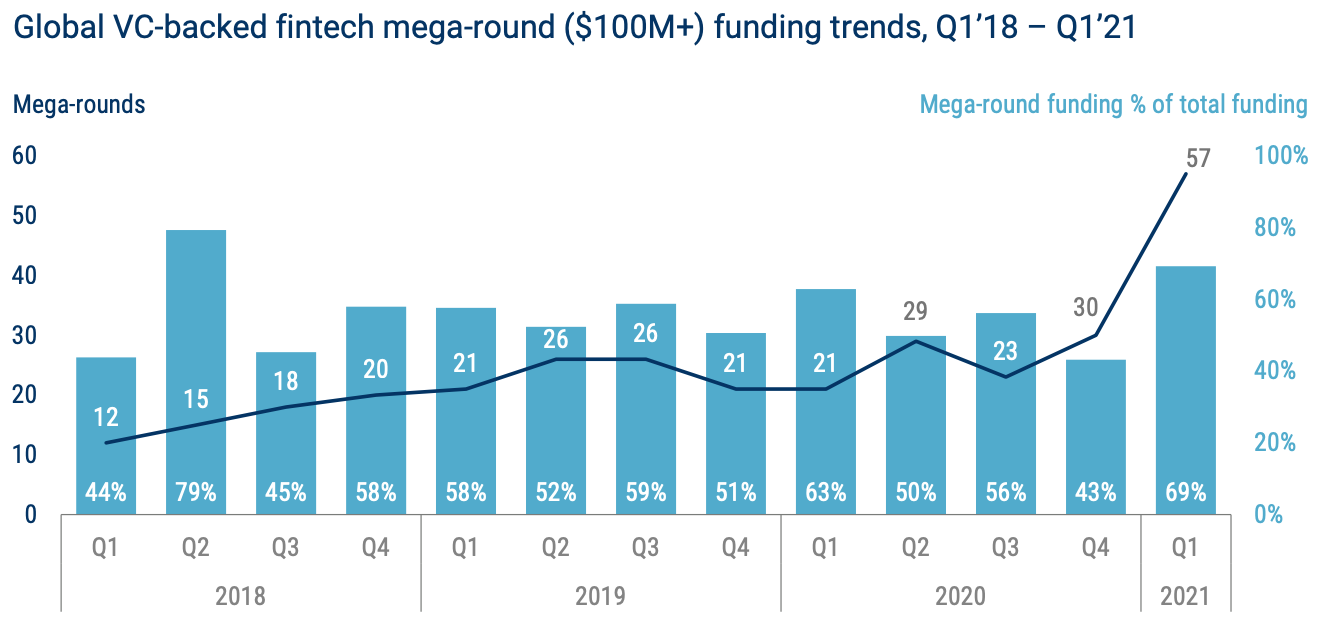

Q1’21’s staggering rise was mainly driven by mega-rounds of US$100 million and over. These totaled 57 deals, a new quarterly record, and together, accounted for 69% of total funding during the quarter.

Global VC-backed fintech mega-round (US$100M+) funding trends, Q1’18 – Q1’21, Source: State of Fintech Q1 2021 Report, CB Insights

Digital investments platforms and stock trading apps took a nice share of Q1’21’s mega-rounds, closing large funding rounds to continue the momentum triggered by the retail trading surge.

Zero-commission stock trading pioneer Robinhood raised two of the quarter’s 10 largest funding rounds, totaling US$3.4 billion. The amount represents about 60% of the total funding raised by wealthtech startups in Q1’21, the report says.

The US-based startup, which allows users to invest in stocks, ETFs, options, cryptocurrencies and more, helped drive this past year’s surge in retail investing. In March, it filed for an IPO that could come late in the second quarter, reported CNBC.

Robinhood’s last fundraising brought its valuation to US$11.7 billion but trading of private shares indicated the company could be valued as much as US$40 billion in its IPO, according to Bloomberg.

Public.com (US$220 million Series D, US), WeBull (US$150 million Series D, China) and FreeTrade (US$69 million, UK) are stock trading platforms that also raised funding in Q1’21.

Other fintech trends in Q1’21

In Q1’21, European payments startups including Klarna, Checkout.com, Rapyd and Ppro closed multiple mega-rounds that pushed their valuations much higher.

Klarna, an online commerce payment company from Sweden, raised the quarter’s second largest round at US$1 billion, nearly tripling its valuation from US$10.7 billion to now US$31 billion.

Klarna offers services including payments for online storefronts, direct payments and post purchase payments. Data from Apptopia suggest that the startup has witnessed stronger growth than its competitors this past year, and is now leading the pack.

Klarna is Europe’s most valuable fintech company, and the world’s second largest, according to data from CB Insights.

UK-based Checkout.com closed a US$450 million funding round that pushed its valuation from US$5.5 billion to US$15 billion. And, Rapyd, another UK startup, raised US$300 million in January that doubled its valuation to US$2.5 billion.

In Q1’21, API-based banking software continued to mature on the back of rising demand for digital experiences. Germany’s software-as-a-service (SaaS) banking platform Mambu raised a EUR 100 million Series D after reporting a 100% year-over-year (YoY) growth.

In the US, data analytics startup MX closed a US$300 million Series C funding round. The company, which helps financial firms use data to reduce fraud, serves more than 2,000 financial institutions and 43 of the top 50 digital banking provides.

Buy now pay later (BNPL) was another hot segment around the world, with deals being closed across different regions and countries including Italy (Scalapay, US$48 million), the UK (Butter, US$21.7 million), Czech Republic (Twisto, US$19.5 million), Saudi Arabia (Tamara, US$6 million), India (ePayLater, US$2.5 million), and Ghana (Motito).

The post SPAC Deals Drive Fintech Exit Activity to New High appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments