Application programming interfaces (APIs) seem set to usher in a new era of payments solutions, particularly with the advent of regulations such as the Second Payment Services Directive (PSD2) in Europe.

However, standardization of technical interfaces constitutes a crucial building block in enabling compliance with PSD2 and accessing the full benefits of API technology, says Deutsche Bank’s white paper, “Unlocking opportunities in the API economy”, produced in collaboration with payments consultancy Innopay.

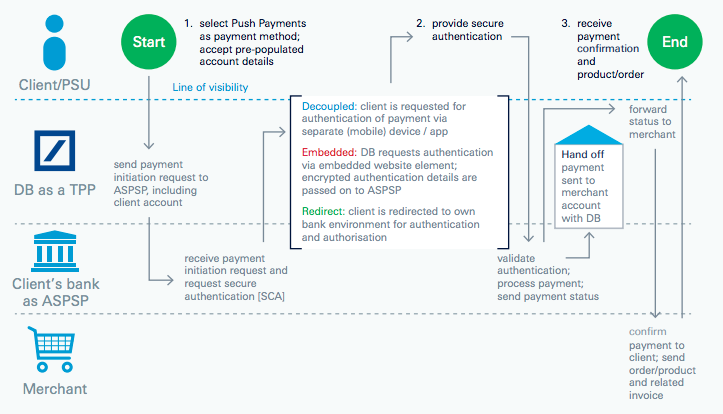

Example of a push payment facilitated by a TPP using an API

From September 2019, PSD2 will see banks provide authorized payments to providers with access to client bank accounts, most likely through APIs. The directive is seen as one step on the journey towards Open Banking, which promises to bring new financial products and services, as well as new business models and revenue streams for banks and financial services companies.

Shahrokh Moinian

“Many corporates are only just beginning to wake up to the opportunities that European regulations such as PSD2 will open up to them in terms of streamlining and reducing the cost of their payments, while gaining access to exciting new services,”

says Shahrokh Moinian, Head of Cash Products at Deutsche Bank.

“Of course, there are also significant rewards on offer for the banks and fintechs that best provide this enhanced payments service.”

For corporates, banks and fintechs to unlock the opportunities, the paper recommends:

- Becoming actively involved in the working groups on harmonisation and implementation of standards, as well as exploring potential collaborations, be it co-developing API standards or working to provide other essential services such as API testing;

- Joining a central directory such as PRETA – which will be essential for the success of any API standardization initiative;

- Smaller market players get involved through their local banking associations.

“Making PSD2 work in practice, and ensuring the implemented interfaces are interoperable, depends on a minimum level of harmonization and agreement of common standards,”

comments Christian Schaefer, Head of Payments, Corporate Cash Management, Deutsche Bank.

“A half-hearted, hesitant and fragmented introduction of providing access to accounts will jeopardize opportunities for all.”

To read “Unlocking opportunities in the API economy”, please click here.

Featured image via Freepik

The post Standards Crucial To Unlocking Opportunities Of PSD2 And Open Banking appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Comments